Selling Covered Calls Option Strategy

Post on: 16 Март, 2015 No Comment

Maximize Your Profits!

Minimize Your Risk!

Selling Covered Calls Option Strategy

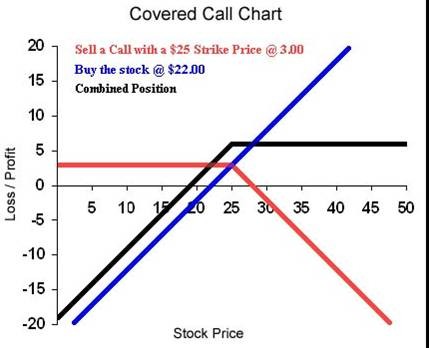

When you are fairly neutral on the market and you want to generate additional income from your investments, there is an option strategy that is worth your consideration. This strategy involves selling covered calls on assets that you own and are willing to sell at a particular price.

With this strategy, you are selling someone the right to buy an asset that you own at a fixed price (the strike price), on or before the expiration date of the option.

This strategy has some nice benefits.

You receive a premium for selling someone the right to purchase your asset at a particular price that you are willing to sell it for anyway. If the asset price is below the strike price at expiration, then the calls that you sold are not exercised and the premium that you collected provides additional income for you, increasing your rate-of-return or reducing your basis in the asset. If you are writing out-of-the-money calls, the asset may continually increase in value, yet the options may never get exercised, allowing you to do this over and over again. This generates continuous income for you, increasing your portfolio and generating cash flow for other investments.

The downside risk of owning the asset is ameliorated by the option premiums that you collect by selling covered calls, because the premiums reduce your basis in the asset.

If the calls that you sold do get exercised, then you are obligated to sell the asset at the exercise price. But you essentially sell the asset at a premium from the asset price that existed when you sold the covered calls, because you collected the option premium. You have already agreed that you would like to sell the asset at the exercise price and the price is augmented by the option premium that you collected.

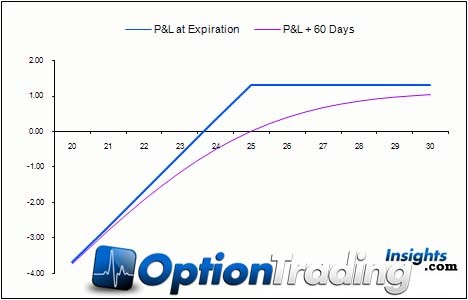

Since you are the seller of the option, the time decay of the option works in your favor. The time-value portion of the call premium constantly declines with time, going to zero on the expiration date. The rate of decay is predictable and is easily calculated by options analysis programs such as Option-Aid. As the expiration date approaches, the rate of decay increases. For this reason, it is often better to sell calls with one month or less until expiration. After they expire, you can sell calls on the next month out and collect another premium.

It is also important to cover risks and caveats of this strategy.

If the price of the underlying asset goes below the strike price by more than the option premium that you collected, then you are losing money on paper. But this risk is similar to outright asset ownership and is ameliorated by the option premium that you collected.

When you sell a covered call on an asset that you own, you are limiting your upside potential. If the asset price rockets skyward and stays above the strike price at expiration, then the option will probably be exercised and you will be obligated to sell the asset at the agreed-on strike price. So there is some lost opportunity cost here if the asset turns into a high-flyer.

It is important to analyze your expectations for the underlying asset before writing the covered call. If you have a target price in mind for the asset, you can write an out-ot-the-money covered call approximately at your target price and collect a lower premium but participate in the rise of the asset. If you expect the asset price to remain stable, you can write the call approximately at-the- money and collect a larger premium without much risk. If you expect the asset to decline, but you do not want to sell the asset at that time, the premium you collect from selling a covered call can help offset the price decline. If you sell an in-the-money call, the premium you collect will be even larger, but you run a greater risk of the option being exercised.

If you are thinking about selling an asset anyway, selling a covered call on the asset can be used to sell the asset at a premium, or generate income for you as you stand ready to sell the asset at a premium. However, if you have decided that there is considerable downside risk in an asset and want to eliminate it from your portfolio, then it is probably better to sell it outright.

When you are analyzing potential option positions, it helps to have a computer program like Option-Aid that swiftly calculates volatility impacts, probabilities, statistics, and other parameters of interest. These programs can pay for themselves with the first trade that they help you with.

Buy Option-Aid Today and Maximize Your Profits!

A s you start using this valuable option software program and become familiar with the vast amount of information it puts at your fingertips, it quickly becomes an indispensable tool for evaluating option positions.

Information is the Key to Increasing Wealth

Buy it today! Profits from your first position can more than pay for the program. Your order will be placed through a secure server.