RMC Speakers Volatility of Volatility Rose in Recent Months CBOE Options Hub

Post on: 16 Март, 2015 No Comment

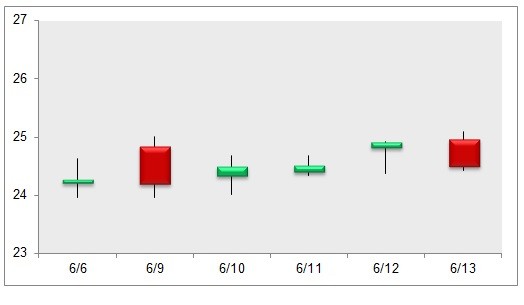

In the first two months of 2015, the CBOE VIX of VIX Index (VVIX ) had an average daily close of 100.2. a higher level than in any of its previous eight full calendar years from 2007 through 2014.

On Thursday at the 31 st CBOE Annual Risk Management Conference in Carlsbad, expert presentations on Volatility of Volatility (VOV) were delivered by Benn Eifert, Ph.D. Portfolio Manager, Mariner Investment Group and Kambiz Kazemi, Portfolio Manager, Picton Mahoney Asset Management.

INTRODUCTION TO INDEXES

Before highlighting the remarks of the speakers, here is an introductory overview of two key indexes that measure 30-day expected volatility – the CBOE Volatility Index® (VIX®) and the CBOE VIX of VIX Index (VVIX). The VIX Index measures expected volatility that is conveyed by prices of S&P 500 (SPX) options, while the VVIX Index measures expected volatility as conveyed by VIX options. On Dec. 12, 2014, the VVIX Index closed at 138.60 its highest daily close in more than four years.

In analyzing the weekly returns for the period of June 13, 2008 through Feb. 27, 2015, the VVIX Index had a correlation of negative 0.47 versus the S&P 500 Index, and a correlation of positive 0.76 versus the VIX Index.

TOPICS COVERED BY THE SPEAKERS

Dr. Eifert and Mr. Kazemi covered these topics

- Understanding the distributions of realized and implied volatility

- Key differences between volatility of volatility and volatility of spot

- Structuring trading and hedging strategies using a variety of instruments

- Impact of trading flows on volatility of volatility levels

PRESENTATION BY BENN EIFERT

Dr. Benn Eifert noted that –

- Basic considerations for volatility-of-volatility include

- Future volatility itself (both implied and realized) is uncertain

- The market prices uncertainty of both implied and realized volatility

- How persistent is implied volatility-of-volatility over time?

- This really depends on how you think about and measure volatility-of-volatility…. Lognormal (%) implied VOV is very quickly mean-reverting, while normal (vega-per-day) implied VOV is more persistent over time.

PRESENTATION BY KAMBIZ KAZEMI

Kambiz Kazemi noted that

- Every option book has exposure to vol of vol (i.e. gamma of gamma or 4th moment)

- Vol of vol is the sensitivity of out-of-money options in relation to those at-the-money

- Why we increasingly hear about vol of vol

- Because vol of vol is directly related to “convexity”

- Because vol of vol is directly related to “tails” (post-crisis everyone cares about “tails”)

- Because VIX options are now being used by a wide range of market participants, and vol of vol matters in pricing and trading these options

ABOUT THE SPEAKERS

Benn Eifert, Ph.D. is a Principal and Portfolio Manager for Mariner Coria, an investment team which focuses on relative-value strategies in equity, foreign exchange, and commodity derivatives markets. Mr. Eifert joined Mariner Investment Group in 2014. Prior to Mariner, Mr. Eifert was at Wells Fargo / Overland Advisors in San Francisco, where from 2010 to 2011 he was Head of Quantitative Research and from 2011 to 2013 a trader for the Derivatives Relative Value strategy. From 2003 to 2005 he was an economist in the Office of the Chief Economist at the World Bank in Washington, DC. He holds Ph.D. and M.A. degrees in Economics from the University of California, Berkeley, where he also taught in the Masters in Financial Engineering program, and B.A. degrees in Economics and International Relations from Stanford University.

Kambiz Kazemi is Portfolio Manager at Picton Mahoney Asset Management. After an engineering-oriented career, Kambiz joined the investment industry in 2001. Prior to joining Picton Mahoney Asset Management, Kambiz was a portfolio manager responsible for volatility arbitrage and derivative-based strategies at Polar Securities. His previous experience also includes developing derivatives-based strategies and trading ideas as a Senior Vice President at Newedge (formerly Fimat). He is a graduate of Ecole Nationale Superieure dElectricite et de Mecanique de Nancy. He received an MBA from McGill University and is a CFA Charter holder.

MORE INFORMATION

To learn more about the CBOE VIX of VIX Index (VVIX) and more than 30 other volatility indexes, please visit www.cboe.com/volatility .