Rebalancing Your Portfolio key to maintaining an effective asset allocation

Post on: 16 Март, 2015 No Comment

Rebalancing Your Portfolio

Jack Piazza

R ebalancing your mutual fund portfolio on a regular basis maintains the desired asset allocation in your investment strategy — it is one of the important keys for effective risk management. Yet, most investors ignore this relatively simple procedure, primarily due to (1) their failure to see the benefits of periodic rebalancing and (2) their uncertainty of the proper procedures. Let’s review these factors in a question and answer format.

What is rebalancing?

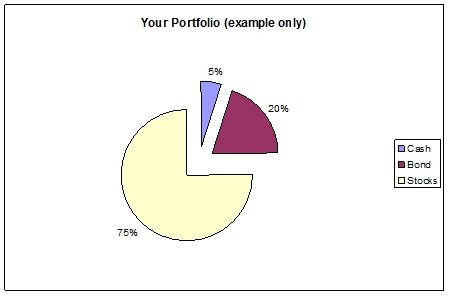

Rebalancing is the periodic adjustment of a portfolio to restore the desired asset allocation mix.

Why is rebalancing important to my mutual fund portfolio?

The primary objective of rebalancing is to manage risk by maintaining effective diversification (i.e. allocating investment assets among different fund categories to achieve both a variety of distinct risk/reward objectives and a reduction in overall risk ). By monitoring that your portfolio is not overly dependent on one or more fund categories, you control risk by curtailing over-weighting and under-weighting — thus reaping the the full rewards of effective diversification in your investment strategy.

Rebalancing forces you to trim back on winners and increase undervalued categories — a principal of buy low, sell high. However, many investors do just the opposite. they chase the best performing funds and end up buying high and selling low, which of course significantly increases the volatility (risk) of their portfolio.

How often should I rebalance?

You should review rebalancing at least annually; many investors rebalance in early January (after year-end statements). Others may choose semi-annual and, to a much lesser extent, quarterly intervals.

What is the best way to rebalance?

For tax-deferred accounts, just shift (transfer) assets to restore you target allocation since no taxes would apply. Any new contributions should follow the desired asset allocation mix.

For taxable accounts, it is best to add (or increase) new contributions to the under-weighted allocations and thus avoid incurring taxes. However, if a particular fund had exceptional results within a year, then consider selling a portion of that fund to restore the original allocation; in essence, you would be protecting your gain and, at the same time, would then be using the gain to buy the under-weighted funds — most likely at a lower than average prices. If taxes will occur upon a sale, then try to minimize the effect by incurring long-term capital gain taxes rather than interest or short-term gain taxes.

What is a recommended allocation variance which would trigger rebalancing?

Rebalance when a fund has varied by the greater of either 15% or ten percentage points (alternatively, rebalance when a fund varies by either 20% or fifteen percentage points, but that may be too great of a variance for some investors).

Example using the following scenario: a four-fund balanced-oriented portfolio (50% stock funds and 50% bond funds).

Original Asset Allocation Mix