Put Diagonal Spread An Income Startegy to Play Downward Move

Post on: 7 Апрель, 2015 No Comment

by OptionPundit on September 11, 2008

The Dow has still been unable to regain the important resistance of 11,750 (few points here and there). It danced around that level for a while before falling like a hard rock. In this post, while I shall be sharing about Put Diagonal Bearish startegy, I shall also briefly touch upon current market state.

Dow is around 11,100-200 and the next level of key support is 11,000 followed by the July 15th low of 10, 827. As I mentioned earlier. the real important area to watch is 10,697 or so which is almost a 50% retracement of the bull market that started Oct’02 on and peaked in Oct’07.

I had earlier mention on how one can survive such a market. One of the key things I would like to highlight is that one needs to be very nimble in decision making these days. You can’t prolong the decision making. For instance- I mentioned that Gold was oversold. it bounced for a very short period but look at it now, it has turned bearish and now it is to test the level it took over 20 years to cross. I booked some gains, some losses (a lost vertical spread even for OPNewsletter) but since then I am in bearish trades for this.

How do you play bearish moves while protecting for any potential upward move?

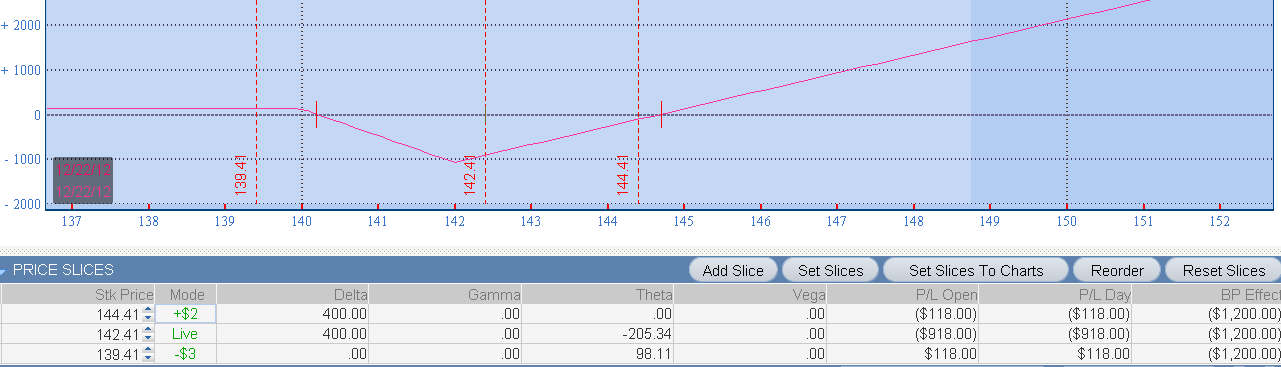

Put Diagonal Bearish spread is one such a strategy that enjoys some excellent benefits and can be used when your analysis indicates that the price of a stock, ETF, index, or commodity futures contract has strong probability of going steadily (not abruptly) lower over the next month (s).

This Put Diagonal option strategy, can be a debit or credit spread and can be done in multiple ways depending on how aggressive you want to be. This is a good trade to do with LEAPS in combination with short-term options. In the conservative strategy, buy an OTM (Lower strike price, e.g. DIA $105) Put with 60 days or greater to expiration, and sell an OTM (higer strike price e.g. DIA $110) Put with at least 30 days until expiration and at most 30 days less until expiration than the purchased Put.

Here are some of the key features of a Put Diagonal spread-

- Because diagonal spread is essentially a vertical spread+ calendar combo, in most cases it is a vega positive trade. I’ll keep it simple and won’t into IV smile curves etc. With the fall in underlying, the average IVs generally rises. So falling markets are Put diagonal’s friends.

- As this is a put diagonal spread with bearish bias, it’s delta negative. Falling markets will general profits due to short delta .

- Since you are selling short options and buying the long option, this trade is theta positive. So as the time passes by you are making receive checks from theta every day.

All key Greeks are in this trade’s favor. But one needs to be watchful. Watchful because even though it will make money when underlying is falling, it may lose money for that day. It only gains because of IV increase and with theta accumulation accompanied by partial short delta.

When to enter — You have bearish expectations for the underlying asset, but you do not expect the asset price to fall too quickly. Pay as close to $0.20-$0.50 for debit/credit (excluding margin). But do note that there should not be a big IV skew between sold Puts and purchased Put. IV skew exist for a reason and implies that a big move probably is on the way. One also need to look at the risk/reward of the trade and selecte short strike where you expect the underlying to be at expiration.

Decide when to exit- Set your exit rules in advance so you don’t have go through the emotional gyrations during panic hours. I generally prefer 15% gains for exit and 12% for loss exit but it also depends on where the underlying is in relation to expiration date. IV also plays an important role. If IV keeps falling spoiling the risk/reward, there is no point in continuing to keep the trade unless I think IV is about to rise.

Adjustments-

You may roll the short options to next month if you are using leaps/longer term options for back month. You may convert it into a calendar, vertical or double diagonal. There are various options which will be applicable depending upon the time to expiration, underlying position and IVs in addition to your outlook about the underlying move.

Key watch-out — Its an excellent startegy and allows lot of flexibility. However, the success if this trade depends upon selection on underlying, selection of short strike, IV profile and risk management. A sound trading plan is required before executing this.

Continue to watch this space, I may share some trade ideas as we are going through this bear market. Feel free to add your comments or question to know more about the strategy.