Saving for College & 529 Plans

Post on: 21 Июнь, 2015 No Comment

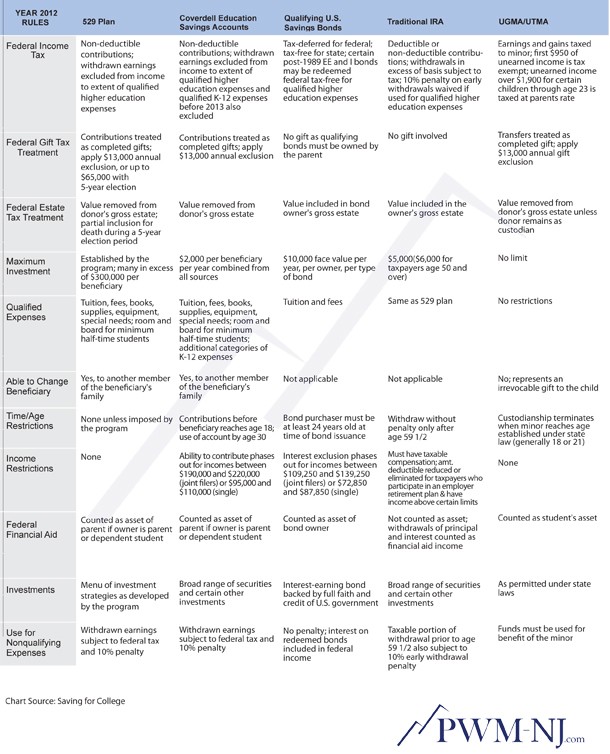

An education is among the most solid investments one can make but tuition is not getting any cheaper. As such, it is becoming more important to begin saving in advance. There are many educational fund options, each with its own set of pros and cons, aimed specifically at saving for college. Since each persons financial situation is different, this article serves as a guide to the variety of college saving choices. Its important to note that each educational savings tool has its own set of rules, contribution limits and fees in addition to being subject to current tax laws. It’s always best to consult with an investment advisor or tax advisor when researching the various college savings plans.

529 College Savings Plans

Although your contributions are not deductible on your federal tax return, the primary attraction to a 529 Plan is that your investment grows tax-deferred, and qualified distributions to pay for the beneficiary’s college costs can come out federally tax-free. Additionally, most states will even give a tax deduction for contributions made into 529 plans. Another common reason for looking into 529 plans is some states offer prepaid plans where you can pay now for future tuition costs at todays tuition prices.

While these qualities are very appealing, there are some drawbacks. Specifically, there are taxes and fees for nonqualified withdrawals and investment choices are often limited.

- Taxes and fees — A common deterrent to investing in college savings accounts is they lack liquidity. Perhaps your child earns a full-ride scholarship or decides to not attend college. Or perhaps economic conditions or unexpected expenses demand using your college savings for other reasons. When the funds in a 529-education plan are used for any purpose outside of education, all earnings become taxable and a 10 percent penalty is charged to the account holder.

- Limited - Because 529 plans are sponsored by the state, fund choices tend to be limited. The State Treasurer oversees the plan and, as an elected official, does not want to do anything that might result in public disapproval.

Coverdell Education Savings Account (ESA)

The same attributes of a 529 plan can be found in the Coverdell education savings account (ESA). Like the 529 plan, growth is still tax-free and withdrawals are not subject to federal taxes as long as qualified distributions are used for education purposes; penalties are incurred otherwise. Coverdell accounts do allow a slightly wider range of uses, permitting funds to be spent on secondary education such as private school or academic tutoring. However, contribution amounts changed in 2013 and are limited to $500 (down from $2,000 in 2012) per year per child and are generally required for the use and benefit of the child by the age of 30. Income restrictions are also applied, so those with higher gross incomes (above $110,000) may not be eligible.

Custodial accounts

A custodial account is a savings account in your childs name that is controlled by a guardian until the child reaches adulthood. These accounts grant unlimited investment options without the $2,000 contribution limit of a Coverdell.

There is also some minor favorable taxation for custodial accounts, but the rules are a little complicated:

- Annual investment income under $950 is tax-free.

- Annual investment income between $950 and $1,900 is taxed at the childs effective rate, which is almost always a lower rate than the parents rate.

- Annual investment income above $1,900 is taxed at the parents rate.

A key feature of the custodial account is the ability to spend the funds on just about anything that benefits the child. Unfortunately, when the child reaches adulthood, he or she inherits all control and you no longer have any say in where the money is spent, which may not meet your needs.

Don’t reinvent the wheel

Each of the savings options described above may have a place in your portfolio. However, it is very possible that the best choice is simpler. Dont be afraid to create a separate account with normal tax treatments. Sure, it wont have all the bells and whistles, but a great fund with a great manager may prove more lucrative. Its okay to trust the time and effort you and your investment advisor put into doing your homework.