Series 65 Exam Practice Review

Post on: 5 Июнь, 2015 No Comment

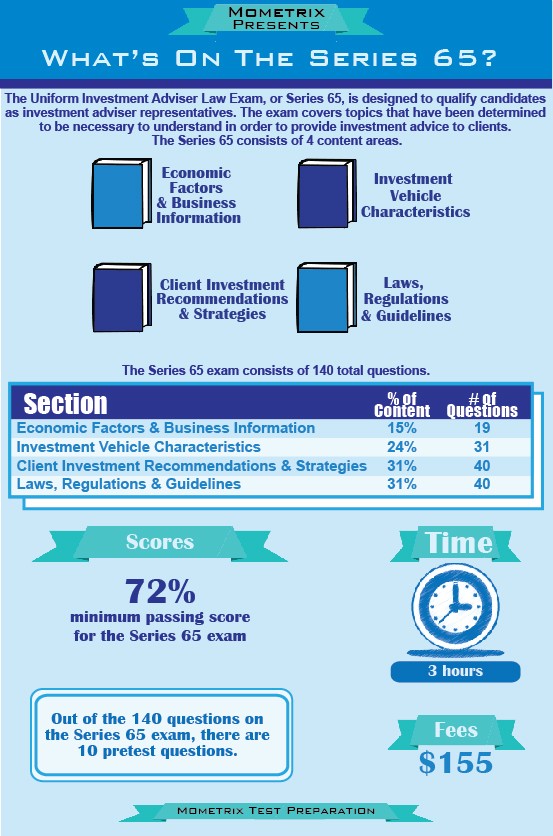

The Uniform Investment Adviser Law, also known as the Series 65 exam, qualifies a candidate to become an investment advisor by testing his or her knowledge on retirement investment options, portfolio management, economic trends in the marketplace, investment advice, and recommendations and ethical business practices, including laws and regulations. The Series 65 exam will have questions on the Employee Retirement Income Security Act (ERISA), dollar cost averaging (DCA), risk tolerance, inflation, and deflation. This three-hour test is given every day of the week, except Sundays. There are 140 multiple-choice questions, although 130 questions count toward the pass-fail grade. The ten pretest questions are American Securities Administrators Association (NASAA) research-based items and could appear anywhere in the test; however, they do not count toward the final grade. Fifty percent of the exam is an essay, and a 72% passing score is required.

If a firm is sponsoring a candidate for the test, the compliance officer will file a U-4 form with the Financial Industry Regulatory Authority (FINRA); however, a person can individually file by completing a Form U10 and paying the $135 application fee; an applicant has 120 days to register and take the exam. The Series 65 exam is administered by the North American Securities Administrators Association at Prometic or Pearson-VUE testing centers across the country as well as locations internationally. Taking the exam at these testing centers is convenient because computerized scores are provided immediately upon completion of the test, and there is no waiting period should the candidate not pass the exam.

The Series 65 exam was designed differently than most tests being that it is criterion based. This means that the candidate is tested and must pass a minimum level of competencies. For example, each question on the test is formulated using two components: a difficulty and content.

Each exam should have the same level of difficulty and test on the same content areas. The FINRA designed the test using a process that has achieved great results and that clearly differentiates those candidates who meet the minimum standards from those who do not meet minimal requirements for the job.

The good thing about this test is that there are no continuing education requirements after it is passed. The process typically involves an applicant passing the exam, paying an application fee and an annual registration fee to the state or states he or she will conduct business in, and then finally filing an advisor (ADV) or disclosure document. Upon completing these steps, the applicant should then receive a letter in the mail saying he or she is a registered representative. Keep in mind that the successful completion of the exam does not give a person the authority to transact business until he or she is officially granted the license or become registered in that state.

There are no U.S. citizenship requirements to become Series 65 licensed. FINRA will assign an ID number for the purposes of taking the test for those who do not have a social security number. If English is a second language for the test taker, FINRA may make accommodations for the candidate to complete the test in four hours. If this situation applies, contact the testing center and ask about this provision when making the appointment.

Annual updates to the Series 65 exam are done with examiners taking the time to create new and revised questions based on current laws. These examiners take the time to weigh each question carefully to make sure a question is not too difficult or easy. All scores are kept in the Central Registration Depository (CRD) for employers and regulators to access. An actual certificate is not provided upon passing the exam. All Series 65 test questions are copyrighted and are not disclosed to the public.

Series 65

1. Under a limited power of attorney, a broker-dealer can…

- sell securities, but cannot buy securities, for the account

- buy and sell securities, and withdraw funds

- sell securities, but cannot buy securities or withdraw funds

- buy and sell securities, but cannot withdraw funds

2. Of the following, which question would best help ascertain a client’s risk tolerance?

- What are the client’s current spending habits?

- What is the client’s investment experience?

- Does the client wish to invest in one lump sum or in structured payments?

- What is the client’s tax situation?

3. Which variable helps determine the cost basis of an investment?

- Stock splits

- Commissions paid

- Dividends paid in the past

- None of the above

4. What is the main difference between a ROTH IRA and a Traditional IRA?

- The total annual contribution to the IRA

- The age at which money can start to be withdrawn

- The type of investments purchased within the account

- Earnings can be withdrawn tax-free from a ROTH IRA

5. Which type of retirement account can be used by self-employed individuals?

- Keogh HR-10 plan

- 403(B) plan

- Defined contribution plan

- 401(k) plan

Answers and Explanations

- D: Buy and sell securities but cannot withdraw funds. A limited power of attorney grants a broker-dealer limited control over an account, which includes the authorization to make trades within specified guidelines without the pre-authorization of the account’s owner. The broker-dealer may buy and sell securities, but cannot withdraw funds from the account. A full power of attorney gives the broker-dealer the authority to deposit and withdraw funds from the account, buy and sell securities, and make investment decisions.

- B: What is the client’s investment experience? A client’s previous investment experience is integral to determining a client’s risk tolerance, as are liquidity requirements, investment time frame, current investments, and expected return on investment. A client’s personal profile will include such factors as spending habits, financial situation, and income. Selecting a funding technique would be answered best by whether a client wishes to invest the money all at once or in a series of payments. Tax planning for a client would hinge on information such as the client’s tax situation.

- A: Stock splits. The cost basis is the investor’s original value of an investment. The cost basis of an investment must be adjusted to account for stock splits and stock dividends, particularly if those dividends were re-invested. In addition, commissions paid on the buy or sell transactions associated with the particular security are used to determine cost basis. The cost basis determines the amount of capital gain or capital loss when the security is sold. A lower cost basis would result in a higher capital gain.

- D: Earnings can be withdrawn tax-free from a ROTH IRA. Individuals can contribute up to $5,000 per year to both the Traditional and ROTH IRAs. This money can be invested in mutual funds, stocks, bonds, limited partnerships, government securities, annuities, and money market accounts. In both types of IRAs, withdrawals may start after the individual turns 59-1/2. Prior to that age, a withdrawal from a Traditional IRA is taxable, while a withdrawal from a ROTH IRA would be tax-free under certain circumstances, such as disability, purchasing a home, or using the funds for education, medical bills or insurance premiums.

- A: Keogh HR-10 plan. Keogh HR-10 plans are used by individuals that file federal income taxes as a self-employed person for Social Security purposes. Keogh HR-10 plans allow an individual to contribute up to the lesser of 20% of their income or $44,000. A 403(B) plan is designed for tax-exempt and charitable organizations. A defined contribution plan, such as a 401(k), is set up by a corporation for the benefit of its employees, and may also include profit sharing and money purchase pension plans.