Put call ratios investor sentiment

Post on: 15 Август, 2015 No Comment

Mar 11, 2010, 4:00 am EDT | By Adam Warner

Put/Call Ratios Using Put/Call Ratios to Gauge Investor Sentiment

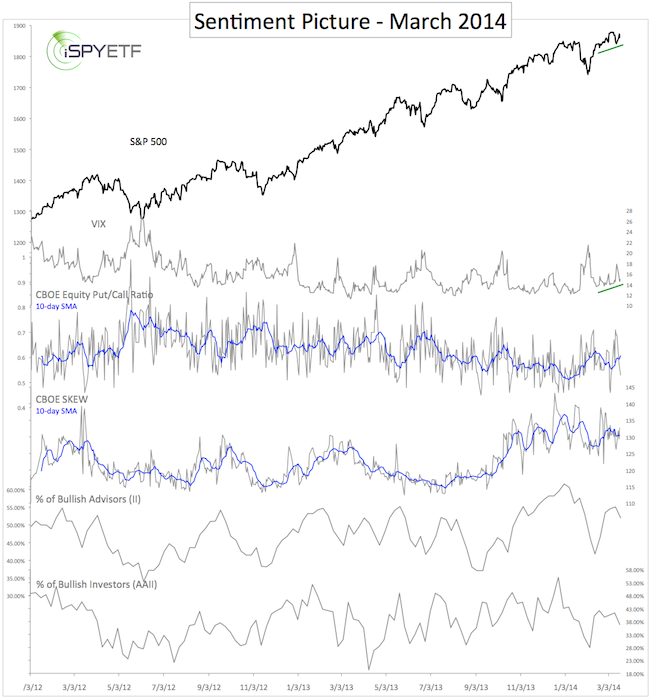

The CBOE Volatility Index (VIX ) is certainly the most popular market gauge investor fear, but its not the only one, options trading articles tell us. Lets not forget the put/call ratio, which is simply a ratio of put options to call options that have traded over a given time period.

The put/call ratio is used to measure investor sentiment. The theory is that the more puts that trade, the more bearish the sentiment and, ergo, the more bullish from a contrarian standpoint.

The most popular put/call numbers are disseminated by the CBOE in an index-only version, an equity-only version, and a combination of the two.

However, there are a number of flaws with this calculation.

3 Problems With Put/Call Ratios

My first issue with put/call ratios is that they do not determine whether the initiator of the trade bought or sold the option in question.

Lets say the initiator of the order sold a large quantity of puts. In a vacuum, thats a complacent and bullish play. But in a simple put/call number, that just prints as puts. And the more puts that trade, the lower the put/call number gets. So, on a contrarian basis, that would give you a bullish signal even though the order itself would give you a bearish signal.

Another complaint I have is that we dont know whether the trade in question stands alone, or is part of a spread against another option or against the underlying stock.

Lets say, for example, the order initiator executes a large buy-write in Research In Motion (RIMM ). In one transaction, he buys RIMM stock and simultaneously shorts RIMM calls. Thats a bullish trade, identical to selling puts. Yet it prints as calls.

The good news, however, is that this will produce the right conclusion for the put/call (contrarian bearish) for the wrong reason (we think calls traded, but they are de facto puts).

Finally, dont know who initiates any of these transactions. Right or wrong, we like to fade retail investors (certainly when you lump them as a group) but piggyback on professionals. But a simple put/call ratio does differentiate; volume is volume.

Alternatives to Simple Put/Call Ratios

Fortunately, there is an alternative. The International Securities Exchange (ISE) produces a call/put number that only measures retail orders, and only if they are buying, and only if they are opening on the transaction. Its called the ISE Sentiment Index (ISEE).

So while a low CBOE number is bearish (too few puts trading), so is a high ISEE number (also too few puts trading).

I like the ISEE methodology better than the CBOE methodology. However, when I studied it for my book, Options Volatility Trading: Strategies for Profiting From Market Swings . I found that, to the extent a put/call number has value, its the good, old CBOE number that works best. Specifically, I found the CBOE Equity Put/Call Ratio was the cream of the crop.

The benefits, however, are limited. I did not find much to work with using this number alone. Rather, it worked best in conjunction with the VIX, especially if it ran counter to the what the VIX was saying.

In other words, if the VIX is tanking, and the put/call ratio is declining, it does not tell you anything you didnt already know. But if the VIX is tanking and the put/call ratio is moving up, it suggests players are buying puts into the volatility dip, which on the margins is bearish. Likewise, a lagging put/call ratio into a surging VIX tells you theres less fear out there than meets the VIXs eye.

Your Best Bet

Theres no magical put/call level to look for. In fact, the printed number itself leaves much to be desired, because theres no context to the actual volume of either side its just a ratio of the two.

Lets say todays CBOE Equity Put/Call Ratio is .50, but on very low volume. The .70 is very low, and bearish. Now lets say tomorrows number is .70, but on triple the put volume. If you average the two youd get .60, which is modestly bearish, but the reality is that if you weight the number youd get closer to a .65. Its not cosmically different, but it is a much more accurate reflection. Plus, the more data the better.

As such, the best way to get a handle on investor sentiment using put/call ratios is to use something like a rolling 5-day total of puts traded divided by a rolling 5-day total of calls traded.