SandRidge Energy Inc (SD) Devon Energy Corp (DVN) Encana Corporation (USA) (ECA) 3 New Oil

Post on: 20 Май, 2015 No Comment

Photo credit: SandRidge Energy Inc. (NYSE:SD)

According to the U.S. Energy Information Agency, American energy production is currently focused around six active onshore production regions. These regions the Bakken, Niobrara, Permian, Eagle Ford, Haynesville and Marcellus – accounted for 90% of domestic oil production growth and virtually all domestic natural gas production growth over the past few years. That said, there are some new regions that could emerge to fuel oil and gas growth in 2014 and beyond. Lets take a closer look at the three that are the most likely to emerge over the next year.

The multi-play Midcontinent in Oklahoma

Oklahoma is already one of Americas top five oil producing states. However, it has the potential to grow its oil production in 2014 and beyond thanks to a number of emerging formations. In fact, many top producers are turning to Oklahoma to fuel growth in the year ahead.

SandRidge Energy Inc. (NYSE:SD ). for example, found the key to unlocking oil and gas from the Mississippi Lime formation. However, the company also found that it is stacked with opportunities above and below the Mississippian that has the potential to fuel future growth. SandRidge Energy is currently appraising the potential of the Marmaton, Chester and Woodford formations. Its quite possible that one more of these zones might emerge in 2014 to really fuel SandRidge Energys stock.

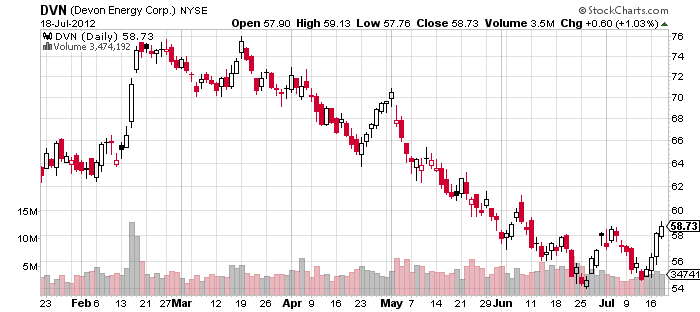

Whats interesting is that the one zone thats currently giving SandRidge Energy Inc. (NYSE:SD) trouble is the one zone that Devon Energy Corp (NYSE:DVN ) likes best. Devon Energy sees the Mississippian-Woodford Trend being an exciting emerging oil opportunity. That play, along with the Cana Woodford in the southern part of the state could emerge as a key growth asset for several American oil companies.

The Gulf Coast

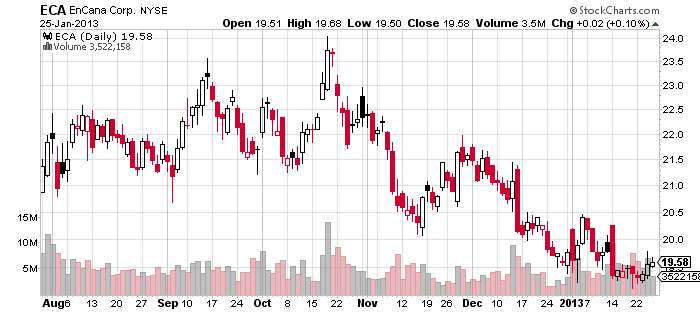

There are a couple of emerging oil plays along the Gulf Coast, but the one that has producers most excited is the Tuscaloosa Marine Shale. Several producers see big potential from this oil-rich play including Encana Corporation (USA) (NYSE:ECA ). which tabbed it one of its five core plays. Thats a big endorsement, as Encana is refocusing its efforts to its five best opportunities to drive future returns. One of the reasons Encana is drawn to the play is because it has an estimated 8 billion barrels of oil equivalent resources in place.

However, Encana Corporation (USA) (NYSE:ECA) might not be the best way to play the Tuscaloosa Marine Shale. Instead, investors might want to take a closer look at Goodrich Petroleum Corporation (NYSE:GDP ). Earlier this year Goodrich picked up 185,000 net acres in the play in one single deal to boost its total position to 300,000 net acres. Overall, 75% of the companys total acreage position is in the Tuscaloosa Marine Shale. In 2014, the company expects to spend $300 million or 80% of its capital on the play. If Goodrich Petroleum is right about the Tuscaloosa Marine Shale, then 2014 could be a great year for its investors.

Californias Monterey

Several estimates suggest that Californias Monterey Shale could be the countrys biggest shale oil play. One estimate has the Monterey holding 15 billion barrels of recoverable oil. If that oil can be recovered it would indeed be a game changer for Americas energy future. However, the Monterey is proving to be a tough nut to crack, as producers need to work around the states fear of fracking as well as the composition of the rock.

Few companies are in a better position to profit from a new California oil boom than Occidental Petroleum Corporation (NYSE:OXY ). The company holds a vast acreage position in the state, with almost a million acres prospective for unconventional resources like the Monterey. Occidental Petroleum is actually adding $500 million to its capital budget in 2014 in order to start capitalizing on its unconventional opportunities in the state. If those funds crack the code it could lead to a new California gold rush, but this time for black gold.

Investor takeaway

There is a whole lot more risk when investing in an exploration play like the three emerging ones Ive mentioned. However, outside of Goodrich Petroleum Corporation (NYSE:GDP), these companies are well insulated to take a hit if none of these plays turn out as expected, because each has a solid core business that would only get better if the emerging target does pan out. That makes for a pretty compelling opportunity for investors looking for a safe way to invest in the next big oil play.

Fool contributor Matt DiLallo owns shares of SandRidge Energy. Matt DiLallo has the following options: short January 2014 $6 puts on SandRidge Energy. The Motley Fool owns shares of Devon Energy.

Copyright © 1995 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy .