Salesforce Forecast Tops Analyst Predictions on Cloud Sales Bloomberg Business

Post on: 29 Апрель, 2015 No Comment

May 21 (Bloomberg) — Salesforce.com Inc. the biggest maker of customer-management software, forecast second-quarter sales that exceeded analysts’ predictions as the company’s Web-based products continue to lure new users.

Revenue in the quarter ending in July will be about $1.29 billion, the San Francisco-based company said yesterday in a statement. That topped the $1.27 billion average analyst projection, according to data compiled by Bloomberg. Profit excluding some costs will be 11 cents to 12 cents a share, compared with the 12-cent average estimate.

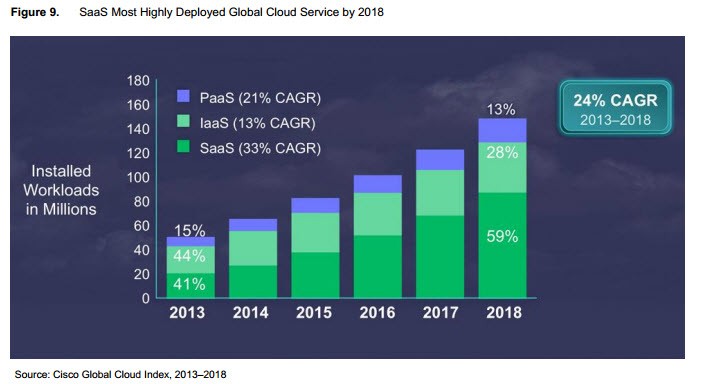

Chief Executive Officer Marc Benioff has been bolstering his online services through acquisitions, including the purchase last year of e-mail marketing provider ExactTarget Inc. and social-media marketing company Buddy Media Inc. in 2012. Sales growth is projected to exceed 30 percent for a third straight year, as businesses gravitate to the cloud to manage their sales leads and marketing campaigns, moving away from traditional software tied to individual servers.

Even with the better-than-expected numbers, Salesforce shares dropped 5.1 percent today to $50.19 at the close in New York. Richard Davis, an analyst at Canaccord Genuity, lowered his 12-month target for the stock to $65 from $80, citing in a report “the broader valuation correction in cloud software.” Davis rates the shares a buy.

Broader Decline

Since the end of February, Workday Inc. ServiceNow Inc. and Veeva Systems Inc. have all dropped by at least 29 percent after surging last year. With today’s decline, Salesforce shares have fallen 20 percent since February, after more than doubling from the end of 2011 through December 2013.

Box Inc. the cloud-storage provider that filed for an initial public offering in April, decided to wait until the market improves before kicking off a promotional tour, people familiar with the matter said earlier this month.

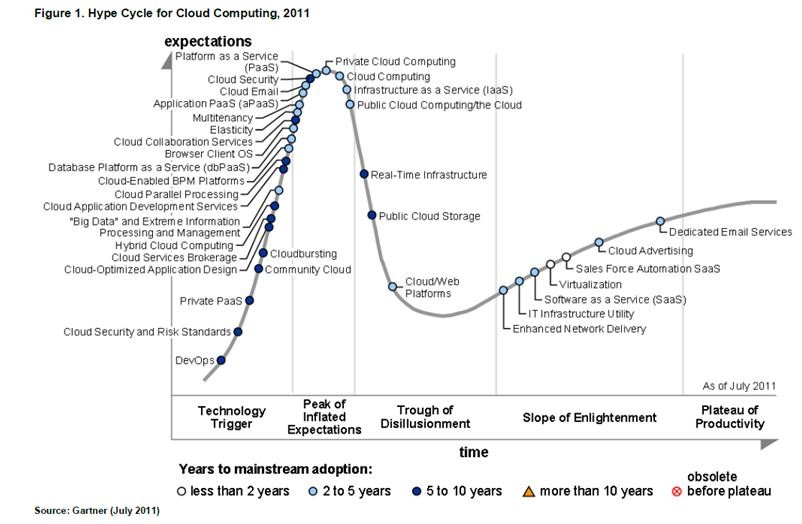

Salesforce has been at the forefront of the shift to cloud, a transition that led rival Oracle Corp. to report no revenue growth in 2013 and pulled SAP AG’s down to 4 percent from 14 percent the prior year. The market for customer-relationship management software, or CRM, increased 13.7 percent last year and topped $20 billion, the fastest growth among any enterprise software groups, according to Gartner Inc.

“The core CRM business still continues to grow,” said Brendan Barnicle, an analyst at Pacific Crest Securities in Portland, Oregon, who has the equivalent of a buy rating on Salesforce. “Every time people think they’ve penetrated every opportunity you look at the Gartner numbers, which show there’s a lot of room to grow.”

No Profit

Benioff’s investments have come at the expense of profitability. For the first quarter, Salesforce’s net loss widened to $96.9 million, or 16 cents a share, from $67.7 million, or 12 cents, a year earlier. Excluding costs tied to stock options and other items, profit was 11 cents a share, compared with the 10-cent average analyst estimate, according to data compiled by Bloomberg. Sales in the period climbed 37 percent to $1.23 billion.

The company also gave an annual sales forecast of $5.3 billion to $5.34 billion, beating the average analyst prediction of $5.29 billion.

Subscription and support revenue jumped 36 percent in the period to $1.15 billion, while professional services and other revenue increased 58 percent to $79 million. Cash from operations climbed 67 percent to $473 million.

Salesforce’s expansion is spreading to San Francisco’s real estate market. The company said last month that it will occupy 714,000 square feet (66,000 square meters) in the newly named Salesforce Tower, which will be the city’s tallest building at 1,070 feet when it opens in 2017. The lease, with base rent starting at $560 million, is San Francisco’s largest in records going back to 2000, brokerage firm CBRE Group Inc. said.

To contact the reporter on this story: Dina Bass in Seattle at dbass2@bloomberg.net

To contact the editors responsible for this story: Pui-Wing Tam at ptam13@bloomberg.net Ari Levy, Reed Stevenson