Put call parity Help for Forward and Contract Options

Post on: 5 Июль, 2015 No Comment

Definition:

Put Call Parity is an option pricing concept that requires the extrinsic values of call and put options to be in equilibrium so as to prevent arbitrage. Put Call Parity is also known as the Law of One Price.

Put Call Parity — Introduction

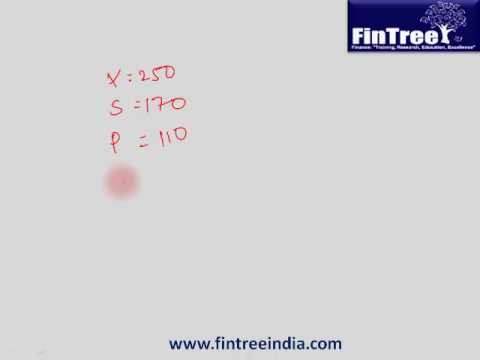

Put Call Parity is a concept that defines the relationship that must exist in European call and put options. Put options, call options and their underlying stock forms an interrelated securities complex in which the combination of any 2 components yields the same profit/loss profile as the 3rd instrument. Under this kind of complex relationship, no combination of 2 components should yield a position with an asymmetric profit/loss profile as the 3rd instrument so that balance is maintained in the system. This balance is known as the Put Call Parity in option trading. The concept of Put Call Parity is especially important when trading synthetic positions. When there is a mispricing between an instrument and its synthetic position, an options arbitrage opportunity exists.

Put Call Parity requires, mathematically, that option trading positions with similar payoff or risk profiles (i.e Synthetic Positions) must end up with the same profit or loss upon expiration such that no arbitrage opportunities exist. An example of Put Call Parity is in terms of Fiduciary Calls and Protective Puts. Fiduciary Calls and Protective Puts have the same profit/loss profile that you see below. If the underlying stock remains completely stagnant by expiration of both positions, both positions would decline in value equal to the extrinsic value (premium) paid on the options. Neither option trading positions would have any advantage over the other during expiration.

Put Call Parity — The Reality of Put Call Disparity

As you might have noticed above, Put Call Parity requires that the extrinsic value of call and put options of the same strike price to be the same. However, in reality, the extrinsic value of put and call options are rarely in exact parity in option trading even though market makers have been charged with the responsibility of maintaining Put Call Parity. When the outlook of a stock is bullish, the extrinsic value of call options tend to be higher than put options due to higher implied volatility and when the outlook of a stock is bearish, the extrinsic value of put options tends to be higher than call options.

There are many violations to the Put Call Parity theorem in practice, most of the option trading arbitrage opportunities result in a loss when transaction costs and delays in execution are accounted for.

Deviations from Put Call Parity or Put Call Disparity has also been used in the analysis of future stock prices as stocks with relatively expensive calls have been found empirically to outperform stocks with relatively expensive puts by a measurable significance and margin.

Deviations from Put Call Parity can also lead to profitable arbitrage opportunities using options arbitrage strategies such as a Box Spread if the disparity is significant enough.

Put Call Parity Assumptions

The assumptions under the Put Call Parity Theorem are:

- Constant Interest Rate

- Future dividends are known for sure