Rolling LEAP Options_1

Post on: 10 Июль, 2015 No Comment

Options are usually seen as tools for the fast money crowd. If an option trader can correctly forecast a stock’s price within a specific time frame and buy the appropriate option, huge profits can be made in a few months. However, if the prediction is wrong, then the same option could easily expire worthless, wiping out the original investment.

However, options can also be useful for buy-and-hold investors. Since 1990, investors have been able to buy options with expiration dates ranging from nine months to three years into the future. These options are known as LEAP (Long-Term Equity Anticipation Securities) options.

Buying LEAPs

Investors can purchase a LEAP call option contracts instead of shares of stock in order to get similar long-term investment benefits with less capital outlay. Substituting a financial derivative for a stock is known as a Stock Replacement strategy, and is used to improve overall capital efficiency.

Rolled LEAPs

The biggest problem with options for the buy and hold investor is the short-term nature of the security. And even LEAP options, with expirations over a year, may be too short for the most ardent buy and hold investor.

However, a LEAP option can be replaced by another LEAP with a later expiry. For example, a two-year LEAP call could be held for a single year and then sold and replaced by another two-year option. This could be done for many years, regardless of whether the price of the underlying security goes up or down. Making options a viable choice for buy and hold investors.

Selling older LEAP calls and purchasing new ones in this manner is called the Option Roll Forward. or sometimes just the Roll. An investor makes regular small cash outlays in order to maintain a large leveraged investment position for long periods.

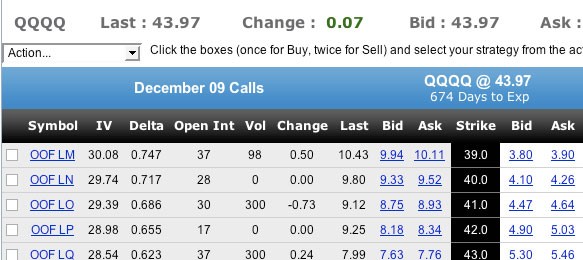

Rolling an option forward is inexpensive, because the investor is selling a similar option with similar characteristics at the same time. However, predicting the exact cost is impossible because option pricing depends upon factors such as volatility. interest rates and dividend yield that can never be precisely forecasted. Using the spread between a two-year and one-year option of the underlying security at the same strike price. is a reasonable proxy.

Using LEAP calls, like any stock-replacement strategy, is most cost-effective for securities with low volatility, such as index or sector ETFs or large-cap financials, and there’s always a tradeoff between how much cash is initially put down and the cost of capital for the option. An at-the-money option on a low volatility stock or ETF is generally very inexpensive, while an at-the-money option on a high volatility stock will be significantly more expensive.

Leverage Ratio and Volatility

Note that a $1 increase in the underlying security will not immediately result in a full $1 increase in the LEAP call price. Because options have delta. they receive some appreciation immediately, and then accumulate the remainder as they get closer to expiry. This also makes them more suited for investors with longer holding periods.