Pros and Cons of owning and operating money market accounts Guides to CDs Money Markets Savings

Post on: 24 Август, 2015 No Comment

Posted in Money Market by DailyDeals on Monday, January 3rd, 2011 at 1:02 am

The money market accounts that are offered by financial institutions like banks and credit unions are for people who hope to put their money into savings and start building an alternative income. These savings can be kept for a period of one or more years. This is best for people who do not want to risk their savings.

There are a few salient merits and demerits associated with operating these accounts. We shall discuss a few of these in the following passages,

Security is an important issue when it comes to investments. Money market accounts are generally insured up to an extent of $250000 by the federal deposit insurance corporation. In the rare case that the financial institution fails to perform as it promised the depositors will not be at risk of losing all their money. This is the reason why these deposits are considered to be safer than mutual funds or even stock options. But if you invest more than that limit of $250000, you will not get that amount over the limit in case the bank fails.

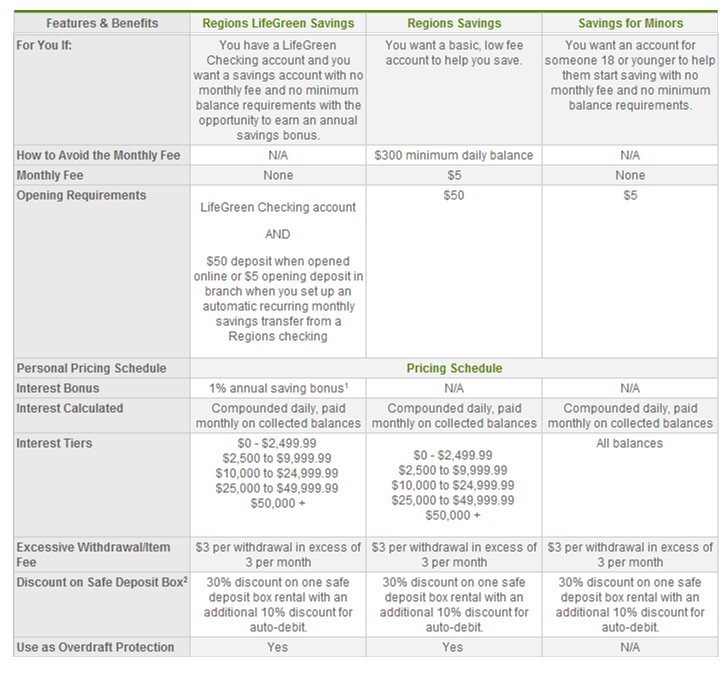

One major disadvantage of this account is that you need to maintain a minimum balance in order to keep the account. And the minimum balance requirements are quite hefty compared to general savings accounts. You will usually be expected to keep $5000 as a minimum balance. Whereas with savings accounts you would just keep say $50 or even zero if it is a zero balance account.

The fees that you need to maintain this account is zero. But this is only as long as you keep a minimum balance. If you fail to keep a minimum balance then the fee will be applied to your account. You will have to pay this fee to the bank in order to make any further withdrawals. This is another demerit that you need to tackle.

The liquidity of the account is a major factor that you need to consider. These accounts are very liquid compared to certificates of deposits or fixed deposits that carry a maturity date. But they are not as liquid as a savings bank account or a checking account. In the money market account, you can make only a said number of withdrawals every month. There will also be a limit on the value of checks that can be written every time period.

The rate of return on these deposits is directly linked to the amount you invest. The more you invest, the more you will get in terms of returns. The returns on money market accounts are more stable when compared to returns from stocks or shares. This is one major advantage of investing in money market accounts. With stock markets, you will be at the mercy of a single entity but with money market accounts, your money is diversified in to a number of companies and you will get returns from all of them. If you go for a more conservative account, you will have a more stable return but it will be lower and vice versa.