RiskFree Rate of Return

Post on: 21 Май, 2015 No Comment

The riskiest risk-free rate of return, also known as the risk-free interest rate, is the return that an investor can expect from a theoretically risk-less investment. There is no such thing as a true risk-less investment as all investments entail risk even if it is considered negligible. In practice the risk-free rate of return is considered the yield of the 3 month T-Bill.

This rate of return is used as the base from which to judge the risk-reward profiles of different investments.

Risk Free Assets

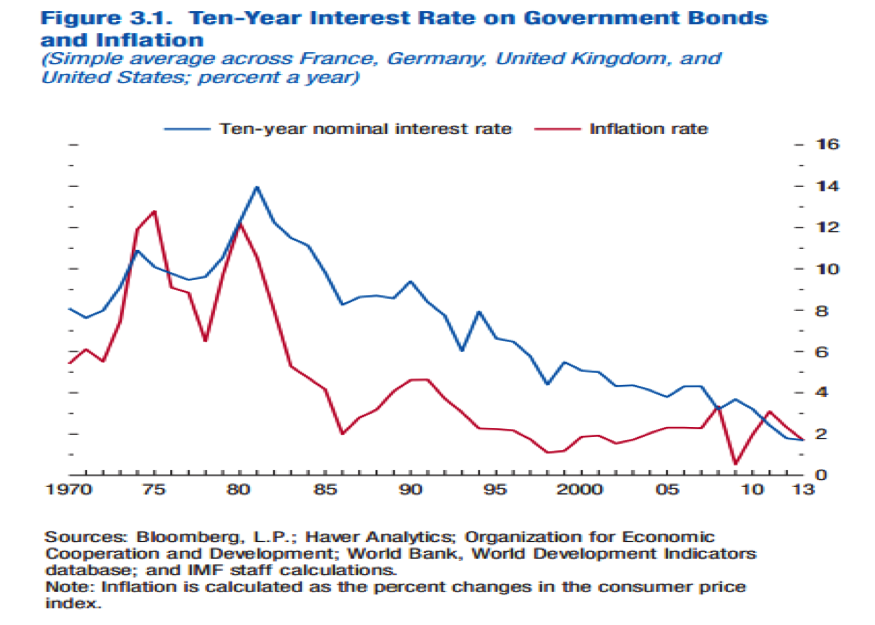

Though a truly risk-free asset exists only in theory, in practice most professionals and academics use short-dated government bonds of the currency in question. For USD investments, usually US Treasury bills are used, while a common choice for EUR investments are German government bills or Euribor rates. The mean real interest rate of US treasury bills during the 20th century was 0.9% p.a. (Corresponding figures for Germany are inapplicable due to high inflation and hyperinflation during the 1920s.)[1]

These securities are considered to be risk-free because the likelihood of these governments defaulting is extremely low, and because the short maturity of the bill protects the investor from interest-rate risk that is present in all fixed rate bonds (if interest rates go up soon after the bill is purchased, the investor will miss out on a fairly small amount of interest before the bill matures and can be reinvested at the new interest rate).

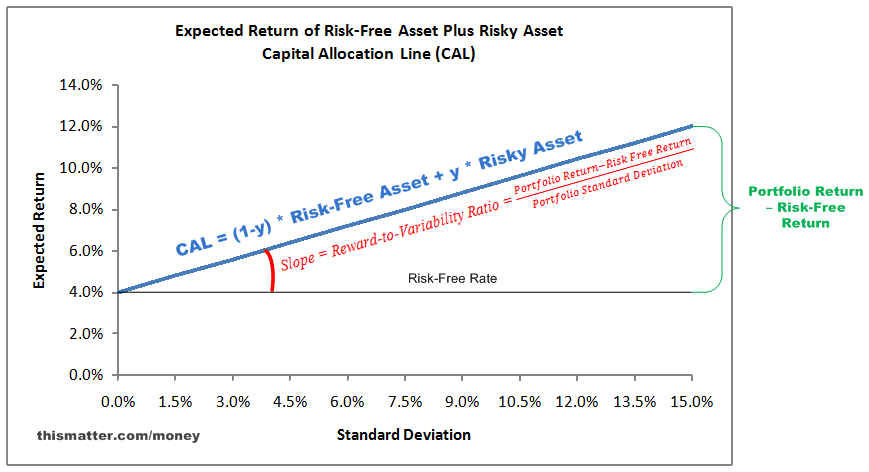

Since this interest rate can be obtained with no risk, it is implied that any additional risk taken by an investor should be rewarded with an interest rate higher than the risk-free rate (on an after-tax basis, which may be achieved with preferential tax treatment; some local government US bonds give below the risk-free rate).

Application

The risk-free interest rate is thus of significant importance to Modern Portfolio Theory in general, and is an important assumption for rational pricing. It is also a required input in financial calculations, such as the Black-Scholes formula for pricing stock options. Note that some finance and economic theory assumes that market participants can borrow at the risk free rate; in practice, of course, very few borrowers have access to finance at the risk free rate.

Why risk-free?

An alternative interpretation is that, while no investment is truly free of risk, scenarios in which a major government with a long track record of stability defaults on its obligations are so far outside what is known that one cannot make quantitative statements about their chances of happening, and therefore it is simply not feasible to include them in financial planning. A German investor living circa 1904 trying to decide whether to purchase long-term bonds issued by the German government could scarcely have been able to anticipate a World War followed by hyperinflation.