PUT CALL RATIO

Post on: 1 Июль, 2015 No Comment

5 13 Bookmark

What is put call ratio and implied volatility?

1. What is put call ratio? It is easy to define put call ratio, it is the ratio of total number of put options to call options. There are two types, volume based PCR and open interest PCR. Total trading volume is taken to calculate the Volume PCR and total open interest is taken in the case of open interest PCR.

2. What is implied volatility? Implied volatility of an option contract is defined as the volatility of underlying asset price, which is implied /indicated by the market price of that option. Simply, Nifty 5000 call option’s implied volatility means the volatility of the price of nifty index, indicated by the price of 5000 call option. So Implied volatility is the relative rate at which price of the nifty/stock changes with reference to that particular strike price Different strikes will be having different implied volatility numbers. Implied volatility is a main part of option pricing. Premium of an option consist of intrinsic value and time value.

What is intrinsic value?

Simple, if Nifty is trading at 5000 and 4900 call costs 150 Rupees, then 5000- 4900 =100 is the intrinsic value and rest of 50 is the time value. When implied volatility is high, there is higher possibility for a good trend/ price movement. It can also be called as expected volatility till the contract expires. There will be increase in implied volatility, when market is expecting for something, like any economic event/ important results etc. hence it will also reflect in the price of option.

Means if 5000 call is trading at 150 Rs at 30 % implied volatility, When that expectation is over and guess Implied volatility comes down to 15 %. option price will fall to 75 RS (imagine there is no change in Nifty index price). Hence implied volatility is a very important factor in option pricing and option trader need to be cautious about changes in Implied volatility. Bear market will be having higher implied volatility than the bull market, because falling prices makes people more emotional than the rising prices.

More suggestion and opinion are welcome for educational purpose.

From: RAJESH SINGH at 05:19 PM — Mar 29, 2012

OTHER DEFINATION

The definition of Put-Call Ratio (PCR) is as follows:

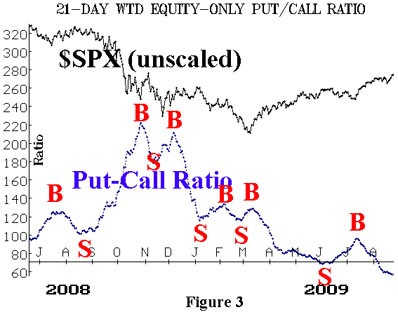

The ratio of the volume of put options traded to the volume of call options traded, which is used as an indicator of investor sentiment (bullish or bearish).

1 group of thought says that a high PCR means more number of Puts have been written and markets should go ahead. Another school of thought says the converse.

Lets go by the data in hand for past 1 year.The market has bottomed when PCR was around 0.8-0.9 and topped when it was 1.2 or above.

I have marked in black the instances where the PCR was above 1.2. At this point of time, the market remains flat for a day or 2 by which time the PCR comes down to lower level or the market tanks.

From: RAJESH SINGH at 08:25 PM — Mar 30, 2012

This thread is for educational and learning purpose, if you like this article, dont forget to Spread the word and let your friends know of this article so that all can benefit from our perspective.