Reining In CEO Rewards

Post on: 7 Июль, 2015 No Comment

We often hear talk of crazy CEO compensation packages and skyrocketing salaries, but just like sports salaries, the numbers have become so huge they’re hard to comprehend. So, let’s try breaking it down:

If you’re an average American, earning the average salary of about $32,000 per year (according to the U.S. Census Bureau), the average chief executive officer (CEO) of an S&P 500 company earns more than your entire annual salary in one single day of work. For a 15-minute, paid coffee break the average CEO earns well-over $1,000 — probably enough for the down payment on your car.

And these numbers assume the CEO works eight hours per day, all 365 days in the year — no sick days, no holidays and no weekends off.

When the discussion turns to the widening income gap, usually the focus is the rich versus the poor; however, as you’ll see, the widening gap between the rich and the ultra-rich is even more astounding. In this article, we’ll examine the numbers behind gap and take a look at some out-of-control CEO compensation that is fueling the disparity, and finally well look at what you as an investor can do about it. (For more on the income gap, see Losing The Middle Class .)

Rich Just Won’t Cut It Anymore

So, who are these rich people? The U.S. census bureau sets the top quintile (20%) as households earning at least $159,583 per year. While a salary at that level is nothing to sneeze at, it’s not enough to live in the lap of luxury in many major cities on either coast. With modest homes in the San FranciscoBay area fetching seven figures and luxury apartments going for multi-million dollar prices in New York, those at the bottom of the ranks of the so-called rich can’t even afford to stop renting.

The real action isn’t with the top 20% of the workforce, it’s with the top 0.5%. Entry-level gross income for this club is $500,000, but to get to the real CEO level, you need to earn at least $2 million, and often much more.

According to the Corporate Library, the average head honcho of a Standard & Poor’s 500 company earned $13.51 million in total compensation in 2005. That’s approximately 85-times more than the earnings of households on the bottom tier of the rich classification. For comparison, moving to the bottom end of the income scale, if you earn $19,178 or less, the lowest ranking members of the rich only out-earn you by 8.5 to one.

While it’s clear the disparity between the haves and have nots is wide, the disparity between the haves and the have mores is simply staggering.

How Did We Get Here?

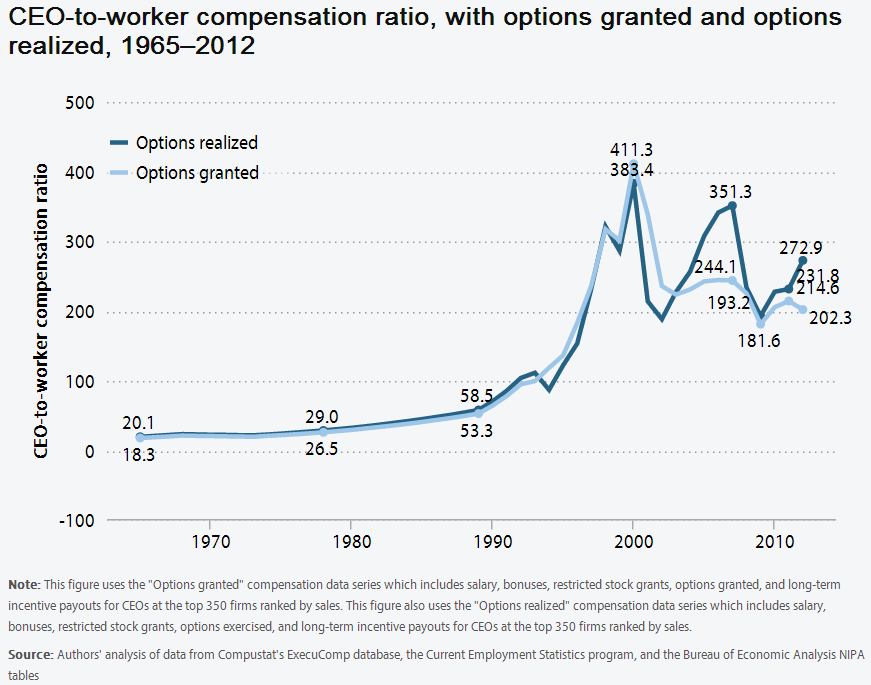

It wasn’t always this way. The trend has accelerated since the 1970s according to the Congressional Budget Office. The top 20% of wage earners accounted for 45.4% of total U.S. income in 1979. In 2004, they had 53.5%. Households bringing in $1 million or more got most of those gains, with an after-tax income increase of 6%. The bottom quintile fell 1.7%.

Much of the excess has been fueled by the stock market. Executive compensation is increasingly funded by stock options ; a practice frowned upon by everyone from Warren Buffett to the U.S. House Committee on Financial Services (the House Banking Committee). Pumping up stock prices has enormous positive implications for CEO paychecks. The result is a dramatic increase in accounting fraud and options backdating to maximize the share price even if the profits aren’t real. (For more insight, see Cooking The Books 101 and The Ghouls And Monsters On Wall Street .)

The United States is the source of the most egregious CEO compensation packages and accompanying corporate scandals, but it is quickly exporting the trend to the rest of the world as global corporations compete with each other for talented CEOs. After offering an already generous compensation package, many companies seem compelled to add a premium to the number to make sure that their CEO ranks among the industry’s highest paid executives. To do otherwise might suggest the company hired a lesser talent.

Infamous Examples Of Excess

The out-of-control nature of CEO compensation has been spotlighted by a number of high-profile cases.

- Divorce proceedings against former General Electric boss Jack Welch revealed a treasure trove of perks from private jets to Knicks tickets. All of these goodies were funded by GE shareholders even though Welch retired with a multi-million dollar golden parachute .

- Home Depot’s Bob Nardelli helped the company’s split-adjusted share price drop during his tenure. For hurting shareholder value, he was rewarded with a $210 million early retirement package.

- The late Enron Chief Kenneth Lay spent $5,000 on an umbrella holder.

- Former Tyco CEO Dennis Kozlowski spent $1 million of shareholder money on a $2-million party for his wife. The shindig included an ice sculpture of Michelangelo’s David urinating top-shelf vodka.

- WorldCom’s Bernie Ebbers got a $1.5 million-per-year pension for bankrupting the company.

All of these perks were funded with dollars that could have gone to shareholders. The average shareholder who can’t rely on a company-funded pension or government-funded Social Security is funding the lavish lifestyle of the CEO who will get a pay raise (via stock price increases) for downsizing that worker’s job. The irony is a little thick. (To find the telltale signs of corporate misdeeds, check out Playing The Sleuth In A Scandal Stock and Putting Management Under The Microscope .)

AMR, the parent of American Airlines, illustrates this point. Executives were slated to receive huge bonuses while unionized workers were asked to make concessions. Public outcry put an end to the bonuses. Public, and especially shareholder, dissent could be the only thing that can put the brakes on.

The Road Ahead

Globalization and advances in technology are likely to keep the trend moving in the same direction. CEO compensation will continue to rise because global competition means there are a large pool of companies chasing a small pool of CEOs. Parallel to this, worker pay will continue to fall as a large pool of workers chases a shrinking number of jobs.

Politically-motivated income redistribution schemes targeted at the top 20% of wage earners will simply bring down the salaries of those in the corner office, not the executive suite. They will have no impact at all on those in the top 0.5%. The same goes for ideas like raising the minimum wage.

While the average worker has little direct control over the hippo-sized compensation packages being offered to even the most mediocre CEOs, shareholders are beginning to take note, including influential institutional investors. Because CEO compensation is set by each company’s board of directors. pressuring the board can yield results. If the big pension funds. hedge funds and endowments want action, it will happen. (Footnotes hold important information on board activities, but can be hard to understand. To learn how to do it yourself, see How To Read Footnotes — Part 3: Evaluating The Board Of Directors .)

What You Can Do

As a shareholder, you can write to the board and to those responsible for managing your investments and encourage them to adopt responsible CEO compensation practices. Demand real pay-for-performance packages that aren’t tied to stock options and that recognize the contributions of the thousands of workers without whom the CEO wouldn’t get paid at all. Another action you can take is using public forums to call attention to top-dollar CEO paychecks of poorly-performing companies. Corporations hate negative attention.

To reach this goal, investors need to pay attention. Remember, it’s your money that’s being used to pay the massive salaries. In addition to voicing your opinion, you can also vote with your wallet. Don’t invest in companies that you don’t support, and don’t buy their products. If you prefer to voice your opinion in person, attend annual general meetings for shareholders and put forth resolutions for change.

To assess whether a CEO has a stake in doing a good job for shareholders, read Lifting the Lid on CEO Compensation and Evaluating A Company’s Management .