Roth IRA Basics Guildelines Limitations Qualifications Minimums and more

Post on: 21 Август, 2015 No Comment

Roth IRAs are one of the most popular retirement plan investment options. This page will give you the information you need to know about Roth IRAs, including how Roth IRAs work, Roth IRA rules, benefits of opening a Roth IRA . comparing Roth IRAs to other retirement plan options, how and where to open a Roth IRA, and more.

Got questions about Roth IRAs? We have answers!

How a Roth IRA works

A Roth IRA is a tax advantaged retirement plan that offers investors the opportunity to make a contribution with money that has already been taxed and the ability make tax free withdrawals in retirement age (age 59½). This is a huge benefit to investors because it means your money is only taxed once (when you earn it) and it grows via compound interest without the drag of taxes until you decide you want to make a qualified distribution. The key to that last sentence is the term qualified distribution, which means you cant take out your money any time you want, there are certain rules about making withdrawals from your Roth IRA. Well cover more on that in a second, and send you to a link that gives even more in depth information about how and when you can withdraw your money from your Roth IRA.

Roth IRAs are investment vehicles, not an investment. The second thing you need to know about a Roth IRA is that it is not an actual investment; it is an account you can invest in. This is a common misconception. In fact, a common question is where to get the best Roth IRA rates . The truth is that Roth IRAs do not earn a rate; Roth IRAs are an account that holds investments and it is your investment that earns interest or otherwise grows in value. The article linked in this paragraph explains this situation more fully. The good news is that you can use just about any kind of investment in your Roth IRA.

Roth IRA Rules: Contribution Limits and Withdrawal Rules

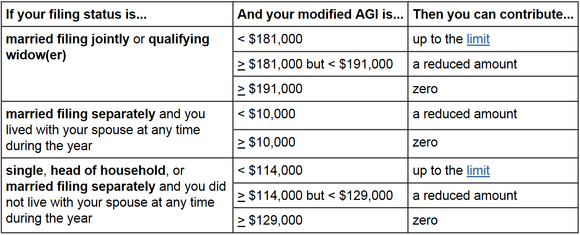

Roth IRA contribution limits. Roth IRAs have contribution rules including a maximum annual contribution and maximum income levels to be eligible to contribute to a Roth IRA. Basically, you can only certain amount to a Roth IRA, and once you reach a certain income level, you can only contribute a portion of the max contribution limit, or none at all. You can read more about the contribution and income limits in this article: Traditional and Roth IRA Contribution Limits .

What if you contribute too much to a Roth IRA? Roth IRAs have specific contribution limits and exceeding those contribution limits may subject you to a 6% excise tax that may be assessed annually until the situation is resolved.You can avoid the 6% excise tax by withdrawing any excess contributions before the tax deadline or reassigning your excess contributions to a future tax year. You can read more about what happens when you contribute too much to a Roth IRA ?

Roth IRA withdrawal rules. Roth IRA account owners can make withdrawals of their contributions at any time without paying taxes or early withdrawal penalties. However, there are limitations regarding when earnings from contributions may be withdrawn. Under most circumstances, earnings cannot be withdrawn without taxes or penalties until age 59½ and if they meet the 5 year rule (earnings must remain in a Roth IRA for a minimum or 5 years before withdrawal). There are exceptions to these rules, including those for first time home buyers, paying for qualified college expenses, and certain other instances. For more information see the article Roth IRA Withdrawal Rules .

Benefits of Opening a Roth IRA

In addition to the outstanding tax benefits, Roth IRAs are one of the most flexible retirement plans you can open. Being able to withdraw some or all of your contributions without fees or penalties is a flexibility not offered by most retirement plans. Roth IRAs also do not have a required minimum distribution age, which means you dont need to make withdrawals in retirement unless you want or need the money. Roth IRAs are also a hedge against future increases in tax rates. You know the tax rate you pay now, but you dont know the tax rate you will pay in the future. If you are concerned about potential tax increases, or you think you may be in a higher tax bracket because you have more income, then a Roth IRA may be an important part of your financial planning.

Comparing Roth IRAs to Other Retirement Plans

Roth IRAs offer different benefits compared to other retirement plans or taxable investments that dont offer tax benefits. The most important benefits of investing with a Roth IRA are: tax free withdrawals during retirement; no required minimum distributions so you can let your money compound for longer periods of time; ability to make tax free and penalty free withdrawals of your contributions at any time.

Comparing Roth IRA to Traditional IRA. There are several similarities between Traditional and Roth IRAs, including the name, where you can open them, and often how much you can contribute to them (there are income limits for tax deductible Traditional IRAs and for Roth IRA contributions, so be sure to read up on the IRA contribution limits page for more information). But there are also differing factors between these two retirement accounts. The fundamental differences between Traditional and Roth IRAs boil down to how and when the money is taxed and how and when you can make withdrawals of your investments.

Traditional IRA contributions may be tax deductible, and the funds are taxed when you make a withdrawal. Roth IRA contributions have already been taxed and the qualified distributions, or withdrawals, are tax free. The next major difference is how and when you make withdrawals. Traditional and Roth IRAs both list age 59½ as the minimum age requirement for penalty free withdrawals, but Traditional IRAs require account holders to make minimum required distributions once they reach age 70½, otherwise they face stiff tax penalties. Roth IRAs do not have a required minimum distribution. You can read more information about these two plans in the article: Comparing Roth IRA vs Traditional IRA .

Comparing Roth IRA to Traditional 401k. Some companies offer both Traditional 401k plans and Roth 401k plans. The Roth 401k has similar benefits to a Roth IRA, but follows the contribution limits for 401k plans. Traditional 401k plans are closer in nature to a Traditional IRA and offer a current tax deduction, but are taxed when withdrawn in retirement age. 401k plans also have a required minimum distribution age.

One of the most common questions people face is where to invest first 401(k) or IRA . For most people, a Traditional 401k plan is a better option if their employer offers a company match on their investment. Take the free money, then contribute to the Roth IRA if you can afford to contribute beyond that. I encourage you to read these articles for a more in depth comparison between Roth IRAs and Traditional 401k plans. See also: Should You Contribute to a 401k Without an Employer Match? . which addresses the issue of contributing to a Roth IRA if your company does not offer a 401k match (in this case, a Roth IRA probably offers more flexibility).

How many retirement accounts can you have? You can actually have many retirement accounts. It is common for people to have employer sponsored retirement plans such as a 401k, 403b, or Thrift Savings Plan, IRAs, and sometimes other retirement plans such as a self-employed retirement plan. You can have IRAs at multiple financial instituions, but they are considered one IRA for tax purposes (meaning you cant exceed contribution limits in any given year by opening multiple IRA accounts with other banks or brokerages). For more information read: How Many Retirement Accounts Can You Have? .

Who Should Open a Roth IRA?

Personally, I think the Roth IRA is a great investment option and should be considered by anyone who is eligible to open a Roth IRA. A Roth IRA is a great deal for people who are currently in a lower tax bracket than they anticipate they will be in later in life. The advantage for them is paying taxes at a low tax rate now, then making tax free withdrawals when they reach retirement age and may be in a higher tax bracket.

Why young people should open a Roth IRA. I took this situation one step further an compared Traditional and Roth IRAs for younger investors. The idea is that many people in their youth are in a lower tax bracket than they will likely be in the future as the income potential for most people grows with time. you can read more about that in this article: Traditional IRA or Roth IRA for Young Investors? . Keep in mind your specific situation may vary, so apply these principles to your situation.

Why military members should open a Roth IRA. Military members have the opportunity for several specific benefits for Roth IRA plans that civilians do not have, including the ability to make tax contributions if they served in a tax free war zone, and the ability to make tax free withdrawals in retirement age (tax free contributions, growth, and withdrawals!). Some military members may also qualify for additional time to make contributions to their Roth IRA beyond the normal cutoff date if their military duties permit a tax extension. I recommend reading the full article if it applies to you, but be sure to bookmark the page you are currently on, as the link takes you away from this site: Military Members Should Open Roth IRAs .

How to Open a Roth IRA

All of this sounds great, right? So are you ready to open your first Roth IRA? Good. Opening a Roth IRA is super easy and only takes about 10-15 minutes. All you need to do is go to the bank or brokerage company you wish to do business with, fill out some paperwork, initiate a money transfer and you are done. Of course, it is important to do some research first, and the following articles will help you get the necessary information you need to open the best Roth IRA for your needs.

Getting Started with a Roth IRA

As mentioned above, opening a Roth IRA is just a 10-15 minute process. If you read the articles listed above, you should have a good idea the benefits of a Roth IRA, why you should open a Roth IRA, what to look for in a Roth IRA, and some of the best places to open a Roth IRA. Now you just need to get started! Looking for more investing information? Here are some tips for first time investors .

Maximize your Roth IRA contributions. The current maximum contribution limit for a Roth IRA is $5,000. Most people cant contribute $5,000 at once, and that is OK. A great way to invest the most money that you are able is to set up automatic investments to your Roth IRA account. Determine how much you can contribute each month and send in that amount each month automatically. Making it automatic will ensure that you contribute each month (writing a check each month creates the opportunity for forgetting or deciding not to invest). You will also take advantage of dollar cost averaging . which can be a great way to invest over long periods of time. Dollar cost averaging ensures that you will buy more investments when values are low, and fewer when values are high, hopefully averaging out in your favor in the long run. Here are some more strategies for maximizing Roth IRA contributions .

What are you waiting for? Lets get started and open a Roth IRA today !