Retirement Income Plan Do You Have One

Post on: 24 Май, 2015 No Comment

by Guest Post

David Bakke is a financial contributor for Money Crashers Personal Finance. He writes about retirement planning, frugal living tips, paying off debt, and achieving financial success.

A retirement income plan is different from saving for retirement, which is a necessary precursor. Saving for retirement is what you do during your earning years, while a retirement income plan is about where to invest your money when you retire, and how to withdraw that money in order to maximize its longevity.

I am very much a do-it-yourself kind of guy. I love DIY home improvement and DIY car maintenance projects. However, one thing I must stress is this: Know your limitations . Creating your retirement income plan is a broad and extensive undertaking, and it will play a significant role in how enjoyable your retirement is.

If you make an investment mistake while saving for retirement, you have time to make up for it. But if you misunderstand your accounts or their tax treatment and overestimate how much you have to spend during retirement, the effects could be devastating . To help decide whats best for you, Ill go into the advantages of planning your own retirement income versus the advantages of hiring a professional.

Advantages to Planning Your Own Retirement Income

If you prepare and plan for retirement without the benefit of a paid professional, youll save yourself money in financial advisor fees and commissions. Since planners charge an average of $175 per hour and your income plan wont be completed in a mere 60 minutes, professional help can get very pricey.

2. Information Is Easy to Access

If youre willing to invest the time, you can find a great deal of planning advice on the Internet and utilize online retirement income calculators. But you must be financially savvy to pull this off. The web contains many conflicting and outdated opinions, methods, and rules, and unless you possess a strong understanding of financial elements, planning your retirement income could result in disaster.

3. No One Knows You Better Than You

Nobody knows the ins and outs of your personal financial situation better than you. I would be leery of allowing strangers to set up my retirement income plan if they didnt first ask how I want to spend my retirement, what sources of income I expect to have, how comfortable I am with risk, what insurance plans I have in place, what my current expenses are, and how or if I see these factors changing.

If there is an error or something goes wrong, who will pay the price? Your planner certainly wont.

Advantages to Professional Retirement Income Planning

Professionals Possess Expertise

I question whether most people have the amount of knowledge it takes to create an effective and manageable retirement income plan. After decades of saving, most new retirees can benefit from professional advice on how to invest and withdraw their retirement funds wisely.

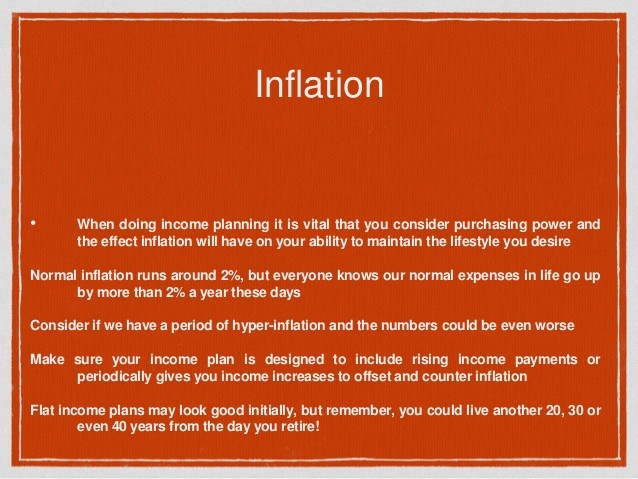

Youll need to estimate your social security income, your pension, and other sources of income, such earnings from your 401k, annuity, or a life insurance policy. Plus, you must determine how much money youll need or want to live on, and how that will be affected by taxes and inflation.

The process also involves a lot of prognosticating and a familiarity with a wide scope of financial instruments and accounts, taxation, risk, and various forms of inflation. Furthermore, many of these factors change according to law or the economy on a regular basis. It may be too much for regular Joes to handle.

You Can Avoid Flaws Associated With Conventional Knowledge

Conventional wisdom on topic of investing can leave you vulnerable. Take, for example, the 4% plan, which states that if you withdraw 4% of your savings in the first year of retirement and boost that percentage annually for inflation, your nest egg should last you roughly 30 years.

However, this method is considered to be outdated. By following this guideline without considering where and how youre invested, you could set yourself up for disaster during the markets down years when your allotted percentage just isnt enough. If you dont have an alternate plan, this could result in you running out of money.

Free and Low-Cost Help Is Available

While professional services can be pricey, there are a few free and low-cost options to get you started. For example, if you have more than $500,000 in assets, Vanguard can provide you with a retirement income plan at no extra charge. If your assets are below this mark, however, you can get one for $250.

That said, if you decide to bring in a professional, shop around. Make sure you find someone youre comfortable with and that you have confidence in. Cost is always a factor, but you may want to shell out a few extra hundred dollars to get the job done right.

Final Thoughts

If youre like me well-versed in things financial and accustomed to doing them on your own you may want to create your own retirement income plan. However, you may still find it necessary to run it by a professional. You can spend far less money on a review of your income plan rather than the entire creation of it.

Whether you hire a professional to create your plan or simply review it, take the time to find one who is highly qualified. There are many factors and variables that go into creating an accurate and manageable retirement income plan, and once your plan goes into effect, you may be beyond the point of return if you experience a miscalculation.

What are your thoughts on creating and managing your retirement income plan? Do you plan to hire a professional advisor, or go the DIY route?