Ruble Plunges Again As Russia Cuts Interest Rates But What Else Can They Do

Post on: 10 Июль, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

The Russian ruble plunged against the US dollar again as the Russian central bank announced that it was cutting interest rates. The real problem is that there’s nowhere really for the authorities to go on this. It’s not so much that they’re stuck between a rock and a hard place, it’s that they’ve got to decide which particular manner they wish to employ in crashing the Russian economy. For much to the surprise of a lot of us the sanctions against the country over Putin’s adventures in Crimea and Ukraine have actually been pretty successful in boxing them in. Not the adventures, those still carry on, but in directing the cost of their continuing directly at the oligarchs surrounding Putin.

Essentially the central bank is left with one of three options. Killing off the larger non-oil economy through choking it with high interest rates to support the currency, financing the oligarchal borrowings through monetisation and thus killing the economy through inflation or, well, umm maybe they can persuade Vova to rein himself in in Ukraine?

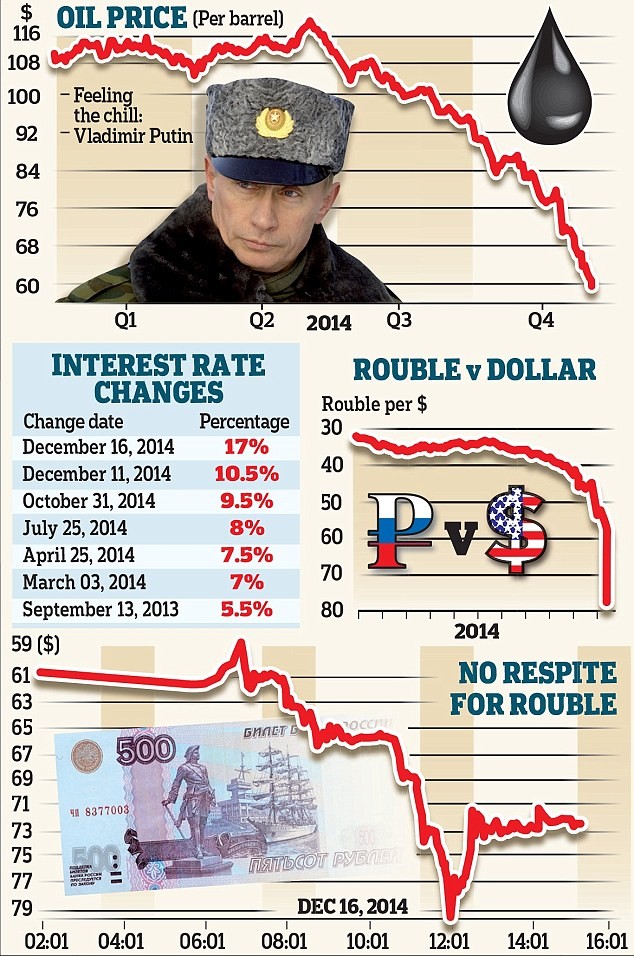

Russia’s central bank unexpectedly cut its benchmark interest rate by two percentage points, letting the ruble slide as the economy sinks toward recession.

The one-week auction rate was cut to 15 percent from 17 percent, the central bank said in a statement on its website Friday. Only one of 32 economists in a Bloomberg Bloomberg survey forecast a decrease, predicting a move to 9.75 percent. The rest saw no change. The ruble weakened beyond 70 against the dollar after the announcement.

The Russian economy depends a great deal on imports. Thus that fall in the ruble translates pretty quickly into domestic inflation. And that just makes the population poorer. So, not an attractive option.

Russia’s choice: save the ruble – or the oligarchs?

Fortune doesn’t quite go on to explain how this saves the oligarchs. So I shall.

The major companies linked to the oligarchs of Putin’s inner circle have had financial sanctions directed at them. Most importantly they cannot gain access to longer than 90 day finance in US dollars. And in effect this means that they can’t gain access to longer term finance in any major currency as the US would put pressure on any bank that had a US presence (ie, all of them). But those same companies have substantial borrowings in dollars and other foreign currencies. Normally this would be fine: they’re currently on time paying for them. But they will require rolling over: and that they’re not allowed to do. So, they’ve got to pay back their old loans and cannot take out new ones to finance them. For some of them this will just mean not being able to finance expansion, others of them might actually fail as a result.

Except: there is a way to finance those loans. Most of those companies have substantial exports (that’s the way to be an oligarch, own a company that exports, after all) for which they get paid in dollars and euros and so on. In the normal course of things they would sell those for rubles which they would then use to pay taxes and so on. But perhaps they can instead borrow in roubles? Use those to pay their domestic expenses and use the dollars to pay off the foreign loans. Everything would be ticketty boo at that point.

Except there’s just nowhere near enough in ruble savings to finance the sort of amount that they need. Enter the central bank. If a central bank says that a particular bond is valid at the discount window (this gets very boringly complex so let’s skip the details)….let’s just say that the central bank gets to decide which bonds, issued by whom, can be presented to the central bank and thereby be borrowed against. So, if the central bank were to say that, say, Rosneft Rosneft. was now one of these privileged companies then Russian banks would happily buy bonds issued by Rosneft. Because they know they can take their new Rosneft bonds off to the central bank and get newly printed rubles for them.