Share The Cyprus Crisis 101 Good Articles to Share

Post on: 9 Август, 2015 No Comment

[Share] The Cyprus Crisis 101

March 19, 2013

Talk about blindsided. Friday was a normal day in the recent bull market; although the market sold off slightly, the fact that the Dow continues to print all-time highs is barely news anymore. Investors went into the weekend thinking all was well, but when news that Cyprus had entered into a bailout deal with the European Union emerged, investors were blindsided.

First, where is Cyprus? Cyprus is located in the Eastern Mediterranean Sea, east of Greece and South of Turkey. Its one of those sleepy countries that frankly isnt large enough for most of the investing world to care about. According to the CIA Factbook, the country has a population of 1.1 million — about as many people as the state of Rhode Island. The country is 77% Greek, 18% Turkish and 5% other ethnicities with a median age of 35.

Its land mass is about 7,800 square miles — roughly the size of New Jersey. This doesnt sound like a country that would become the subject of international headlines, but theres a lot more to the story.

Its Greece All over Again

Until 2009, Cyprus had turned its economy around. After a deficit of 6.3% in 2003, it implemented a series of austerity measures that gave it a surplus of 1.2% in 2008. When the recession hit, Cyprus fell back on hard times because of its large exposure to Greek debt. In 2012, the country contracted by 2.3%.

The country was downgraded numerous times in 2012 with agencies like Fitch giving it a BB- rating and warning of further downgrades. This drove Cyprus borrowing costs higher.

A Closer Look at the Banks

According to CNBC, the Cypriot banking sector is about eight times the size of the economy with almost $19 billion, or one-third of all deposits, coming from Russian sources. Dmitry Rybolovlev, the largest Russian investor, has almost a 10% stake in the Bank of Cyprus equaling $8 billion to $10 billion.

The Canadian Press reports that the Russian elite use Cypriot banks to avoid political uncertainty and corruption in Russia. In addition, money earned through illegal means is often funneled to Cyprus because of its policy of turning a blind eye. Russia estimates that $49 billion was illegally wired to foreign accounts last year — 2.5% of Russias GDP.

Theres concern that if Cyprus imposes capital controls, Russian banks could face losses equal to 2% of the countrys GDP because Russian banks have loaned Cyprus-based companies of Russian origin $40 billion. Although Russian officials may show outward discontent for the practice, their actions prove that its as Russian as the cosmonaut .

Whats the Story on the Bailout?

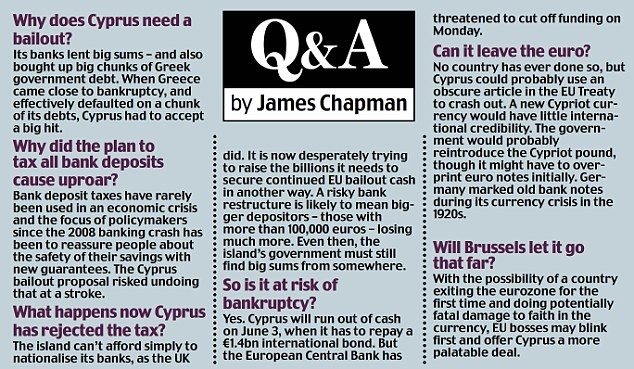

Cyprus was systemically damaged due to its exposure to Greece. It, like Greece and so many other countries, was forced to ask the European Union for a bailout but this time the EU didnt reluctantly say yes, as it repeatedly did with Greece.

Instead, the EU said, If were going to help you, you can first help yourself. That was the beginning of a controversial and unprecedented move to force everybody with money deposited in a Cypriot bank to pay for the bailout.

Who threw the biggest fit? Germany, and most would say rightfully so. They are tired of being the go to place for the EU when it needs money. Michael Fuchs, deputy parliamentary leader of Merkels Christian Democratic Union party said, Why should Germans bail out these people and they are not willing to accept at least a minor bailing out by themselves?

With Chancellor Angela Merkel facing election in September, she can no longer afford to hand out Germanys money without much regard for public sentiment. This was clearly a public display for the sake of her country.

What resulted wasnt a small tax; anybody with more than 100,000 euros in deposits could pay a 9.9% tax, and those with less than 100,000 euros, a 6.75 % tax. The idea was simple: Stick it to the Russians — let them pay for the bailout. But during what had to be a very late meeting with an empty coffee pot, somehow they forgot about Cypriot citizens who are also bank depositors and living in a country deep in recession. The plan is supposed to raise 5.8 billion euros, but there may be a new plan on the horizon.

Monday just so happened to be a bank holiday (hardly a coincidence) so there could be no run on the banks to get the money out before the tax was imposed. Once it became clear that parliament was not going to vote to adopt this plan, the state-run banking system said they were remaining closed until at least Thursday. (So politicians in favor of this plan could lobby for votes.)

What now seems clear is that Cyprus should brew some stronger coffee and come up with a better plan. CNBC reports that the first 20,000 euros could be exempt or those with savings up to 100,000 euros might only pay a 3% tax.

What Does This Mean to the World?

First, it means that the way banks do business can no longer be completely trusted. Dennis Gartman, author of The Gartman Letter. said Monday, The very nature of banking has been shaken to its roots.

Imagine if you woke up Sunday morning to an email from your bank saying, As a result of an agreement with government officials, 6.75% of your bank account will be withdrawn before the beginning of the business day. You would reconsider keeping your money in any bank. Thats the fear going forward. How safe is a persons money in any bank around the world if this precedent is set?

Second, the United States has been in a bull market not just because of the Fed injecting money into the economy but because the drama in Europe that made headlines over the past couple of years has been noticeably absent. Investors are worried that this story signals the return of eurozone troubles.

Take Action

Investors know that when the eurozone is a front page story in the financial media, the markets become unstable. The Federal Reserve is still pumping massive amounts of liquidity into the markets and gauging the markets response from Monday, it doesnt appear that the bull run was thwarted because of these headlines.

Still, in light of the S&P up more than 8% in the last three months, Cyprus, or any other event like it, could trigger the correction that everybody is waiting for. Consider reducing your long exposure or hedging your portfolio against a downturn.

With the VIX at such low levels, buying protection in the form of put options is cheap. If youre not an options trader, purchase lower beta names like Coca-Cola (NYSE:KO ) or Abbott Labs (NYSE:ABT ). These names pay a healthy dividend and will likely not decline as much as the broader market. Another way to hedge is to use bond ETFs like the iShares iBoxx $ High Yield Corporate Bond ETF (ARCA:HYG ), which pays a 6% dividend.

Most important, when the market becomes news driven, protect your portfolio by keeping up on global events and study how they affect the markets. Learning the personality of the markets will make you better prepared for the next stretch of negative headlines.

www.investopedia.com/articles/investing/031913/cyprus-crisis-101.asp