Relative Strength Index Rsi Chartschool 2015

Post on: 16 Март, 2015 No Comment

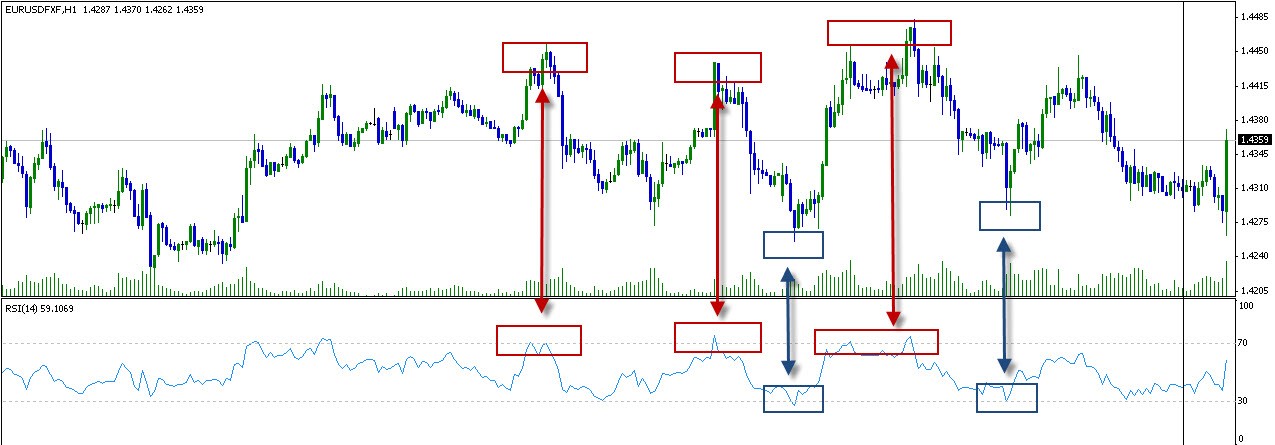

3A%2F%2Fwww.forbes.com%2F?w=250 /% can try to measure the level of fear in a given stock is through a technical analysis indicator called the Relative Strength Index, or RSI, which measures momentum on a scale of zero to 100. A stock is considered to be oversold if the RSI reading falls

3A%2F%2Fwww.thestreet.com%2F?w=250 /% We define oversold territory using the Relative Strength Index, or RSI, which is a technical analysis indicator used to measure momentum on a scale of zero to 100. A stock is considered to be oversold if the RSI reading falls below 30. START SLIDESHOW

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% can try to measure the level of fear in a given stock is through a technical analysis indicator called the Relative Strength Index, or RSI, which measures momentum on a scale of zero to 100. A stock is considered to be oversold if the RSI reading falls

3A%2F%2Fwww.investopedia.com%2F?w=250 /% The StochRSI combines the benefits of both the stochastic oscillator and the relative strength index (RSI). By applying the stochastic calculation to a security’s RSI data, the StochRSI measures the degree to which a stock’s current RSI, rather than price

3A%2F%2Finvestorplace.com%2F?w=250 /% can try to measure the level of fear in a given stock is through a technical analysis indicator called the Relative Strength Index, or RSI, which measures momentum on a scale of zero to 100. A stock is considered to be oversold if the RSI reading falls

3A%2F%2Fforexmagnates.com%2F?w=250 /% This guest blog post is written by Clive Lambert. RSI stands for Relative Strength Index and is a momentum study developed by a chap called J. Welles Wilder back in the 1970s. It has stood the test of time and is still a widely used study in technical

3A%2F%2Fwww.dailyfx.com%2F?w=250 /% One of the first indicators that most new traders get introduced to when discovering the world of Technical Analysis is RSI, or ‘The Relative Strength,’ index. RSI is classified as ‘a momentum oscillator that measures speed and change of price

3A%2F%2Fwww.fxempire.com%2F?w=250 /% The index moved from positive to negative territory confirming the sell signal. The RSI (relative strength index) moved lower with price action reflecting accelerating negative momentum, but the current print of 25 is below the oversold trigger level of 30

3A%2F%2Ffinance.yahoo.com%2F?w=250 /% These indicators are derived by applying a formula to the stock price. The commonly used technical indicators are the Relative Strength Index (or RSI), stochastics, the Moving Average Convergence Divergence (or MACD), and Bollinger Bands. Relative Strength