Retirement Retirement Accounts

Post on: 23 Июнь, 2015 No Comment

Government and employer sponsored retirement accounts such as 401(k)s and IRAs are the best ways to save for your retirement goals. Depending on your situation, you can choose from:

- For (almost) everyone: IRAs (Regular, Spousal, Roth)

- For employees at larger organizations: 401(k), 403(b)

- For small businesses and the self-employed: SEP IRAs, Keoghs, SIMPLEs

In this section, we describe:

- Why retirement accounts are such powerful investment vehicles for retirement savings.

- The primary types of retirement accounts (including 401(k)s, the various types of IRAs, and options for the self-employed).

- Some basic strategies for deciding how to invest these funds.

Why Retirement Accounts Are So Powerful

Government and employer sponsored retirement savings accounts are the most powerful retirement vehicles available because they combine the benefits of 4 of the most effective principles of saving:

- Compounding interest

- Consistent saving

- Reduction in taxable income

- Tax-deferred growth

Compounding interest

By investing early (ages 19-26) to let the power of compounding work for her, Sue invests 1/5 as much as Kim but earns 25% more than Kim.

Compounding is a cumulative “snowball” effect of interest accumulating over time, both on your original investment as well as the interest earned. Money compounding at a steady rate of return grows not at a constant but at an accelerated rate. So the longer your money can compound, the more you will enjoy the benefits.

Without compounding, $1,000 invested at 10% for 20 years would grow to $3,000. This may sound fine, but with that same investment compounding at 10% interest, you would end up with $6,730—almost 7 times your original investment.

Consistent saving

Steady progress towards retirement savings, even if small and steady, has proven to be the most successful approach to saving for retirement.

Why?

The reason isn’t financial—people simply tend to put off saving for retirement, and thereby let valuable time pass when their money could be compounding. Compounding is just as effective on small amounts of money as it is on large amounts.

Reducing taxable income

One of the best reasons to use retirement accounts (some, but not all, offer this benefit) is that those contributions reduce your taxable income. In other words, you don’t have to pay taxes on the amount you invest.

This may not sound all that significant, but if you consider that you don’t have to pay tax on a $4,000 contribution to your retirement account and your effective tax rate is 28%, you simultaneously save $1,120 in taxes and have that much more money compounding for you.

Tax-deferred growth

Much like reducing your taxable income, tax-deferred investments are given special tax status. With retirement investments, you have to pay capital gains tax when you sell investments for more than their purchase price. You also pay tax on any dividends received. In tax-deferred retirement accounts, however, your money is allowed to grow tax-free, so you only have to pay taxes when you withdraw funds from your account. Since taxes don’t take a bite while your money grows, the acceleration of compounding is maximized.

Retirement Vehicles

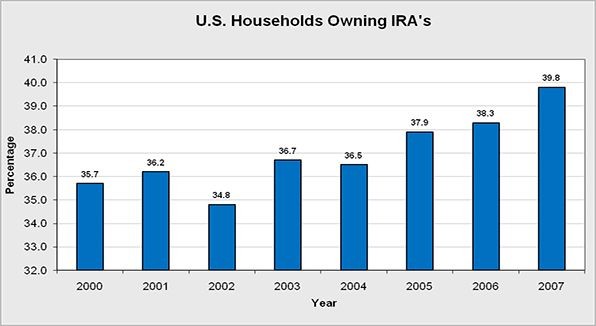

Individual retirement accounts

You may contribute up to $4,000 of your earnings for2006 or up to $5,000 if you are age 50 or more because of the extra $1000 catch-up amount. You may fund a traditional IRA, a Roth IRA (if you qualify), or both, but your total contributions cannot be more than these amounts.

You may be able to take a tax deduction for the amounts you put into a traditional IRA, depending on whether you — or your spouse, if filing jointly — are covered by an employer’s pension plan and how much total income you have. You cannot deduct Roth IRA contributions, but the earnings on a Roth IRA may be tax-free if you meet the conditions for a qualified distribution.

How do these IRAs differ? Roth and Spousal IRAs were created in 1998 to offer more flexible alternatives to the regular IRA

(check with www.irs.gov and your tax advisor for current and complete information)

Spousal IRAs

- These allow spouses to take full advantage of IRAs, regardless of the other spouse’s retirement arrangements.

Roth IRAs

These IRAs were designed primarily for people with qualified company retirement plans or whose income exceeds the deductibility limits of traditional IRAs.

- Contributions made to Roth IRAs are not tax-deductible, but when you withdraw your money in retirement, you will not have to pay taxes.

Which type of IRA is best for you? Learn more about IRAs and compare the options with a Regular IRA or Roth IRA Tool .

Employee retirement accounts: 401(k), 403(b)

What exactly are these? In a sense, these are personal pensions. In the past, large corporations administered defined 401(k) and 403(b) benefit plans (or in other words, pensions) that guaranteed a certain level of income after you retire. Now, 401(k) plans are becoming more common because pensions are costly to administer, and people are changing jobs more often.

Instead of defined benefits, 401(k) plans have defined contributions. Employers define how much they will contribute up front but make no promises about what you will have when you retire. You administer the funds in your 401(k) plan, and are responsible for making sure that they are invested appropriately to provide enough money for you during your retirement. 403(b) plans are similar to the 401(k)s, but are designed for public-sector employees.

Certain 401(k) plans are better than others but they are all sound retirement vehicles. Why?

- Contributions are tax-deductible.

For further information, refer to Tax Topic 424, 401(k) plans .

The best reason of all to take advantage of a 401(k) plan is the matching contributions from your employer. See this example and the tremendous savings that are created:

- Situation: annual salary $60,000

- 401(k) saving rate: 10% ($6,000/yr)

- Company match: 50% ($3,000/yr)

- Investment return rate: 8%