Realized pay realizable pay grant date value pay and noadjusted compensation GMI

Post on: 6 Апрель, 2015 No Comment

By Paul Hodgson, Chief Research Analyst

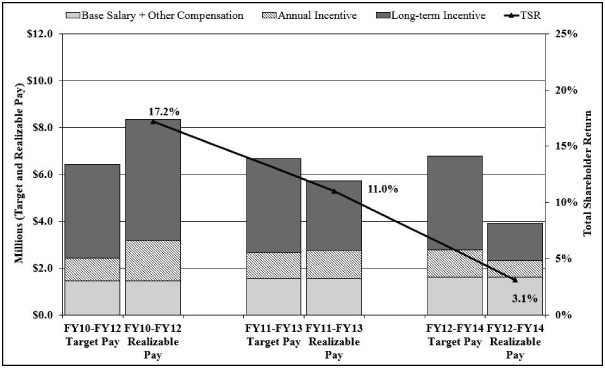

A recent white paper from compensation consultancy Farient Advisors brings a new approach to valuing executive compensation. It premises three main concerns about the existing alternative approaches to putting a number to compensation – realized pay (the GMI Ratings approach which includes vested stock and exercised stock options) and realizable pay (which attempts to put a value on outstanding equity awards). These are:

- Mismatched time periods for pay and performance.

- Different option valuation methodologies, some of which systematically understate the value of options.

- Using target vs. actual number of shares earned in performance share plans, thereby overstating or understating their value

The authors, Robin Ferracone and Jack Zwingli, discuss a solution to these issues developed by Farient which it calls performance-adjusted compensation (PAC). The key differences between PAC and realizable pay are that PAC gives value to out-of-the-money stock options since they have life left in them and therefore could move into the money, and it only values performance shares once they have vested, rather than trying to ascribe a value to the “target” number shares as realizable pay does.

While I believe this does address some of the flaws of realizable pay, none of the arguments are strong enough to move me away from realized pay because, as the authors admit, “it captures the actual value of the awards received and is not subject to interpretation or manipulation.” The two main arguments against realized pay put forward by the paper only apply if you use it without properly understanding what you are dealing with. Yes, it is nonsense to try and match the profits from a stock option award that has been held for 10 years to a three-year performance period. GMI Ratings does not do that. And, yes, it can create spikes in compensation because executives have power over when stock options are exercised. But this is only an issue when you look solely at a single year’s compensation. GMI Ratings does not do that.

However, the paper serves a very useful purpose in checking the headlong rush towards realizable pay that is occurring at the moment, by calling attention to some of the flaws in that approach and suggesting solutions to them. These solutions take time, analysis and expertise – never a popular combination because it is expensive – and the only flaw is that they again utilize the Black-Scholes method of option valuation which is, when not in the right hands, as subject to as much manipulation and interpretation as any other pay evaluation… except realized pay.