Protective Puts Definition � Options Explained � optionMONSTER

Post on: 29 Май, 2015 No Comment

Long puts can be used to protect holdings or portfolios as insurance.

They can be a limited-risk way to profit from downside moves in the underlying.

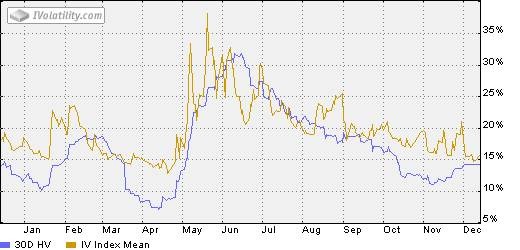

They are significantly affected by implied volatility and time decay.

When long puts are used as protection for a stock holding, they are equivalent to a long call.

The maximum risk is capped; the maximum gain is unlimited to the upside.

Would you like to.

- Have a limited-risk way of profiting from falling stock prices?

- Be able to buy insurance on your stocks or overall portfolio?

You insure your house. You insure your car. Why don’t you insure your portfolio?

Insurance for your portfolio — or any stock position — is available using put options. While options have the reputation of being risky assets in some circles, their original purpose was as insurance policies to protect positions, and buying puts is a limited risk way of doing just that.

What is a Protective Put?

Puts make money when the underlying stock goes down, and therefore when owned along with the underlying, provide downside protection. As a buyer you limit the risk of stock ownership. Just as with your other insurance policies, your risk is the premium you pay. And like your other insurance policies, you have it in place with the intention of not using it.

A protective put requires you to identify the strike price and the expiration date that you want, and to purchase the option. This is as easy as picking a stop-loss point, usually involving an out-of-the-money put (a put strike that is below the stock price) which restricts the loss to a size that you are comfortable with. Add the cost of the option to the difference between the stock price and the strike price, and that is your maximum loss to the downside. And for those stock traders familiar stop-losses, there is no slippage and no gaps down past your stop price.

As options are expiring assets, they are also decaying assets. There is a time value component to the premium price of an option and every day that amount decreases. The decay rate also increases as expiration approaches. Longer-term options decay at slower rates than short-term options, so most investors use longer term puts for protection, and sell them before the decay rate increases dramatically (usually in the last 30 to 45 days).

For example, if you own 100 shares of EBAY at $31.00 and want to protect your position, you could buy a four-month 30 strike put for $2. Below $28 (the strike minus the premium cost of the option), you are protected dollar for dollar against stock declines.

Below, a profit and loss diagram of a long stock position with a protective put at expiration. We have already discussed the fact that you don’t want to hold this position until expiration, so let’s look at the position half way until expiration (with no change in implied volatility):

In this second P/L chart, we can see that EBAY would have to drop all the way to 28 to produce the maximum loss of $300. An increase in implied volatility would help the position and therefore would lower that price at which the maximum loss occurs.

If the stock moves up to $36, a gain of $300 is produced. Again this will be impacted by a rise or fall in implied volatility.

Finally, if the stock remains unchanged, time decay will eat away at the options value and will produce a small loss (the cost of insurance).