Retirement Income Strategy

Post on: 24 Май, 2015 No Comment

- Well-defined plan Conservative investment portfolio Wealth protection (health insurance, life insurance, income protection and critical illness insurance) Estate and wealth transfer

An important component of total wealth management in pre-retirement years and well into retirement involves generating income from various sources in a tax effective way. This could include:

- Drawing on registered plans prior to full retirement

- Receiving tax-efficient income once retirement begins

- Being cognizant of how actions made today will impact future income and government benefits

- Safeguard for a guaranteed minimum level of income for a surviving spouse or partner (if applicable)

- Transitioning remaining assets to the estate or a charity in a tax-effective way

Your retirement income may come from a variety of sources including:

- Government benefits

- Employer’s pension

- Registered retirement income fund/life income fund

- Life insurance proceeds

- Life annuity

- Part time employment

The written retirement income plan will lay out a specific strategy that could utilize all of the above sources of income, while at the same time emphasizing the most effective use of these sources over the longer term. This is also why consolidating all of your assets and developing a long term relationship with a Certified Financial Planner who specializes in retirement planning is so important to ensuring you have a road map that helps you to where you want to go. Of course, this plan will need to be adjusted from time-to-time as life-changing events occur.

Asset Allocation

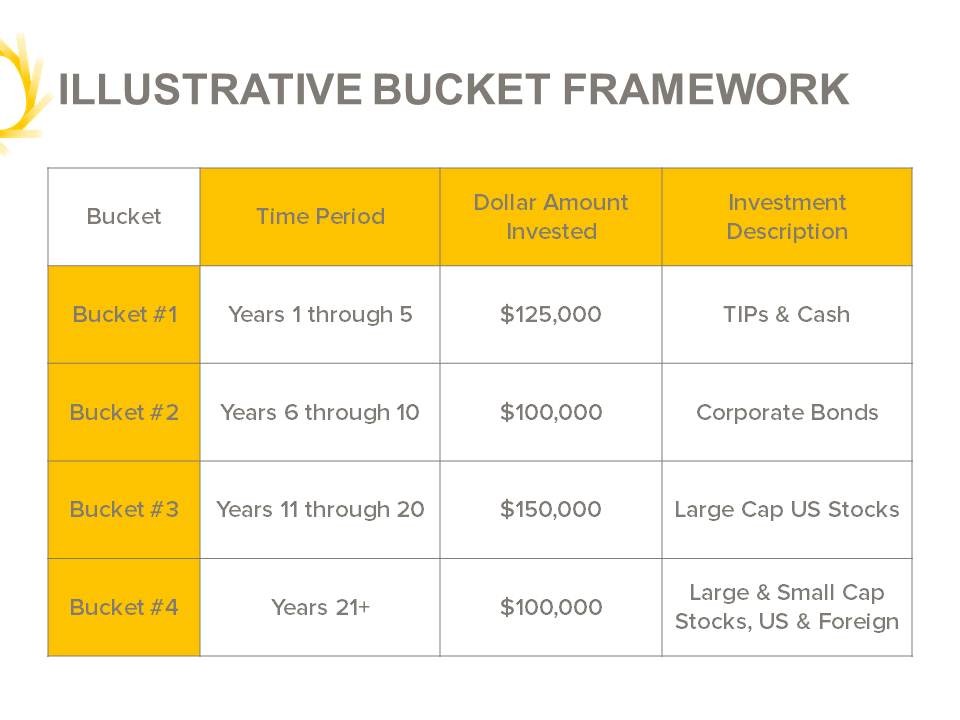

I advocate following a time-segmented asset allocation model for your retirement years. A time segmented allocation model spreads a client’s assets across multiple accounts based on a client’s risk tolerance, with each account designated to produce income over a certain period of time. These assets can be held separately among many accounts or can be combined in one account and segmented by time. Normally, early segments have a very conservative asset allocation, often made up of guaranteed interest options (GIOs) or high quality bonds which are generally not prone to volatility.

Later segments are typically allocated more aggressively based on risk tolerance to allow for the potential for market appreciation. Given that this part of the portfolio will not be required for many years into the future, some market volatility can be tolerated as this segment can add some protection against inflation.

A time-segmented allocation structure also provides a yardstick for measuring how well the segments are performing, thus allowing for adjustments along the way. I can calculate the target amount each segment needs to generate to produce the desired amount of income yearly.

The strategy’s progress can be measured each year to determine whether ‘harvesting’ is appropriate. In ‘harvesting’, a portion of a higher risk segment is re-allocated to a lower risk segment over time, thus ensuring that an appropriate amount remains in each segment.

‘Harvesting’ is critical to the time-segmented model’s ability to provide inflation-adjusted income.

The time segmented allocation model for generating income is one which is easily understood, while at the same time providing a framework that both the client and I can follow.

In retirement, most people are looking for a sustainable and predictable level of income, rather than trying to generate a high rate of return.