Range of Profit on Things With Wings A Look at $RUT Iron Condors and Butterflies Theta Trend

Post on: 10 Июнь, 2015 No Comment

Overview:

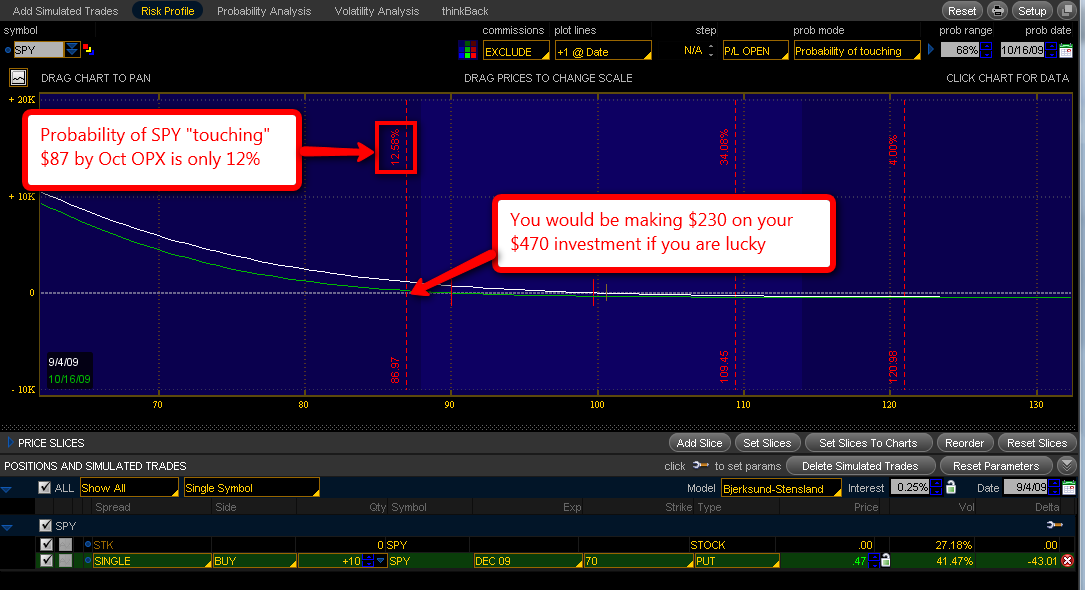

Many options traders like to trade non-directionally and gravitate towards Iron Condors because they provide a wide profit range without having a directional bias. The general philosophy is that if you can sell some out of the money vertical spreads and price doesnt move as far as your short strikes, you can make money at expiration. While I have spent time trading Iron Condors, Ive always found the likelihood of running into trouble problematic. As a result, Ive focused on selling premium in a more directional manner so that my risk is only on one side of the market.

While being short premium in a trend following manner works well when the market is trending or slightly neutral, it is less desirable when the market goes against the trend. My opinion is that a non-directional trading system could provide another system to diversify risk. This post is a look into some research that is likely to become the foundation of a non-directional trading system. Im evaluating different positions below to compare the characteristics of RUT Iron Condors and Butterflies.

When trading non-directionally, I dont like to sit in trades through expiration. As a result, I wanted to take a look at the various positions a couple of weeks into the trade to compare the various profit ranges and potential profit. My goal is always to be out as fast as possible and I want to trade a position that will facilitate getting in and getting out quickly.

Positions Chosen:

Were going to be taking a look at three different positions. All of the positions have 49 days to expiration and use RUT closing prices as of 7/10/2014 when RUT closed at 1161. The positions are a 10 Delta Iron Condor, an ATM Put Butterfly, and a Put Butterfly placed 20 points below the market (ATM-20). I chose the positions because theyre commonly discussed in income trading communities as trades to put on every month.

RUT Put Butterfly with 49 days to expiration and short puts placed approximately 20 points below the current RUT price of 1161.

Issues:

The biggest risk for most non-directional spreads at the time a trade is entered is to the upside. There are ways to mitigate the risk or tweak your position to make the T+0 delta more neutral, but the option skew tends to create a situation where the trade has more risk to the upside. The Put Butterfly placed 20 points below the market has the best risk/reward profile (ignoring probabilities) and theoretically should be the easiest to adjust in a way that keeps the trade in the money.

Two Weeks In:

One of my main questions is where the positions sit a couple of weeks into the trade. Specifically, what is the T+0 line on day 14 (the T+14 line). The result is a little surprising. In the image below Im comparing the three positions. Im giving the break-even values for the T+14 line, the open profit if RUT stays at 1161, and the max profit and the location of that max profit. Intuitively, the max profit is the highest point on the T+14 curve.

The most interesting thing about the data two weeks into the trade is that, in terms of profit range, there is very little difference between an ATM Put Butterfly and the Iron Condor. The biggest difference is that the ATM Fly has a higher potential profit. The widest range of profit is provided by the ATM-20 Put Butterfly, but that profit range is positioned slightly lower.

The images below compare the RUT Iron Condor, the RUT ATM Butterfly, and the RUT ATM-20 Butterfly. The vertical lines are set to the Iron Condor Break even points 2 weeks into the trade and at the current price. The lines were left in place on the images of the Butterflies for comparison.

RUT Iron Condor 2 weeks into the trade with a RUT price of 1161.

RUT ATM Butterfly 2 weeks into the trade. Note that the break even points are very similar to the Iron Condor values. The main difference is that the potential profit is higher and there is more gamma risk.

RUT ATM-20 Butterfly after two weeks. The upside break-even point is slightly lower than on the Iron Condor, but there is plenty of room to run on the downside. Additionally, the gamma risk is slightly greater than with the IC and much less than the ATM Butterfly.

Four Weeks In:

After 4 weeks I want to either be out of the trade or exiting soon. The results below show the profit ranges at T+28 days when the positions have 21 days to expiration. At 4 weeks in, the Iron Condor is starting to widen out and the range of profit has grown considerably. That being said, the range provided by the ATM-20 Butterfly is still very attractive. In terms of profit range, the biggest difference between the two trades is that the Butterfly has a lower upside break-even point.

The images below run through the three positions four weeks into the trade or T+28.

Take Away:

Iron Condors tend to get a lot of attention because of the wide profit range and the high probability of achieving that profit. The reality is that the ATM-20 Butterfly has a similar profit range and the potential to hit a dollar based profit target faster. The big tradeoff for the additional theta is much higher vega and gamma.

With both the Iron Condor and the ATM-20 Butterfly, the initial risk in the trade is greatest to the upside. Specifically, if price moves sharply higher after entering the trade, the position will quickly go underwater. As a result, it makes sense to construct the position in a way that mitigates upside risk by either buying calls, shares of IWM, or bringing the long upside wing in 5 or 10 points. That being said, tweaking the position in a way that mitigates risk is the topic of another post.

One final thing to note is that one RUT Butterfly is not quite the same as one RUT Iron Condor. The greeks are very different and, consequently, the trades would feel very different to trade. The greeks presented in the tables above are based on RUT not moving, which is both an ideal scenario and unrealistic. The main point of this post was to analyze the potential profit range to determine a starting point for a non-directional trading system and that analysis has shown that an ATM-20 Butterfly may be a good place to start for a non-directional trading system.

Are you trading Iron Condors or Butterflies? Tell me what youre trading in the comments below and/or what youd like to see covered in coming posts.

Thanks for reading and please share this article using the toolbar above if you enjoyed it.