Reduce Risk with Market Volatility Strategy Collars

Post on: 17 Июнь, 2015 No Comment

Reduce Risk with Market Volatility Strategy: Collars

Reduce Risk with Market Volatility Strategy: Collars 5.00 / 5 (100.00%) 1 vote

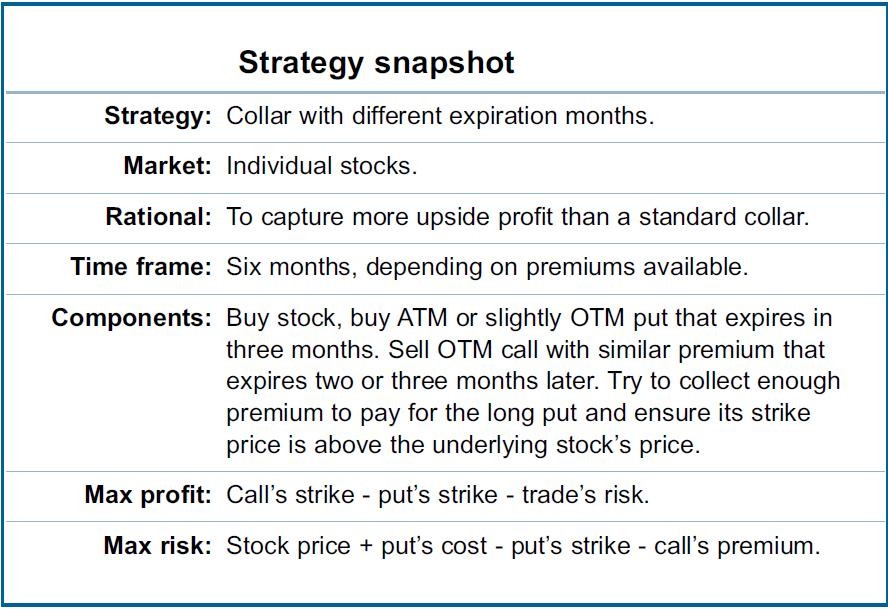

Investors are taking advantage of a strategic option that allows for a better market volatility strategy: collars. The main purpose of the strategy is to reduce the risk of loss when a put or call option is purchased. Indeed, this involves buying and selling the options simultaneously.

The most direct way to hedge against a market downturn is buying put options or puts. The problem is that the puts can be quite expensive. Sometimes investors choose to leave their portfolios without protection against drops, but with an uncertain market, you should never leave your portfolio unprotected. A solution to this problem is collars.

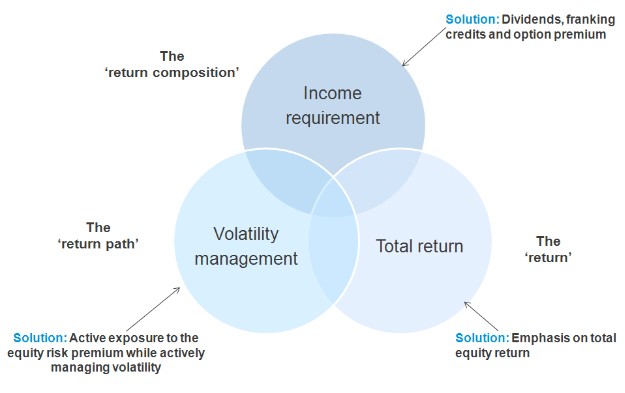

These features offer an advantage so that investors who have different profiles, different goals and different capital can use this type of instrument.

But is it really important that the specialized options trader has this huge choice?

Yes. Such combinations allow you to adapt more risk and reap a bigger reward, protect profits, to limit losses, take advantage of the fall of the time value, or defend and take advantage of the variation in volatility. Proceeds from the sale of the call options are used to finance the purchase of put options. This combination continues to protect on the downside (below the strike price of the puts) and has upside potential to the strike price of the calls.

Options for Buying and Selling

The simplest strategy is to buy an option. Then, the investor chooses to exercise the option (the fixed price that the option can be purchased for), only if the asset is above the exercise price, which means that it is profitable to purchase the option.

For example, if a call option has an exercise price that is $ 5 below the market price, then the owner of the option can purchase and then immediately sell the underlying asset for a profit. If an investor holds shares of the underlying asset, and then buys a put option (where the asset can be sold) they use this strategy for protection.

Another strategy is a basic option, also called taking a short position. An investor who buys and holds the underlying asset is buying short. Investors typically sell short hoping to realize a profit on an asset which appears to be overvalued.

Generally, the options for buying and selling involved in a collar are out of the money, which means that the exercise price of the call option is above the market price and the exercise price of the put option is under the market price. Investors can structure collars to protect their actions and absorb losses.

Traders who are more experienced commonly use this type of strategy, and they can have a better understanding of markets and their volatility. Remember to generate this type of strategy you should do a thorough analysis of the assets in which you will invest, because it depends on you to minimize risk.