Put Broken Wing Butterfly Spread by

Post on: 7 Апрель, 2015 No Comment

Put Broken Wing Butterfly Spread — Introduction

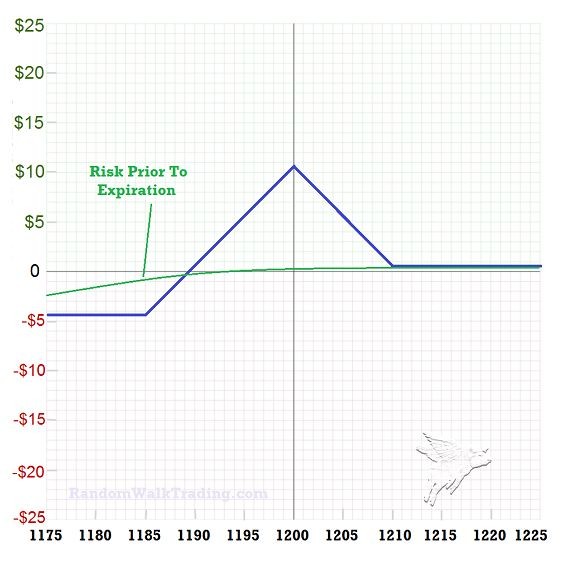

The Put Broken Wing Butterfly Spread, also known as the Broken Wing Put Butterfly Spread or Skip Strike Butterfly Spread, is a variant of the Butterfly Spread options trading strategy. Similar to the Butterfly Spread, it is a neutral options strategy but unlike the butterfly spread, it transfers all the risk of loss when the stock breaks upwards onto the downwards side. This means that the Put Broken Wing Butterfly Spread does not lose money when the stock rallies upwards but will lose more money than a Butterfly Spread if the stock ditches. This is particularly useful when the stock is expected to either stay stagnant or rally.

Find Out How My Students Make Over 87% Profit Monthly,

Confidently, Trading Options In The US Market Even In An Economic Downturn!

Main Difference Between Put Broken Wing Butterfly Spread and Butterfly Spread

The main difference between the Put Broken wing butterfly spread and the butterfly spread is that the Put Broken wing butterfly spread transfers the potential upside losses onto the downside. The Put Broken Wing Butterfly Spread achieves this simply by buying further out of the money put options instead of put options at the same distance from the middle strike price as the in the money Put Options.

In a regular butterfly spread options trading strategy, both in the money options and out of the money options are bought at an equidistance from the middle strike price. This creates a symmetrical risk graph with equal risk of loss on both upside and downside.

By moving the out of the money Put Options further away from the middle strike price than the in the money Put Options, the Broken Wing Butterfly Spread reduces the debit of the position to the extend that the position is either a zero cost position or a credit spread. The result of such an adjustment is that if the stock goes upwards, the position gains the net credit if it is a credit spread or simply makes no loss if the position is a zero cost one.

Example. Assuming QQQQ trading at $43.57.

Regular Butterfly Spread

Buy To Open 1 contract of Jan $44 Put at $2.38

Buy To Open 1 contract of Jan $42 Put at $1.06

Sell To Open 2 contracts of Jan $43 Put at $1.63.

Net Debit = (($1.63 — $1.06) + ($1.63 — $2.38)) x 100 = $18.00 per position

Sell To Open 2 contracts of Jan $43 Put at $1.63.

Net Credit = (($1.63 — $0.40) + ($1.63 — $2.38)) x 100 = $48.00 per position

The Put Broken Wing Butterfly Spread options trading strategy is so named because one wing is shorter than the other.

When To Use Put Broken Wing Butterfly Spread?

One should use a Put Broken Wing Butterfly Spread when one expects the price of the underlying asset to change very little over the life of the option contracts and speculates that even if the underlying asset should stage a breakout, the breakout will most likely be upwards.

How To Use Put Broken Wing Butterfly Spread?

There are 3 option trades to establish for this strategy. 1. Buy To Open X number of In The Money Put Options. 2. Buy To Open X number of Out Of The Money Put Options with a further strike difference than the in the money Put Options bought. 3. Sell To Open 2X number of At The Money Put Options.

The choice of which strike price to buy the In The Money leg (trade 1) depends on the range within which the underlying stock is expected to trade. If the underlying stock is volatile and could move by a larger degree, you will need to buy a deeper in the money put option. However, there will come a point where the in the money put option is more expensive than the net credit collected, thereby rendering the Put Broken Wing Butterfly Spread ineffective. This is why the nearest In The Money option is usually the one chosen.

The role of the out of the money Put Options is not only to reduce the margin requirement of the Put Broken Wing Butterfly Spread but also to set the point beyond which the position will stop losing money if the stock fell. Generally, it has to be far enough out of the money to allow the Put Broken Wing Butterfly Spread to result in a net credit or net zero cost but not so far as to result in the margin requirement or the maximum loss potential being too high. As such the Put Broken Wing Butterfly Spread usually skips only one strike price out as you see in the examples here.

Put Broken Wing Butterfly Spread Example

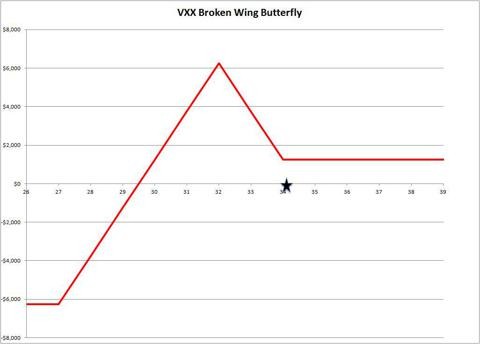

Assuming QQQQ trading at $43.57.

Buy To Open 1 contract of Jan $44 Put at $2.38

Buy To Open 1 contract of Jan $41 Put at $0.40

Sell To Open 2 contracts of Jan $43 Put at $1.63.

Net Credit = (($1.63 — $0.40) + ($1.63 — $2.38)) x 100 = $48.00 per position

Trading Level Required For Put Broken Wing Butterfly Spread

A Level 4 options trading account that allows the execution of credit spreads is needed for the Put Broken Wing Butterfly Spread. Read more about Options Account Trading Levels.