Retirement Plan Investments FAQs

Post on: 14 Июль, 2015 No Comment

Prohibited transactions are certain transactions between a retirement plan and a disqualified person. If you are a disqualified person who takes part in a prohibited transaction, you must pay a tax.

These frequently asked questions and answers provide general information and should not be cited as legal authority.

Are there special limits on the type of investments available to retirement plans?

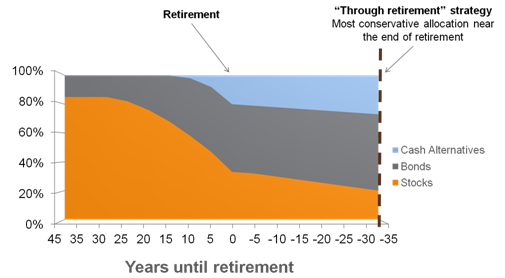

Although there is no list of approved investments for retirement plans, there are special rules contained in the Employee Retirement Income Security Act of 1974 (ERISA) that apply to retirement plan investments. In general, a plan sponsor or plan administrator of a qualified plan who acts in a fiduciary capacity is required, in investing plan assets, to exercise the judgment that a prudent investor would use in investing for his or her own retirement. (ERISA § 404) In addition, certain rules apply to specific plan types. For example, there are different limits on the amount of employer stock and employer real property that a qualified plan can hold, depending on whether the plan is a defined benefit plan, a 401(k) plan, or another kind of qualified plan. (ERISA §407) Certain plans, such as 401(k) plans, that permit participant-directed investment can avoid some fiduciary responsibilities if participants are offered at least three diversified options for investment, each with different risk/return factors. (Labor Reg. Section 2550.404c-1)

In addition, under the Code, both participant-directed accounts and IRAs cannot invest in collectibles, such as art, antiques, gems, coins, or alcoholic beverages, and they can invest in certain precious metals only if they meet specific requirements. (IRC Section 408(m))

Individual retirement accounts also are not permitted to invest in life insurance. (IRC Section 408(a)(3))

Finally, certain transactions between a plan and a “disqualified person” are specifically prohibited by law (see below). Similar rules apply to transactions between an IRA and its owner or beneficiary or between an IRA and a disqualified person.

What is a prohibited transaction?

A prohibited transaction is a transaction between a plan and a disqualified person that is prohibited by law.

Prohibited transactions generally include the following transactions:

a transfer of plan income or assets to, or use of them by or for the benefit of, a disqualified person;