Rail Theory Forecasts

Post on: 1 Июнь, 2015 No Comment

North American Rail Car Market

Ohio Castings

Rail Castings Corp.

Miscel Parts and Services

WabTec (WAB)

LB Foster (FSTR)

Portec Rail Products (PRPX)

Suppliers

Dec. 16, 2012

ARII merger with Greenbrier

Icahns bid is too low! A serious bid would have been in the $25-28 range. Greenbriers fortunes are looking up. They should see more car orders in the next two quarters to build their backlog; they are building barges again; their leasing business should be picking up; and their repair business got a big boost with the recent Statoil contract (not to mention the boost to tank car orders it may also bring.) So why are they trading at a P/E of 10? Hopefully Greenbriers investment mistakes (and triennial write offs) are a thing of the past and their prospects for the future look better than ever. A $28/share valuation may be in the future even without Icahn.

Nov. 16, 2012

ARII merger with Greenbrier

Antitrust considerations should not hinder a merger between American Railcar (ARII) and The Greenbrier Companies (GBX). The companies do not compete in the balkanized market for new railcars, and their product lines and sales forces compliment rather than duplicate each other. Moreover, there may be some synergies from the combination and some significant cost savings in administration and overhead expenses. The railcar market is fragmented with only one builder with a history of competing in all markets: Trinity Ind. The other five builders specialize in only a few types of railcars and suffer wild swings in production when demand moves from some car types to others. Trinity has been less affected by these swings than the other builders and the new combination should benefit from a more stable production volume also.

August 10. 2010

Greenbrier Cos. will be running near capacity soon

The fears that are gripping Wall Street have not been reflected in the reports of deliveries and new orders coming from the railcar builders. Business is booming and the backlogged orders are high enough to keep production increasing well into 2012. Greenbrier is battling Trinity Industries for the top spot in delivery totals and the recent orders may help it gain the lead if it can ramp up production fast enough before the end of the year.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

May 10. 2010

Prospects for railcar builders and railroad companies look very different

In the short term, i.e. this year and next, the fortunes of the two related industries could be very different, regardless of what happens in the overall economy. The rosy outlook painted by many rail industry analysts overlooks some basic differences between the two industries and misinterprets some of the recent developments to paint the future of both industries with the same brush.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

March 10. 2010

Greenbrier benefits from change in intermodal logistics

The recent spate of orders for intermodal railcars seems to defy logic when one counts the thousands of relatively new intermodal cars in storage. However, there have been a few operational changes in the intermodal sector which are driving the need for intermodal cars designed to carry 53 (domestic) containers. All of the intermodal cars in storage have 40 wells and are best suited for the international containers.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

March 10. 2010

GATX and Trinity Industries make up

Four years ago, Trinity Industries was so aggressive in the leasing business that GATX and other major railcar leasing companies were grumbling that they might not buy cars from them anymore. Time and low prices have always smoothed ruffled feathers in the past and that is what seems to have apparently happened just now. GATX has purchased large quantities of railcar in the past from Trinity and their recent order signals both a renewed confidence in the market and a close relationship to a major builder.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

February 10. 2010

FreightCar America sustained by orders for export coal cars

Norfolk Southern Corporation recently announced their order of 3,000 steel and aluminum/steel hybrid coal cars for delivery in 2011-2012, matching an almost identical order of CSX Corporation for cars to be delivered in 2010-2011. Both companies are expected to use the cars primarily to transport coal destined for export from East Coast ports. FreightCar America seems to have a lock on the market for these cars, but is suffering from the general downturn in the coal car market.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

February 10. 2010

Based on order backlogs, The Greenbrier Companies could be dominant builder in 2011

The fourth quarter results from the railcar builders association had a big surprise: deliveries jumped from 3,706 in the third quarter to 7,333 cars in the fourth. One builder is expected to announce that their deliveries increased by 300%. The orders came in as expected, and The Greenbrier Companies, which has already reported their first quarter results, ended the year with what is expected to be the largest backlog of all the builders.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

November 10. 2010

Greenbriers problems are common to all car builders, but

Greenbriers projection that it did not see a turnaround in its near term future and that output and profits might not rebound until the second half of 2011 might be a common theme among all railcar builders. However, Greenbriers practice of backlogging nonbinding orders often distorts the outlook for the company and the cancellation of these orders can produce unnecessary surprises.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

October 20. 2010

Railcar builders are looking to better times

The RSI announced the third quarter results for the railcar builders and there were improvements in all categories. Orders totaled over 9,100 units and deliveries continued to increase from 2,946 in the second quarter to 3,706 in the third. Moreover, the backlog of unfilled orders increased from 14,930 to 19,267. If the trends continue, and there is no reason to believe they will not, industry output will almost double in 2011.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

October 10. 2010

Railroads are placing big bet on capturing domestic truck traffic

Greenbrier Corp. recently announced a number of sales and leases for intermodal container cars totaling around 5,000 wells. All of this equipment is for domestic container (53 length) service, a traffic segment that lost less traffic during the recession due to highway traffic defections to the railways. The railroads that will acquire the new cars are betting that their new customers will not only stay with them but that more will follow as the economy improves and as the new eastern doublestack corridors improved railroad service levels.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

June 20, 2010

Stock sale may signal something amiss at Trinity Industries

Timothy R. Wallace, CEO of Trinity Industries, made a wise move when he bought over 15,000 shares of his company in March of 2009 when it was selling for $7.18 per share. He should have bought more. He was one of many smart executives who bought shares in their companies when the stock market was crashing and pricing companies at less than their book value. He probably was also acting wisely when he sold over 100,000 shares recently at $23.65.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

June 15, 2010

Greenbrier hides shrinking marine backlog behind political smokescreen

The Greenbrier Companies recently tried to blame the city of Portlands recent passage of an environmental plan for the Willamette River for its cutback of barge construction at its Gunderson Marine Division. CEO William Furman also blamed the soft barge market on the oil spill in the Gulf of Mexico. The only logical reason for the decision to lower the production rate is a declining backlog and the possibility of a total shutdown before another order is booked. Why all the hype?

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

April 16, 2010

Great Expectations, but thats all for the railcar builders

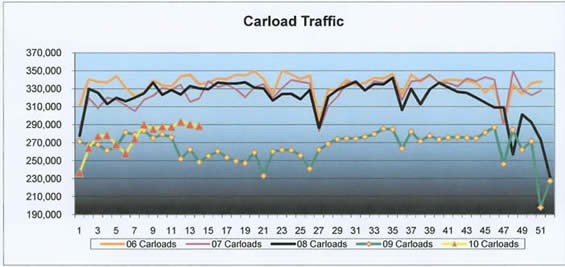

Hope for the railcar builders springs eternal, but reality will eventually have to be considered. It is true that railroad traffic has rebounded from the depths to which it plunged last summer; that railcars that had been stored are being reactivated; and that railroad train speeds are decreasing, increasing the car cycle times and decreasing the number of loads per year that each railcar can handle. However, traffic has a long way to go before it reached the levels recorded a few years ago.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

December 5. 2009

Rising tides cans sink some boats as well as lift them

For some railcar builders, the recovery will be measured in years, not months, and they may be the lucky ones. It is too early to confirm, but there may have been a fundamental shift in railroad traffic, and not all builders are positioned to benefit from the recovery in railroad traffic that is expected in 2010. Only time will tell if there will be another industry shakeout like the early 1980s.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

October 15. 2009

Freightcar America has a strong balance sheet; but thats all!

Freightcar America is a fine company with an old pedigree (1901) and a reputation for producing some of the best coal cars in America. Although the company has no debt, it also has few prospects for growth, since it seems that almost everyone, including some of its own utility customers, want to decrease coal usage in the future. While it has designs for other car types, it has never produced any of these in sufficient quantities to offset any substantial decline that it may be facing in its coal car business.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

August 13, 2009

Railcar industry will take time to recover, lots of time.

There were only 2,165 orders for new railcars during the second quarter, while deliveries totaled 6,463 cars according to the ARCI. Both numbers were 20% less than the totals reported for the first quarter and appear to support both a forecast of 22,000 deliveries in 2009 and a much lower production rate for 2010. Beyond 2010, the future is a lot cloudier than some forecasters will admit, especially those projecting a return to pre-recession production levels within a few years.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

July 13, 2009

Tough times for railcar builders and especially for The Greenbrier Companies

In the quarterly earnings release, Greenbrier (GBX) noted that it had delivered only 800 cars compared to 1,300 last quarter and 2,200 during the comparable quarter in 2008. The decline in business will be a common theme for all railcar builders this quarter, and the outlook for the next twelve months is not encouraging. Deliveries are expected to keep falling for the rest of the year and possibly next year if the economy doesnt show the classic V shaped recovery pattern in the GDP. Some builders will suffer more than others, and Greenbrier may be among the builders who see the most significant decline in new car production.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

April 27. 2009

FreightCar America to halt production at its second shop in two months

With the temporary closure of its Roanoke VA plant, FreightCar America (RAIL) will be down to just one plant in Danville IL where union workers were notified in February that four of five jobs would soon be cut. In 2007, with production falling to 10,282 from 18,548 railcars in 2006, the company closed its largest and oldest facility in Johnstown PA and transferred all production work to its two other plants in Roanoke and Danville. Deliveries held constant in 2008, at 10,239 railcars, but output was expected to a fraction of that total this year. The closure of the Roanoke VA facility indicates that this forecast was on target.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

March 11, 2009

Wabtec forecasts for 2009 freight car and locomotive business appear too rosy

In their news conference to present the fourth quarter results and to explain their 2009 earning guidance, Wabtec executives gave some of the assumptions they used in arriving at their forecasts. They noted that new freight car production was expected to fall from the 60,000 units produced in 2008 to around 30,000 railcars in 2009 and that new locomotive deliveries were expected to fall 25%. It was noted that half of their freight car business was in the aftermarket (repair) segment that it related to fright car use and that they expected ton-miles to decrease only 5% in 2009. While these projections made sense in January, they now appear too optimistic.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

March 11, 2009

Greenbrier faces loss of major order for 2009

At the very end of their plant closure and payroll reduction announcements, Greenbrier (GBX) hinted that its contract with GE for 1,000 tank cars in 2009 and 10,000 tank cars to be delivered between 2010 and 2018 is being renegotiated. The 2009 deliveries covered by this contract account for over 50% of the total projected North American deliveries for this company, and any significant reduction could have major consequences. Since Greenbrier does not own either of its two manufacturing operations in Mexico, its realignment options are constrained by operating contracts at both facilities. Given its bleak outlook for the next few years, the moves made in 2009 may become permanent in 2010.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

February 5, 2009

Trinity will do better than most car builders in 2009

Trinity reduced its first quarter guidance for earnings per share to only 60% of what analyst had expected. The surprise was not the reduction, but that the analysts had not anticipated it. Railcar deliveries were forecasted in December to fall from around 60,000 cars in 2008 to near 30,000 cars in 2009. Moreover, wind power plant installations were also expected to fall from the 9 gigawatts of new power that came online in 2008 to something less in 2009, due both to funding problems and to the current economic contraction. Why these forecasts were ignored is the real mystery, not the expected delay in the companys guidance releases.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

February 5, 2009

Wabtec will try to hold its ground in soft market without price increases

The railroad industry and its suppliers will be in for a rough ride in 2009. Railroad traffic is forecasted to fall back to a level not seen since the last recession in 2002 and many suppliers are looking for a 50% reduction in deliveries this year. Railroad executives are promising that they will raise their freight rates and cut costs enough to offset the revenue shortfalls from lost traffic, but their record on cost reduction is not encouraging and there are political forces gathering to stop any large rate increases. Railcar builders are bracing for a tough year, and locomotive manufacturers are also expecting hard slogging. Of all the companies in this industry, Wabtec has the best chance of not sliding backwards. So how will Wabtec hold its own in this rough environment?

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

January 21, 2009

Greenbrier faces continued losses as demand for its main products looks dormant through 2010

Greenbrier reported a quarterly loss of $3.3 million, with deliveries amounting to only 800 units in its first quarter which ended in November, compared to 1,800 deliveries in the previous quarter, and the delivery total in this quarter may be the high water mark for their fiscal year which ends next August. During the last recession, Greenbriers share of the railcar market rose to 35% when its main car types, boxcars, all types of flatcars, and intermodal cars were in demand and the car types produced by the other builders were out of favor. This time around, the tables have been turned and any real demand for Greenbriers car types is not even on the horizon; its market share may plunge to under 10%. Moreover, Greenbriers efforts to enter the tank car market will be more difficult due to the problems in the ethanol industry and reductions in general tank car demand.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

December 19, 2008

GATX keeps investing in railcars and its future

GATX reported that it recently purchased 3,650 freight cars from an Australian finance company, increasing its leased fleet by about 3%. The cars had an average age of only 2 years and the purchase price indicated the average price per car was $59,452. It takes some fortitude and good intelligence to make long term capital investments in these times, but for a company that has been in the same business for over 100 years, these are both proven virtues.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

December 19, 2008

American Railcar (ARII) consolidating production in Marmaduke

With orders dwindling and backlogs falling, American Railcar decided to consolidate production at the Marmaduke Ark facilities in 2009 rather than continue production at two locations. The 2008 expansion of the Marmaduke made the consolidation possible, since the original plant at that location could only handle tank car production. The second plant that was opened in early 2008 when ARII was contemplating other markets, and it was built to handle all types of railcars.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

November 15. 2008

Watch out for the red coming to the Greenbrier Companies

Greenbrier reported that their backlog for production in 2009 is less than half the number of cars they delivered in 2008 and that they may not make a profit on some of those cars due to higher than expected material costs. And that was the good news. The bad news is that much of their backlog is to be shared with a steel fabricating partner in Mexico who will build 1,000 tank cars for GE in the coming year. The remaining 1,900 cars are for their three other production facilities in Europe, Mexico, and Oregon, some of which might need more cars to make a profit.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

October 28. 2008

Wabtec poised to help railroads and commuter lines with crash avoid ance system

BNSF railroad recently announced that the company would install Positive Train Control (PTC) technology across its entire system by Dec. 31, 2015 and in the Los Angeles basin by 2012. BNSF had been given approval by the Federal Railroad Administration to install the Electronic Train Management System (ETMS) it jointly developed with WabTec (WAB) on a system-wide basis almost two years ago in January of 2007. However, it took the tragic accident involving a commuter train and a UP freight train in LA last month to get the railroad committed to a completion date for this system. Wabtec is working with Norfolk Southern and other freight railroads on similar systems, and will almost assuredly be working with commuter lines to install their failsafe train control system.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

October 3. 2008

Wabtec (WAB) continues to grow

Standard Car Truck will be a great addition to the Wabtec family of companies. There is no overlap in product lines and most of the products offered by Standard will compliment those already made at Wabtec. Moreover, there are potential synergies that may enable the company to grow organically after the initial synthetic growth to their corporate operations is achieved. Wabtec has steadily grown both through increases in market share and through acquisitions over the past several years and this recent purchase appears to be a continuation of a well planned strategy.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

September 15. 2008

Railcar leasing gets a thumbs up from CIT

CIT Group Inc. (CIT) had placed its railcar leasing business on the market and invited several bidders to make an offer for its assets before changing its mind and deciding to hold onto the business. They were not alone in considering a sale of their railcar leasing business, although they were perhaps more public about their intentions than GE, the other major seller in recent months. GATX (GTM) and a few other big money players have actively pursued each company, perhaps seeing a brighter future for the railcar leasing industry than the sellers. So did CIT change its mind or did they really want to sell in the first place?

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

September 10. 2008

Aside from Wabtec and one or two other supply companies, real growth in railroad industry is hard to find.

The current renaissance for the railroad industry began in 2004 when railroad traffic exploded (double digit gains in some key traffic segments) and freight rates were unlocked and allowed to seek a market level. For the railroad companies, the exceptional profit gains since 2005 have been almost exclusively due to continued rate increases, since traffic levels today are barely above those recorded in 2006. For most other companies in this industry, suppliers and financial companies, results have been mixed, with more seeing problems than enjoying the fortunes of the railroad companies. Wabtec is one of the few exceptions, and since its profits have not come from higher prices, it prospects for the future outshine even the railroads.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

August 1. 2008

Freightcar America (RAIL) succumbs to high material costs and low demand

Railcar builder Freightcar America reported a quarterly loss of $0.08/share due to high material costs impacting fixed price contracts and the need to restrain prices in a very slow market for coal cars. Management expressed confidence that demand for coal cars will remain strong in the future, especially if all the new coal fired utility plants that have been in various stages of planning and construction for the past several years come online in the near future. The EIA has questioned the need for all of the new coal fired power at this time, and with the recent declines in the price of natural gas, it is possible that some of the plants may never be built.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

August 1. 2008

Trinity is recapturing market share in declining railcar market

Trinity Industries (TRN) reported earnings growth and increasing orders and deliveries in an otherwise declining market for new railcars, a feat that will probably elude the other railcar builders. Its 6,580 deliveries during the second quarter represented a 44% market share for the entire industry, and its orders for 7,430 cars accounted for 61% of the industry total. Moreover, Trinity said it expects its earnings in the third quarter to be close to those of the second. Is Trinity returning to its old strategy when it and its merger partner Thrall Car had an annual 61% market share?

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

June 11. 2008

Demand for coal cars will increase, but so will Freightcar Americas competition for orders

Overlooking the authors tendency for hyperbole and his greatly distorted timeline of history, his conclusion that demand for new coal cars will soon return is right on target. He is also right in highlighting the current danger to those builders who might be exposed to fixed price contracts and escalating steel and specialty parts costs. However, he overlooks one crucial new element in the market for coal cars that Freightcar America (FCA) did not face the last time demand surged for its products: competition. In 2004, the last time buyers changed course and began ordering cars, FCA enjoyed an almost 100% market share. This time however, they will have to contend with a resurgent Trinity Industries (TRN).

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

May 8. 2008

Coal car builder Freightcar America blames poor economy while coal traffic is up 4%

CEOs never like to go into lengthy explanations on the dynamics of their industry in explaining a dismal financial performance, but with year to date coal volumes up 4.6%, according to the most recent AAR report, blaming the economy for the problems besetting the company seems more like dodging the issue than helping shareholders understand the situation. The new president of FreightCar America cannot be blamed for how the company found itself in these waters, but a better explanation of the problems might have given shareholders more confidence in his ability to navigate the company in the future.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

April 18. 2008

New car production losses at Greenbrier (GBX) are eating into overall profits

During the last downturn in the railcar building industry, Greenbrier gained market share while cutting back production since the cars it produced were more popular that the car types manufactured by the other builders. This time around, just the opposite is true; there is almost no demand for the intermodal well cars, lumber flats, and boxcars that carried Greenbrier through the last recession, but there are still buyers for the coal, tank, and grain cars manufactured by the other railcar builders. In response to market conditions, Greenbrier closed its Canadian plant last year and began to solicit orders in other car types such as covered hoppers and tank cars. Manufacturing margins for these car types will be slim for a while as Greenbrier buys its way into these new markets. In the mean time, its plants are not operating at the levels that are necessary to earn a profit in this marketplace.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

April 2. 2008

Idle cars mean cutbacks are coming for railcar builders

The decline in trailer and container shipments, especially those originating at West Coast ports, has resulted in a large surplus of railroad intermodal cars, specifically the doublestack well cars used to handle containerized imports. BNSF (NYSE:BNI) has been reported to have parked thousands of well cars around its system. Other railroads are reporting, however, that surplus quantities are no greater than might be expected at this time of year due to the seasonal nature of this traffic. Nevertheless, with traffic down significantly from last years levels (-4%), its hard to imagine how the seasonal railcar surplus looks normal.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

March 6. 2008

Chill in ethanol industry may give railcar lessors a bad cold

The growth rate of the ethanol industry has slowed significantly in recent months as the price of corn pinched the profit margins of most firms and put some inefficient producers out of business. With corn prices at $5.55/bu. reformulated gasoline (ethanol) prices must be above $2.00/gal just to break even, and prices last summer dipped as low as $1.50/gal. after a small surplus of ethanol developed. As uncertainties about costs, prices, and demand increase, producers are scaling back their plans for expansion. Railcar lessors however, have already committed to buy, or have already taken delivery of enough railroad tank cars to move the previously projected production total of 10 million gallons 2008. Car surpluses are developing as lessees walk away from commitments, a rarely used and dangerous practice for most users in that industry.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

February 6. 2008

Icahn is known for his patience and he will need it with Greenbrier (GBX)

Carl Icahns purchase of a 9.5% stake in Greenbrier Cos. seems to imply that he intends to pursue a merger between American Railcar (ARII), in which he controls a majority of the stock, and Greenbrier, two railcar builders with complimentary design portfolios and railroad business interests. The two companies each lack what the other possesses and the merger might be a good strategic move in an industry plagued by cyclical swings. However, Greenbriers manufacturing output has declined for the past two years and looks to fall again in 2008.

h ttp://www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

February 6. 2008

Wabtec scores second win in sales of its high tech brake technology

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

January 29. 2008

The fourth quarter orders for new railcars were inflated to make a bad situation look good.

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

January 22. 2008

Greenbrier needs a better second half to match their regular earnings in 2007

Greenbriers reported earnings that were only one third of what had been expected, and even before the special charges due to more plant closing costs and currency losses, the earnings would have been 30% lower than had been recently estimated for the company. Greenbrier tried to put a positive spin on the performance by comparing it to their first quarter of 2007 when they earned $0.12 vs. the $0.16 this year. The comparison was partially appropriate; in a weak new railcar market, the winter months are much worse for Greenbrier than other companies because buyers of intermodal equipment usually prefer to take delivery of their new cars in the second and third calendar quarters. During last year however, Greenbrier had other problems besides a weak market that hurt earnings during their first quarter.

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

January 22, 2008

Railcar builders are in two camps, those in for a rough year, and those holding their own

It is difficult to argue with Chris Versaces facts regarding the past performance of the railcar builders and the railcar industry in general. This is a cyclical industry and the past is often prelude to the future. However, his broad assertions that roughly apply to the industry as a whole and perhaps to general trends at each company overstate the problems for some companies, painting some good companies with the red ink that might only apply to a few. The key to separating out the winners and losers is to know what types of cars each builder profitably produces and what cars are going to be built.

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

December 26. 2007

Union Tank Car will probably remain independent

Berkshire Hathaway announced that it had agreed to purchase Marmon Holdings, Inc. from the Pritzker family. Union Tank Car Company, the oldest railcar lessor and tank car builder in the nation, is owed by Marmon and has been the subject of rumors during the past year regarding a possible sale of the company. Until the purchase by Warren Buffets company was announced, the divestiture by Marmon of some or all of its holdings was a distinct possibility. It now appears as though Union Tank Car is no longer for sale.

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

December 20. 2007

Freightcar America seems to be grooming itself for a sale

Freightcar America announced that they were closing the production facility in Johnstown PA after failing to reach an agreement with the unions at the facility to restructure their agreement. The company said that the costs would amount to $34.3 million and would be subtracted from the fourth quarter results. Orders are down and production in 2008 looks likely to be less than deliveries in 2007, so the company should have no problem meeting all their current commitments with deliveries from their other plants. If the estimated costs of closing this facility are correct, then this company looks very attractive as a takeover target in 2008.

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

December 7. 2007

Railroad tank car production to decline in 2008 at Union Tank

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

December 7. 2007

Counter cyclical earning potential for WABTEC

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

October 15. 2007

Dont anticipate greater profits soon from Greenbriers venture into tank car manufacturing

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

October 15. 2007

Downturn of railcar cycle confirmed by latest quarterly ARCI report

The railcar builders association, the ARCI, reported that in the third quarter, only 8,121 new railcars were ordered, bringing the total orders for the year to roughly 31,000 cars. Moreover, deliveries decreased to 15,032, bringing the year to date total to 48,296. At Rail Theory Forecasts, we had predicted last fall that the total deliveries for 2007 would only reach 61,500 cars, compared to the 74,000 units delivered in 2006. Our preliminary forecast for 2008 in much lower, and the third quarter data appears to support out early prediction.

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

August 20, 2007

New railcar plant to rekindle competition

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

August 20, 2007

Watch out for the hype on Freightcar America

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

August 20, 2007

American Railcar Stumbles

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

July 18, 2007

Quarterly data is sometimes misleading for railcar companie s

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

June 28. 2007

Freightcar America adds some sugar to make bad news more tasteful

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

June 27. 2007

Trinity Leasing update —see May 11 commentary

Trinity Industries has found a way to have their cake and eat it too. The new leasing joint venture will allow them to report a manufacturing profit on cars they intended to build for their own lease-fleet portfolio. Instead of owning the cars with a large (80%) debt, they will own a portion (20%) of the cars and give their partners and 80% equity interest.

May 11. 2007

Investing in the future sometimes hurts present earnings (TRN )

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

April 19. 2007

Bifurcation of railcar builders into haves and have nots

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

April 4. 2007

It will all be downhill at Greenbrier for while

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

March 23. 2007

For railcar builders, the roller coaster cycle is still a problem and a soft landing a myth

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

March 12. 2007

Greenbrier (GBX)— Greenbrier has little to offer even with concessions

The labor union at the Nova Scotia plant of Greenbrier Corp had already rejected the companys request for contract concessions and a three year freeze on wages and was set to strike when government officials asked for a postponement in order to arrange a meeting involving government, union, and company personnel. The plant had been closed during the fourth quarter and was opened in January for a single order that will be completed by April if there is no strike. The union has few options since Greenbrier has little to loose if they shut the plant permanently.

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

March 5, 2007

Freightcar America (RAIL)— Good news for bad times

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

February 15, 2007

GATX (GTM)— Railcar leasing business is red hot

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

January 7, 2007

Wabtec (WAB) scores a big one

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

November 15, 2006

Greenbrier (GBX) —All that glitters. it might be too good to be true

Greenbrier (GBX) announced a strong earnings performance for their 2006 fiscal year which ended on August 31st, and they highlighted their backlog of 14,700 cars in August compared to 9,600 cars at the same time last year. The growth in profits was remarkable given the 13.6% decline in new car deliveries. The company is investing in new railcars for its leasing business and buying shops and companies to grow the railcar repair business in order to diversify their business. However, it will be another tough year for the new railcar manufacturing side of the business, since much of the backlog involves cars ordered in a multiyear contract for delivery after 2007, and many cars that the company built on spec during its first fiscal quarter remain unsold and in storage.

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

November 15, 2006

American Railcar (ARII)— -A reversal of fortune

American Railcar (ARII) reported that although tornado damage hurt production at their tank car plant during the third quarter, their earnings more than tripled, and their backlog of unfilled orders climbed to over 18,000 cars. Adjusting for the lost production between May and August at the tank car facility, the companys backlog represents over two years of production at the current rate of output, which will most certainly climb over the next few months.

www.glgroup.com/Council-Member/Toby-Kolstad-85066.html?obj=search&Keyword=kolstad

August 23, 2006

Trinity Industries, Union Tank, and American Railcar

The railcar builders that manufacture tank cars have seen orders and backlogs climb in recent months, as the booming ethanol business requires more and more railcars. All three builders have been rushing to meet demand, with plans or new facilities to increase their annual tank car capacity. Trinity (TRN) has been expanding their tank car plants in Longview TX with a $7million upgrade; American Railcar (ARII) has just doubled the capacity of its tank car facility in Marmaluke AR, disabled by a tornado during the second quarter, and plans to open a second plant at the site by 2008; and Union tank opened their third tank car facility in 2005 in Alexandria VA. Prior to this year, annual production rates never exceeded 12,000 cars. With the new facilities and booming ethanol business, tank car production should climb to the 16,000-20,000 car per year range for the foreseeable future.

August 9, 2006

Railcar Builders

Profits at all railcar builders continued to climb in the second quarter, some more than others, but stock prices have fallen dramatically from their recent highs. One of the reasons for the apparent disconnect between profits and prices is the negative mood of investors who fear that an inflation-caused recession may be on the horizon. Such feelings have been identified as the reason for the decline in railroad stocks, even as those companies are also reporting record earnings. On a more specific basis, the railroad industry is viewed as a cyclical business and many analysts think that the growth cycle is ending and that a decline in imminent. Investment managers are looking to catch the next wave in another area, leaving only diehard railroad and railcar investors to trade stocks in this industry. RTF does not think that the cycle has yet peaked, although some car types and some builders will sustain a pause in growth while others will see their fortunes improve as demand for new railcars shifts from coal cars and flatcars to tank cars and covered hopper cars. Overall demand for the former cars is only expected to fall to more sustainable levels, while demand for the latter cars will continue at an elevated level as the ethanol industry continues to expand.

May 10, 2006

Railcar Builders

For this cyclical industry, these have to be the best of times. Profits are higher that at any time in the past, even during the last car building boom of the late 1990s. Moreover, rail traffic and economic conditions favor continued demand for new railcars, although changing car type demand will favor different builders than in the past.

March 18, 2006

2006 New Railcar Construction

It has recently been reported that Economic Planning Associates (EPA) have increased their projected new railcar deliveries in 2006 to almost 74,000 cars and their 2007 forecast to almost 70,000 cars. RTF has projected a 64,000 delivery total for 2006, but concedes that its statistical models could be off by as much as 6,500 cars. However, RTFs models show a significantly different delivery rate in 2007 than EPA has forecasted. Investing in railcars and railcar builder stocks is not for the faint hearted during such times as these. RTF has some skin in the game. so to speak, and is not thinking of changing its forecasts for a while.

January 25, 2005

Greenbrier reported to the SEC that they had a multiyear order of 13,000 railcars, most of which will be doublestack intermodal units. 5,300 cars will be delivered over the next two years, with the remaining cars scheduled for delivery after 2008. Although it was not stated, the buyer is most probably the BNSF railroad, which also ordered some covered hopper and centerbeam flatcars in the package. This order will allow Greenbrier to keep its manufacturing lines from shutting down, since their backlog of past orders would have run out in late spring.

January 23, 2006

A fourth railcar builder is about to go public, increasing the percentage of railcars manufactured by public companies from 74% to 82%. As we said last April when Freightcar America went public, the heretofore secret world of railcar supply is getting more transparent. The surge in orders mentioned in the Jan. 12 comment was evidently due to a large, multi-year order by CIT from ARI. without that order, the quarterly deliveries and orders would have been roughly balanced, with the average industry backlog remaining at about 9 months production.

January 12, 2006

4th Quarter New Car Orders, Deliveries

The ARCI announced yesterday that 26,569 railcars were ordered during the last quarter and that 17,975 cars were delivered, raising the number of backlogged orders to 69,408. Assuming there were no intermodal car orders and that most of the orders were for hopper, gondola, and tank cars, the backlogged orders at Freightcar America (RAIL) and Trinity Industries (TRN) must have risen and could possibly extend to 2007. Fortune did not smile on Greenbrier (GBX) that well.

12/30/05

Dearth of Fleet changing new designs

It has been over 10 years since the aluminum 286k coal cars were introduced, and around twenty years since the 73 centerbeam flatcars and doublestack well cars were first built. All of these cars were fleet changers, in that all existing cars were made obsolete and fleet owners replaced most of them within the next ten years. There is no indication that another fleet changer is likely to soon appear, and new car orders will be driven by traffic growth and slow trains for a few more years.

11/3/05

Railcar Builders

Third quarter earnings for the publicly owned railcar builders showed continued improvement over the results of the preceding quarters. Greenbrier hit the projected $1.92 EPS for 2005 (its Fiscal year ends in August); Trinity is still expected to handily exceed the analyst projection of $1.45 and Freight Car America should easily beat their target of $3.28. As for next year, RTF expects FCA and Trinity to meet the current analyst estimates, but Greenbrier may have trouble. TTX will need more intermodal cars than are currently backlogged, but the 2006 production of this car type should come in well below 2005 levels. Unless boxcars or centerbeam flatcar orders increase, Greenbrier might not top its current performance. Trinity and Freightcar America might face similar problems in 2007, so a high PE ratio might not be justified.