Protective Stops

Post on: 16 Июнь, 2015 No Comment

Posted by Pete Stolcers on May 26, 2006

Option Trading Question

Today Bobby Z. asked, How do you determine where to place your stops?

Option Trading Answer

First of all, thank you for all of the questions. There were many of you that had this question but Bobby asked it first. Keep them coming.

I could write on this topic for weeks and still not cover it so I will try to provide an overview and hope that in the future I can drill down into specific examples. Today I will cover stops designed to protect capital as opposed to stops that lock in profits.

Stops are an integral part of the game plan and they are not an after thought. I do not believe that you can assign a random number (i.e. 10%) and use it universally — each trade is different. Before I determine a stop I write down my expectations for the move and it incorporates the market, the previous price patterns for the stock, the technicals and time frame.

All of my analysis starts with the market — 75% of all stocks follow the market. Think of it, you will lose money on 3 out of 4 trades if you are on the wrong side. I look at support/resistance lines, trend lines and moving averages to form my opinion. If there is a market breakout or a breakdown, I may stop out a stock trade even if the stock has not participated in the markets move.

When I consider previous price behavior I look at how the stock normally acts. If it is a wild ride, I will keep my size small and use wide stops because I dont want to get whipsawed out. The small size gives me staying power and I dont sweat the loses due to noise. Two weeks ago in the Daily Report we were short NBIX. I told subscribers keep the size tiny (200 shares) and use a very wide stop, this stock will drive you nuts while we wait for the breakdown. Sure enough it was up and down $2 a day and then one day it was down $31. I picked a resistance level and stuck with it. In other instances where the stock is orderly, a tight stop would be more appropriate. These stocks are relatively predictable and when they stray, the move is over.

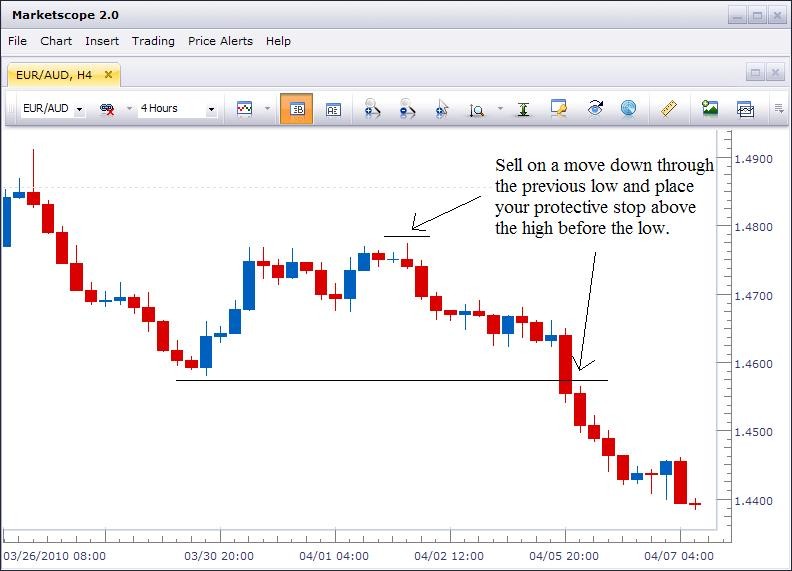

For the technicals I keep it simple. I use horizontal support and resistance levels, trend lines and major moving averages. I try to determine in each case which one will have the most significance. In some cases stocks really follow a trend line, in others it might be a support line. If a level is violated and in my game plan I thought it would hold — Im out.

Time is important because it keeps me honest. If a trade has not done what it was supposed to Im forced to question my original assumption. I do my analysis and I execute the trade. Im not placing a trade because I think in two years it will be higher. Im doing the trade because the stock looks good — RIGHT NOW. If it doesnt look good right now, Ill wait until it does. As time ticks away, the risk increases and randomness enters the equation. I saw something that looked good and I jumped on it. With every passing moment there is a greater chance that I will be blindsided. Im also forced to evaluate weather the stock is still showing relative strength/weakness to the market. If the market is up and Im long, why isnt the stock participating? Has it lost its Mo Jo?

Options stops are a completely different animal and I can address that another time. In short, the stops are based on the underlying, not the price of the option.

Option Trading Comments

- On 07/12, Kurnia Dharmawan said:

You mentioned. I may stop out a stock trade even if the stock has not participated in the market’s move.

Despite 75% stock is influenced by market, I believe some stocks are indeed have their unique characteristics. Means that they do not quite affected by breakdown nor breakup of the market.

If it does not participate in market move and you still close the position, does it too soon to react.

I would like to learn how to best use collars for stocks I own. Can you give me some direction on some questions like, how do you determine how far out to sell the call and buy the put? Should they both have the same expiration? Can I sell the call much further out and have the put much closer in?

The collar is a function of your expectations for the stock and your risk tolerance. If you are very fearful, make it tight (sell a near the money call and buy a near the money put). If your are just looking for catastrophy insurance, sell an OTM call and buy and OTM put.

You can construct it using any month or strike of your choosing. Each strategy will have its own risk/reward profile.

There is no standard (best) approach. Conduct technical analysis and use support/resistance levels to help you in your decision.

Hi Pete -

The last line of this great article of yours: In short, the stops are based on the underlying, not the price of the option.

I am applying this currently and my question is should you use the Market or Limit price? My hunch is to use the market but then how if the spread is too big at that time? Is there anyway to get around this situation?

Thanks as always,

Ario

That is a great question. When the option market is tight, you can use a market order. When the options are relatively ill-liquid, you can estimate where the option will be trading. You can either use an option calculator to determine where the price will be based on the move in the stock, or you can multiply the stock price move by the delta of the option to calculate the change in price. The second method is crude and it only works for small moves (under $2) over a period of a day or two. It is useful if you are close to your stop and you need to determine a limit price.