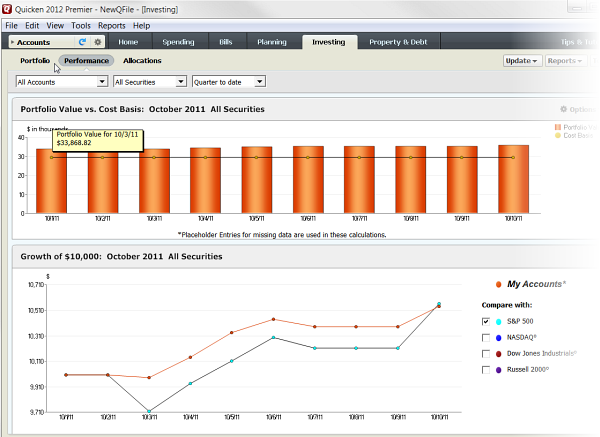

Quicken 2015 Review – Analyze Your Investment Portfolio

Post on: 3 Май, 2015 No Comment

Ive been a long-time user of Intuits Quicken since 1992 now over 20 years. My family and I track 60+ accounts within Quicken. So to say Im a power-user of their product would be an understatement. We have every bank account, credit card, asset, retirement, investment, and liability linked within the software. For this review of Quicken Premier 2015 for Windows, I bought a copy from Amazon and converted from my previous version of Quicken 2014.

The conversion from Quicken 2014 to 2015 took about ten minutes to complete, and was more descriptive than previous. This conversion process was flawless, and I did not have any issues.

Intuit never does radical changes with their annual software updates, as they incrementally add features to Quicken, and the enhancements tend to be evolutionary rather than revolutionary.

In todays cloud/web 2.0/Internet world, Quicken is no longer the only game in town. Its possible to completely store your financial information online using services like Intuits own Mint.com service, or what we recommend Personal Capital.

However, these financial aggregation services tend to be read-only, and are more for alerting or reporting your finances. And reconciliation and online bill pay isnt usually available with these types of services.

For individuals who prefer to stay with a locally installed application, there is also YNAB (You Need A Budget). Moneydance. or if you are looking for a native Macintosh software application there is iBank as well.

Though none of the mentioned applications come close to Quicken in marketshare usage, or from our tests, the comprehensive personal finance features make Quicken for Windows the leader in the industry, and theres no question why this is the case (though the others are catching up).

Quicken 2015 vs. Quicken 2014

Quicken 2015 for Windows adds even less new features than previous years. The major new features are:

- Portfolio X-Ray Available with Premier and higher, you can get insights from Morningstar into your investment portfolio

- Free Credit Score This is something Intuit also added to their Mint.com service as well

- Mobile Improvements Syncing occurs faster and spending graphs

- Improved Options Trades Ability to better handle options trades in the register

Its nice to see after many years of little or no improvements, theyve finally added a new functionality to the investment section.

Portfolio X-Ray

Breakdown your investment asset allocation with Morningstar (click to enlarge)

Now with Quicken 2015 Premier and higher, this feature is built right in. It slices and dices your portfolio and tells you where you are under allocated, and where you are over allocated.

New for 2015 is the Quicken Portfolio X-Ray feature. In partnership with Morningstar this is a much welcomed feature, and wish Morningstar had this available on their website.

While I love using Morningstar for research and thinking their X-Ray tool is invaluable, it was too cumbersome to manually enter the investments. I also was never able to get the export out of Quicken to work correctly with Morningstars X-Ray tool. So I didnt use the X-Ray tool as much as I would have liked to.

For those not familiar with Morningstars X-Ray tool it dissects your portfolio into these areas:

- Asset Allocation What percentage of stocks, bonds and other asset classes

- World Regions How much you have invested around the world

- Stock Sectors How much is invested in various industries

- Stock and Bond Style With stocks: how much is invested in Value, Core and Growth, vs. Small, Mid and Large Cap stocks.

- Fees & Expenses Breakdown of your overall annual expense ratio

In my situation it recommends I decrease my allocation to Asia, and I have too much exposure to financial services. Unfortunately the one limitation (which is the same with Morningstars service) is the ability to adjust your asset allocation, and adjust your risk profile for what if scenarios.

Free Credit Score

Get a financial checkup of your credit score (click to enlarge)

Another neat feature in Quicken 2015 is the ability to generate a free credit score. Though in my case wasnt able to get this working within Quicken because of some Cloud ID issue.

This was also recently added into Mint.com as well. Though its not without its limitations. Intuit pulls your credit score from only one of the three credit agencies (Equifax), so its not as useful when compared to Credit Karma.

Intuits service also doesnt monitor your credit score or negative changes so the report is only useful for that moment in time. Unfortunately, if you are married, there doesnt appear to be a way to get a credit score for your spouse.

Features Added in Previous Versions of Quicken

Thinking about upgrading from an existing version of Quicken, but not sure whats changed since you bought last? Heres a summary of what features were added in previous versions.

New Features in Quicken 2014

- Store and Save Receipts You can take pictures of your receipts and store them within Quicken for later retrieval.

- Memorized Transactions Show Up in Register This is perhaps the best new feature I like. Previously you had to enter memorized transactions, but this feature will display future events within in the register before entering the transaction.

- Overall Speed Improvements While I did not do exact performance tests, it seems Quicken 2014 was much more responsive.

- Mobile Synchronization Improvements Many users complained how Quickens mobile synchronization was broken in 2013. Intuit claims, and from my testing so far, this feature has been improved.

- Budget Improvements Users also complained about 2013 and the budget changes. Quicken added two options that should satisfy users who want their budget displayed with including and excluding specific transactions.

- More Connectivity Resolutions Quicken 2014 makes it even easier to fix connectivity issues with your financial institution

New Features Quicken 2013

- Quicken Mobile First version of Quicken Mobile app for Apple and Android devices

- Synchronization Improvements Gave a step-by-step process to help with bank synchronization problems

- New Budgeting Functionality Though many users complained about this new functionality and was later improved in 2014

Technical Requirements

Quickens requirements have always been the middle to low lend-end of new computers sold. The specs listed below shouldnt be an issue if your hardware is less than 3 years old. These are similar specs needed to run Quicken 2011, 2012, and 2013. I would recommend a slightly more powerful machine than listed. Note that Quicken 2015 does not support Windows XP which has been EOLed.

- CPU: 1 GHz

- Operating System: Windows Vista SP1, Windows 7/8/8.1 (32 and 64-bit)

- Memory: 1 GB or more (I recommend at least 2GB; 4GB being ideal)

- Hard Disk Space: Up to 450 MB free space; up to 1.5 GB if .NET not installed

- Display: 1024768 or higher resolution, 12801024 for large fonts

- CD/DVD Drive: Recommended

- Internet: 56 Kbps (broadband recommended for online services)

- Sound: Sound Card and Speakers Recommended

- Printer: Any printer supported by Windows Vista/7/8/8.1

- Additional Software (included in Quicken installer): Microsoft .NET 4.0 or later

Using Quicken for Windows on a Macintosh

Ive been using Quicken since my first MS-DOS computer in 1991. Now that I am a Macintosh user, I still prefer Quicken for Windows. Though the question becomes how do I run Quicken for Windows on my Macintosh?

Even with the recent release of Quicken 2015 for Mac, the product isnt complete enough for my needs. It currently lacks bill paying, and lacks many of the features in the investing section.

So I run Quicken 2015 Premier for Windows by running it in a VMware Fusion 7 instance. If you want to find out more about this process you can read my article: How to Run Quicken for Windows on a Mac .

The added benefit of virtualizing Windows is an additional layer of security, since no other software is installed on that instance. You dont have to worry about any rogue viruses or software compromising your finances. This technique is also possible on a Windows-based machine .

Quicken Review and Summary

The free credit score is a neat new feature, though you can get free credit scores from other services. The credit scoring also lacks monitoring, and cant get a free report for your spouse.

The Portfolio X-Ray feature is the best new feature available in Quicken 2015 for Windows. Unlike Morningstars website it makes it easy to analyze your portfolio. As an investor, I welcome this addition.

Like the last few years, if you have a current version of Quicken, I dont see any must-have features to upgrade. If you have no issues with your existing version, then theres no real reason to upgrade.

If you have an EOL (End Of Life) version of Quicken, or currently dont use Quicken, then it makes sense to purchase this version. I much prefer Quicken over Inuits Mint. because it can handle much more complex financial scenarios and it isnt read only. Quicken can definitely grow with you as your finances become more complex Mint on the other hand cannot.

Personal Capital is another possible option if you are looking for a purely cloud-based solution, and you want more complex investment reporting than Mint.com.

Quicken 2015 for Windows still remains the personal finance app to beat locally installed or in the cloud.

Rating: 3 1/2 out of 5 stars

Get Quicken

Save 40% off your order. You can order and download immediately from Intuits website. I recommend Quicken Premier 2015 for its investment features. If unsure if Quicken is right for you, Intuit offers a 60-day money-back guarantee.