Retail Notes A Simpler Alternative To Bond Funds_5

Post on: 8 Июль, 2015 No Comment

Focusing on Capital Preservation: Stable Value and Possible Alternatives

- Stable value, which combines an actively managed fixed income portfolio with a contract to help assure principal and income, offers capital preservation potential and historically higher risk-adjusted returns than money market and low duration strategies.

- Plan sponsors that cannot obtain the wrap contracts or fixed income managers of their choice may want to consider a modified stable value solution, such as stable cash or stable interest.

- If stable value strategies do not offer meaningful benefits to a plan, PIMCO believes a short-term bond strategy specifically designed and managed for the plan’s unique return and volatility needs may be the best alternative.

Article Main Body

Offering a strong, conservative capital preservation option is crucial for defined contribution (DC) plans, as volatility in the financial markets remains high and a growing number of investors approach retirement. In our view, stable value strategies, which combine an actively managed fixed income portfolio with a benefit-responsive contract, or “wrap,” that helps provide an assurance of principal and income, are perhaps the most attractive conservative investment option for DC plans. Despite continued challenges for some with gaining or retaining quality wrap capacity, stable value potentially offers capital preservation and attractive long-term risk-return characteristics, while its historically higher long-term returns versus lower-yielding money market alternatives can also help preserve purchasing power and help mitigate the effects of inflation.

Stable value is a significant asset class within the defined contribution space and, according to the 2012 PIMCO DC Consulting Support and Trends Survey (PIMCO DC Survey), most plan sponsors that offer stable value will likely stay with it but will evaluate their underlying investment managers. At PIMCO, we have developed what we believe are effective ways to assess stable value offerings and optimize exposure to this asset class in light of ongoing wrap capacity constraints. And for those plan sponsors that cannot fully maintain – or do not want to continue with – the stable value option, we have identified potentially attractive alternatives.

Assessing return and risk in stable value

Stable value is a fixed income investment typically used as a capital preservation option in DC plans. According to the Plan Sponsor Council of America’s 54th Annual Survey as of 31 Dec 2011, 61.5% of DC plans offer a stable value portfolio, including over three-quarters of plans with more than 5,000 participants, resulting in more than half a trillion dollars in stable value. There is little doubt that the prevalence of and significant assets invested in stable value portfolios have drawn increased interest from plan sponsors and consultants given the capacity constraints of the last few years.

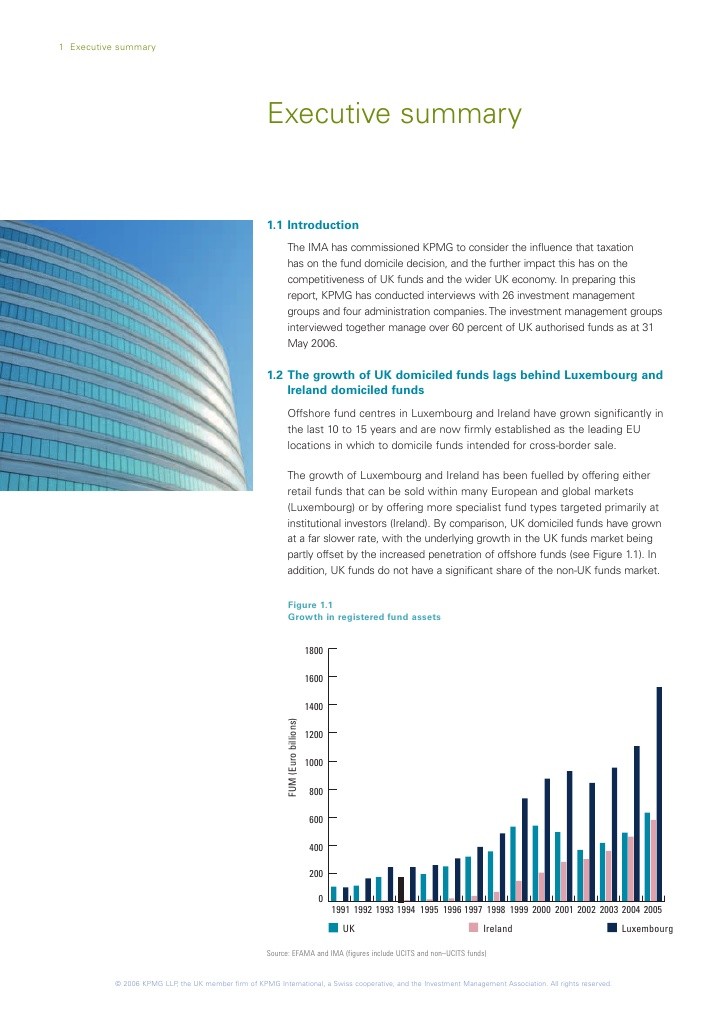

Stable value seeks capital preservation, but with higher return potential compared with the main alternatives, money market and low duration strategies. Stable value has delivered better risk-adjusted returns over time than these alternatives, as shown in Figure 1, which uses Hueler Analytics Stable Value Pooled Fund Comparative Universe as a proxy for stable value risk and returns.

Over the last 10 years ending 31 Dec 2011, the Hueler Index returned 4.22% while the Lipper Money Market Index returned 1.72% and the Barclays 1-3 Year U.S. Government/Credit Index, a typical benchmark for low duration strategies, returned 3.63%. During this same period, as represented by standard deviation, the Hueler Universe exhibited about half the volatility of returns as the Lipper Index and less than one-sixth of the volatility of the Barclays 1-3 Year Index.

Going forward, absolute returns on stable value, as well as money market and low duration strategies, are likely to be lower given the Federal Reserve’s long-term near-zero interest rate policy.

202012%20Schaus%20Gorman%201.PNG /%

Stable value’s historical performance relative to alternatives in the capital preservation space will likely come as no surprise to those familiar with the asset class. Unfortunately, the overall stable value market is still working through the wrap capacity challenges that resulted from the financial crisis in 2008, with some wrap providers – banks, especially – shrinking their outstanding book of business or exiting the wrap market entirely.

Wrap contracts are critical because, when combined with their associated fixed income assets, they help deliver the stability of principal and income characteristic of stable value portfolios. Additionally, while the risks to wrap providers have substantially decreased since 2008 due to recovering contract market value-to-book value ratios, many providers still seek to renegotiate wraps with more conservative guidelines and generally more restrictive terms for plan sponsors.

Despite those challenges, the PIMCO DC Survey shows that 78% of consultants believe plan sponsors are increasingly satisfied with their capital preservation plan options, up from 68% in 2011, and only 6% of consultants say plan sponsors will likely look to exit stable value for money market strategies, down from 11%. This change in attitude may result from indications that wrap providers are not as urgently seeking wrap contract changes in the last year and that the supply of wraps is improving, with much of the new capacity coming from insurance providers.

Nevertheless, the challenges in the stable value market in the last several years have caused a few plan sponsors to leave stable value, including several large, high profile plan sponsors. When asked in the PIMCO DC Survey what factors would cause plan sponsors to discontinue stable value, consultants’ top responses were generally consistent from 2011 to 2012: The top two remained “insufficient quality wrap capacity” followed closely by “wrap issuer restrictions on plan design.” A distant third was an “increase in wrap fees.”

Seeking to optimize fixed income management

In our view, choosing the fixed income manager for a stable value option is one of the most important decisions a plan sponsor makes – especially in such a low rate environment where index yields are anemic. The 2012 PIMCO DC Survey showed that many consultants think a clear majority of plan sponsors are inclined to evaluate the underlying investment management of their stable value option in the coming year. PIMCO believes this is especially important given that much of the new wrap capacity entering the stable value market is offered by insurance providers, many of whom are only issuing contracts in a bundled arrangement with provider-affiliated fixed income managers.

By smoothing the performance of associated fixed income portfolios, wrap contracts can also inadvertently, and for extended periods of time, mask poor fixed income performance by the manager; that underperformance will be eventually reflected in reduced crediting rates for participants. Unfortunately, with the wide differences in fixed income manager performance during and after the 2008 market crisis, many plan sponsors have experienced this directly.

Indeed, the 31 Dec 2011 Hueler Analytics Universe data show a return differential of 183 basis points (bps) between the three-year crediting rate of the top decile stable value portfolios at 3.84% and bottom decile portfolios at 2.01%. Historically, this difference was much smaller on average, but the underperformance of many fixed income managers in 2008 is only fully reflected in the crediting rates over time given the smoothing mechanism of the wraps. For comparison, note the difference in the 10-year crediting rate between the top and bottom deciles is 64 bps, including the most recent three-year period. In our view, many stable value options underperformed not only because of the broader market dislocations but also because some stable value managers have generally weak fixed income investment and risk management processes.

The 1.83% return advantage of the top-decile-performing stable value funds of the Hueler Universe is significant. This is why PIMCO believes fixed income management in a stable value option is such a crucial decision. Additionally, with the current year-over-year U.S. inflation rate as measured by the consumer price index in excess of 3%, those top-performing stable value portfolios did a better job of providing a real return for participants than poorly performing stable value portfolios.

Focusing on good capacity from good partners

We also recommend considering assessing the wrap contracts and wrap providers. First, we suggest assessing whether the wrap contracts in the stable value option are what PIMCO would call “good capacity” – that is, determine if the contract terms are fair and equitable, with investment guidelines that are not overly restrictive. This is important because the wrap contract’s terms will govern participants’ coverage when they need it most.

Unfortunately, we believe some wrap providers have taken advantage of the supply-demand imbalance of the last few years to push risk back onto plan sponsors and participants. Gaining access to new capacity should not be at the cost of accepting excessive contract risk through unfavorable terms or overly constrained guidelines.

We also prefer wrap providers that are good partners. Specifically, we prefer issuers committed to the stable value business and flexible enough to work with plan sponsors as their plans and the DC market evolve. Plan sponsors are under ongoing pressure to offer competitive benefits packages, which often means more choice and transparency, as well as increasing legal and regulatory scrutiny. It is therefore important that the wrap providers are relatively easy to work with, responsive to plan sponsor needs and committed to developing long-lasting relationships.

Stable value: all or none?

Some plan sponsors may feel they do not have access to 100% good capacity, all good partners or the fixed income managers of their choice. Yet these plans sponsors may not have to exit stable value entirely. There are alternatives, specifically two modified stable value solutions, which we call “stable cash” and “stable interest,” as shown in Figure 2.

202012%20Schaus%20Gorman%202.PNG /%

Stable cash

“Stable cash” is a partially wrapped stable value solution with no expected principal volatility that aims for higher returns over time than a money market strategy. The goal is to obtain as much good stable value capacity from good partners as possible, using preferred fixed income managers, but the balance of the portfolio’s assets are then allocated to a money market strategy. The money market allocation sits ahead of the wrapped assets in the portfolio’s withdrawal order; this can help reduce wrap provider risk and, potentially, reduce provider contract constraints. It can also possibly increase the plan sponsor’s flexibility during employer-initiated events or increase the likelihood of gaining wrap provider approval for plan changes.

If a plan sponsor prefers, the stable cash structure can be designed to maintain a $1 net asset value (NAV), similar to a money market strategy. Figure 3 illustrates three blended hypothetical stable cash strategies, using historical returns of both the Hueler Universe as a proxy for stable value and the Lipper Index as a proxy for money market returns.

The end result for a plan that increased the targeted cash amount in a stable cash portfolio to 15%, 25% or even 50% could have been returns over the last 10 years that exceeded money markets but with less volatility.

202012%20Schaus%20Gorman%203.PNG /%

Of note, a stable cash structure of 75% stable value and 25% money markets resulted in a hypothetical return of 3.59%, just a few basis points less than the Barclays 1-3 Year U.S. Government/Credit Index return of 3.63% over the same time period (as shown in Figure 1), but with about one-sixth of the volatility.

Stable interest

Like stable cash, “stable interest” is a modified stable value structure that seeks to maximize its allocation to good capacity with good partners. But instead of an allocation to a money market strategy, stable interest has an allocation to unwrapped bonds – generally a short or low duration bond strategy.

The unwrapped, marked-to-market allocation within the portfolio results in a NAV that may fluctuate, both up or down, on a daily basis. The type and amount of the unwrapped assets determine the portfolio’s overall volatility. The unwrapped fixed income allocation also sits ahead of the wrapped portion of the portfolio, providing many of the same potential benefits as the money market allocation in stable cash. One additional advantage to stable interest is more flexibility for the plan sponsor to keep the unwrapped assets with their preferred fixed income managers.

202012%20Schaus%20Gorman%204.PNG /%

Figure 4 compares returns and risk for blended hypothetical stable interest strategies, using historical returns of the Hueler Universe as the proxy for stable value and historical returns of the Barclays 1-3 Year U.S. Government Credit Index as the unwrapped fixed income proxy.

Even with a surprisingly large allocation of 50% to the unwrapped fixed income strategy, only eight negative monthly periodic returns occured over the 10-year period ending 31 Dec 2011. Of the eight months with negative periodic returns, only one was lower than -0.25%, which was a monthly return of -0.34%.

In general, the hypothetical returns of the stable interest structure were higher than those of the stable cash structure, with the trade-off being a small amount of ongoing volatility in the portfolio’s NAV. Moreover, with a lower allocation of 25% to unwrapped assets in the stable interest portfolio, the hypothetical total return was 4.07%, significantly higher than the Lipper Index return of 1.72% over that same period but with slightly lower volatility of 0.46% vs. 0.49%.

In our opinion, either stable cash or stable interest strategies may be superior to accepting suboptimal contract terms, wrap providers or fixed income managers. Any of the blended allocations could likely have been achieved with fewer wrap providers than might be needed for full stable value implementations.

Beyond stable value: other DC conservative options

We recognize, however, that stable value is not for every plan. Some plan sponsors may find it does not offer meaningful benefits for participants, or the plan sponsor may decide to exit the asset class for other reasons. What, then, are the best alternatives?

In the past, plan sponsors have looked to money market strategies or low duration options. In the 2012 PIMCO DC Survey, most consultants said that plan sponsors looking to replace the stable value option would likely consider money market strategies. Today, however, money market strategies present a fundamental challenge as a true capital preservation option in a DC plan. Specifically, participants are facing a form of “financial repression,” meaning they are being forced to accept near-zero returns on short-term investments for a long period of time due to the Federal Reserve’s commitment to low short-term interest rates; with the CPI in excess of 3% recently, many participants may actually be losing purchasing power on an inflation-adjusted basis by investing in money markets. As for low duration strategies, they may provide a better alternative in terms of after-inflation expected return potential, but their additional volatility may be unappealing.

PIMCO believes a short-term bond strategy specifically designed and managed for the unique return and volatility demands of a DC plan may be a better solution because it can appropriately balance the short-term need for capital preservation and the long-term demand for real returns to maintain purchasing power. This is particularly true if the short-term strategy is tailored to meet the low-risk needs of DC participants. In fact, we believe short-term strategies modified for DC participants will play an increasingly important role in the future of capital preservation strategies within DC plans.