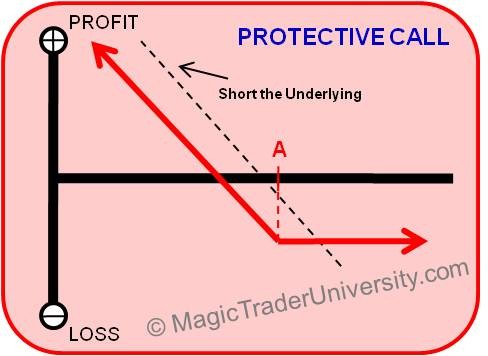

Protective Call

Post on: 29 Май, 2015 No Comment

Outlook: Bearish, but cautious

You may already be familiar with the use of protective puts to hedge long stock positions. Essentially, a cautious bull will purchase one or more put options against an existing portfolio holding, with the idea being to lock in paper profits (or limit losses) in the event of a downturn by the stock. A protective call is used in the same vein, although its employed by short sellers to limit upside risk.

Lets see how the protective call works by breaking down an example.

Entering the Trade

You shorted 100 shares of Stock XYZ at $32, and the shares have since pulled back to $27. However, the stock appears to be testing potential support on the charts, and youre nervous about a near-term rebound eating away at your profits. Youre not ready to bail out entirely, though, since you believe there could still be more losses in store for XYZ a few months down the road.

Knowing that the upside risk on a short sale is potentially unlimited, you decide to ease your mind during this period of short-term uncertainty by buying a protective call. To protect a portion of your unrealized profits, you buy to open one 30-strike call at the ask price of 0.15. Multiplied by 100 shares per contract, youve spent $15 to acquire this portfolio protection.

Potential Gains

In the best-case scenario, you wont realize any gains on your protective call option. Thats because youre a short seller first and foremost, and youd like to see the stock keep dropping.

In a typical call trade, your option will begin to gain value after the shares rise above breakeven, which is calculated by adding the net debit to the strike price or 0.15 + 30 = 30.15. However, youre not trading for premium here. Once XYZ tops the $30 level, you will have locked in two points worth of profit on your short stock position, since you shorted the shares at $32. At this point, you can exercise your option to buy XYZ at $30 per share, return the shares to the broker, and exit the short sale with a profit of $2 per share, or $200. Less the cost of your protective call, youre still $185 ahead.

You may want to wait until expiration to decide whether or not to exercise, depending upon how the stock is faring. If the shares make only a brief move above $30 before resuming their decline, you may regret buying back your shorted shares too quickly.

Potential Losses

If XYZ remains at or below the strike price of your protective call option through expiration, youll forfeit the entire cost of the call as your maximum loss on the hedge. In other words, youll be out the net debit of 0.15, or $15 per share. As long as the stock is actively moving lower, though, your gain on the short sale could offset the minor loss you took on the hedge.

Remember, too, that youre not buying the protective call in the hopes of turning a profit on the option play. Rather than thinking of the net debit paid as a loss, you may want to consider it as an insurance premium to protect your stock trade.

Volatility Impact

Usually, after youve bought a call option, youd prefer to see implied volatility rise. This will increase the value of your option, thereby raising your potential return should you need to sell to close. However, a protective call will most often be left to expire worthless, or exercised upon expiration. Whats more, since youve got offsetting long and short positions on the same stock, the overall impact of implied volatility is essentially null and void.

Other Considerations

When buying protective calls, be sure to match the number of options purchased to your level of stock exposure. For example, if youre short 100 shares, one call option should be sufficient to hedge your bets. If you have 500 shares sold short, youll need to buy five calls to hedge your entire position, and so on.

You can also adjust the strike price to suit your risk tolerance. The example above discusses a scenario where there are profits to be locked in, but you can also buy cheaper, out-of-the-money calls if youre OK with exiting the trade at breakeven, or even defining your loss to a set amount (such as 5% or 10%).