Retirement blog Beware targetdate funds

Post on: 16 Апрель, 2015 No Comment

Wednesday, Jan. 6

Posted 2 p.m. EST

Target-date funds have rebounded from losses suffered during the recent bear market, prompting Josh Charlson, Morningstar senior fund analyst, to defend them in his column A much-maligned fund group bounces back . His article focuses on target-date 2010 funds, which I wrote about in November 2008. right at the time they were freefalling. Fund losses at that point ranged from 15 percent to more than 40 percent, though for calendar-year 2008, 2010 funds fell 23 percent on average, according to Morningstar.

Charlson says critics were too quick to judge them a failure, and points out that two of the funds that lost the least in the market malaise also gained the least when the market revived. In the 25 months since the bear market began, the average 2010 fund lost 4.5 percent — far from catastrophic, Charlson says.

That may be true, but losing 20 percent, 30 percent or 40 percent in 2008 had to make investors facing imminent retirement queasy. And some likely bailed out, locking in losses. In hindsight, that was the worst thing they could do.

A quick history

Target-date funds have become ubiquitous in retirement plans in recent years. In fact, employers who offer automatic enrollment commonly use them as the default option for workers who don’t take the trouble to review their plan’s investment options. Thanks to the Pension Protection Act, target-date funds became a qualified default investment alternative, or QDIA in the industry lexicon, meaning employers can direct your contributions to them without worrying much about legal reprisals.

The problem: 401(k) plan participants are told that target-date funds automatically shift into more conservative holdings as their target date approaches. So investors in target-date 2010 funds certainly don’t expect to lose a big chunk of their assets one year before they may retire.

When these funds did suffer big losses in 2008-2009, they got the attention of Congress and became the subject of several Senate subcommittee hearings last year. Nothing much has come of that.

Whose fault is it?

Brian Graff, executive director and chief executive officer of the American Society of Pension Professionals & Actuaries, a retirement industry trade group, doesn’t blame Congress for the problem. The Department of Labor said you can use this as a QDIA. It didn’t say the industry should disguise what a target-date fund is, and that’s what the industry did, in my opinion.

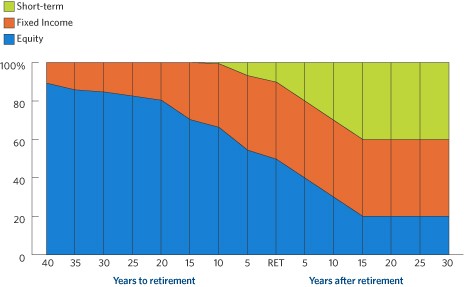

The truth is there are two types of target-date funds: 1) the kind that really do get very conservative by a particular target date, heavily laden with fixed-income investments, and 2) the kind that remain fairly aggressive, with big stock positions designed to promote portfolio growth under the assumption that investors will live 20 or 30 years beyond their target retirement date.

How big of a stock position belongs in a target-date 2010 fund? The majority of the retirement planning professionals Graff recently addressed in South Florida answered 20 percent. But the actual average for 2010 funds is 57 percent, according to Graff.

You wanna know the disclosures that target-date funds currently have? Every single one of them says pretty much the exact same thing: ‘Capital appreciation and current income consistent with its current asset allocation.’ Can someone try to explain to me what the hell that means? It doesn’t mean anything, he says.

The Securities and Exchange Commission has to step in and impose labels or disclosure rules that will help educate plan participants about these funds, Graff says.

In my opinion, they should come with a label that says, Warning: This target-date fund is loaded with equities that may be hazardous to your retirement plans.