Rolling Options Positions

Post on: 10 Июль, 2015 No Comment

Rolling an option position implies that you are changing the current open position. After rolling you will continue to have an open position, the underlying (stock, ETF, index, etc.) remaining a constant. Rolling is an option trader’s tactic used to better position the trader relative to the current and anticipated change in the future value of the underlying. Rolling is what I refer to as morphing your position into being a presumably more effective one.

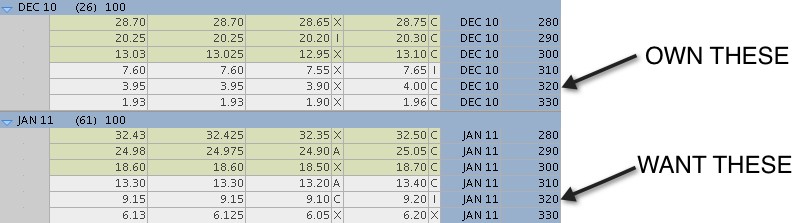

The roll can be horizontal, vertical and expiration related. You might roll a position from one that was a vertical call or put spread into one that is morphed into a calendar or time spread. That combo would become a horizontal spread. You might roll a position that was a calendar spread into one that is morphed into a vertical spread, the position being bullishly or bearishly biased on completion of that roll. That new combo would become a vertical spread. You might roll a position that was nearing its expiration, or maybe nearing its ex-dividend date, doing so in order to either kick the can relative to that expiry, or maybe capture or avoid that ex-dividend date depending. There are more reasons for rolling, but these three are the rolls most frequently executed.

When kicking the can is the primary motive for rolling, you should not think of using this type of tactic as being equivalent to adding to a losing position. Of course you should only morph a position related to an expiry, that being to colloquially buy more time, if you have done the homework and have pre-planned to physically as well as mentally accept the added capital risk. This venerable Wall Street adage might be your spiritual ally: Wall Street’s graveyard is filled with traders who were merely early. Thus, a kicking-the-can roll at times will become profitable due to the buying of more time for the position. And that early grave thing avoided was time well-bought.

Always be alert to the current volatility environment for both the underlying and the CBOE Volatility Index (VIX). One rule I apply when thinking about a roll is to buy as much wholesale time as possible when volatility is on sale. As well I prefer to short as much retail time when the VIX’s chart is considered to be a good short sale. Knowing whether or not the underlying might form into my coiling pattern. is currently coiled, or is far from coiling is additional technical evidence that should add to the effective analysis of the value of time as it relates to option premiums.

The majority of all options trades are those where time is either the bulk of the premium bought or shorted if not being entirely all time value. Thus for us time is literally of the essence! Option traders do not have the luxury taken by stock market experts who predict stock price movement. That luxury these experts use to their advantage is the time factor. Listen very carefully to them as you will almost never read or hear them pin down the date that XYZ will trade at a certain price. What they will write or say will relate to their projected future price of XYZ while purposefully leaving out the time factor (the date!) relative to that projection.

Any options trade related to rolling a position is executed with the art of the trade in effect. That is true because once the homework on the underlying has been done, and the projected (by you!) conclusions drawn relative to the new risk/reward parameters that are about to become a reality, all that remains is the artistic ability of the trader to better position themself. For a detailed explanation on the art of the trade.

EXCLUSIVE OFFER: Jim Cramer’s Protg, Dave Peltier, only buys Stocks Under $10 that he thinks could potentially double. See what he’s trading today with a 14-day FREE pass.

At the time of publication, Skip Raschke held no positions in the stocks or issues mentioned.