Ratio Spreads by

Post on: 29 Июль, 2015 No Comment

Ratio Spreads — Introduction

Ratio Spreads — Content

Star Trading System Training Course

What are Ratio Spreads?

Types of Ratio Spreads

There are 4 main types of ratio spreads; Vertical Ratio Spreads, Horizontal Ratio Spreads, Diagonal Ratio Spreads and Ratio Backspreads.

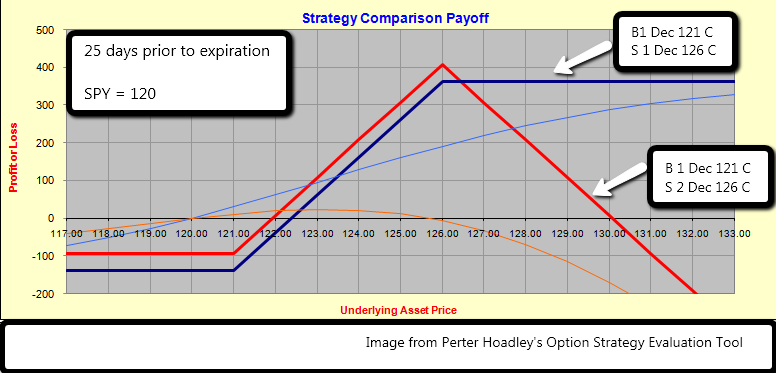

Vertical Ratio Spreads are the most common type of ratio spreads and are commonly known as Call Ratio Spreads or Put Ratio Spreads. These spreads, also known as Bull Ratio Spread and Bear Ratio Spread. are simply call and put vertical spreads that sells more short options than long options are bought.

Horizontal Ratio Spreads. also known as Calendar Ratio Spreads, are horizontal spreads that shorts more near term options than long term options are bought so that the position is established for free or for a net credit.

Diagonal Ratio Spreads. also classified as Calendar Ratio Spreads, are diagonal spreads that shorts more near term options than long term options are bought so that the position is established for free or for a net credit. There are two main Diagonal Ratio Spreads and they are Call Diagonal Ratio Spread and Put Diagonal Ratio Spread.

Ratio Backspreads are Ratio Spreads with more long options than there are short options. Ratio Backspreads are also credit spreads as in the money short options are used instead of out of the money ones. Unlike all the above ratio spreads which are mainly neutral to slightly bullish or slightly bearish options trading strategies, the ratio backspread profits when the underlying stock breaks out strongly to upside or downside. Call Ratio Backspread and Put Ratio Backspread are examples of Ratio Backspreads.

STOCK PICK MASTER!

Probably The Most Accurate Stock Picks In The World.

Purpose of Ratio Spreads

The basic aim of Ratio Spreads is to eliminate upfront payment for the long options or even transform debit horizontal, vertical or diagonal spread positions into credit spread options trading positions so that the position makes money even when the stock should go into the wrong direction.

When Ratio spreads are put on for a net credit, they become options trading positions that profit 3 ways ; When the underlying stock is stagnant, when the underlying stock moves in the favorable direction slightly and when the underlying stock moves in the disfavorable direction strongly. This is almost as good as profiting no matter what happens and covers the directional weakness in horizontal, verical and diagonal spreads.

Vertical Ratio Call Spread Example.

Assuming the QQQQ is trading at $44 and its Jan44Calls are bidding for $1.30 while the QQQQ Jan46Calls are asking for $0.30. A 5. 1 vertical ratio call spread is set up for a net credit by buying 1 contract of Jan44Calls and shorting 5 contracts of Jan46Calls. Net credit = ($0.30 x 5) — $1.30 = $1.50 — $1.30 = $0.20

When QQQQ rises to $46, the Jan44Calls will be worth $2.00 while the Jan46Calls expire, producing a profit of $2.00 + $1.50 = $3.50.

When QQQQ remains stagnant or drops lower than $44, both Jan44Calls and Jan46Calls expires worthless producing the net credit of $0.20 as profit.

This tri-directional profit is unique to Ratio Spreads and is what makes it so powerful. The only problem occurs when the stock moves beyond the strike price of the short options. When that happens, an unlimited loss results as the short options move faster than the long options. That is why you should set up a contingent order to close some or all of those short options when the stock reaches their strike price.

Ratio Backspread are a little different as its purpose is to create unlimited profit potential out of a credit volatile options position. All other credit volatile options strategies have limited profit potential due to their nature as credit spreads but Ratio Backspread is a volatile options strategies capable of unlimited profit potential when the stock breaks out one way and a limit profit in the other way. In this sense, it is again a more advanced strategy than conventional volatile options trading strategies.