Property Tax

Post on: 16 Март, 2015 No Comment

How to Value Household Items for Estate Tax

When figuring out estate tax, one thing you’re going to have to do is value all of your household items. Value household items for estate tax with help from an Read More

How to Write a Complaint Letter About Property Tax

A well-written complaint letter about property taxes can help you motivate your county assessor’s office to address your issue of concern. Although there are formal processes for many property tax Read More

How to Qualify for a Homestead Exemption in Ohio

In the past, the Ohio homestead exemption was only available to homeowners with limited income, but, as of 2007, qualified homeowners do not need to meet any income requirements. To Read More

How to File a Homestead Exemption in Houston County, Alabama

Residents of Houston County, Alabama can potentially enjoy a reduction in their property tax liability by claiming a homestead exemption. As of 2011, state law permits qualifying homeowners to deduct Read More

What Does Property Tax Exempt Code H3 Mean?

If you own a home, you will typically receive a property tax statement each year. This statement shows the appraised value of your property, tax rate and applicable exemptions. However, Read More

How to Accurately Fill Out the Homestead Exemption Application for Florida

You may be eligible for property tax relief through Florida’s Homestead Exemption program. You must own your own home and live there on a permanent basis; rental properties will not Read More

What Does Grade Mean in a Tax Assessment?

Property tax bills are based on the property’s assessed value. The county assessor’s office is responsible for deciding what the assessed value is. Two deciding factors are the grade and Read More

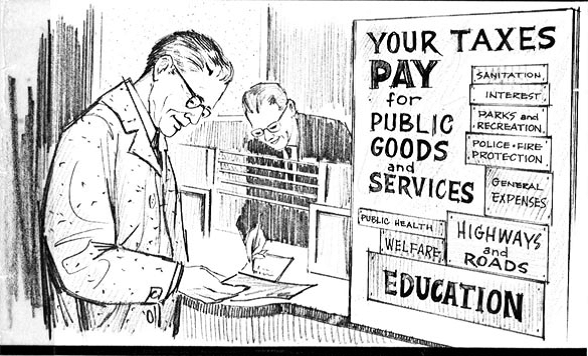

Advantages & Disadvantages of Property Taxes Used to Fund Education

In the United States, most cities and states rely heavily on property taxes to fund public education. As with any funding scheme for a public service, there are negatives as Read More

What Is Equalized Assessed Value?

While local governments will determine the fair market assessment values of real property for property tax purposes, some states use equalized assessed values (EAV) to modify the locally assessed value Read More

The state of New Hampshire requires residents to annually register all motor vehicles. While the total amount of the registration fee varies depending upon the year, make and model of Read More

Sandy beaches, snow-packed mountains and year-round temperate weather make California an ideal state to own a second home. Federal tax incentives for owning a second home in California are the Read More

How Much of a Tax Break Do Seniors Get for Property Tax?

Many baby boomers have a love-hate relationship with the thought of celebrating another birthday. While the wrinkles may multiple as seniors age, so do the benefits. Whether you are fortunate Read More

What Tax Forms Do I Have to Give to a Land Contract Holder?

Buying a home on land contract is an alternative method of financing that new home you want. A land contract may be the only way you get a home if Read More

Finishing your basement will increase the value of your home by 70 percent of the remodeling costs, according to Remodeling Magazine. But that doesn’t mean your property taxes will go Read More

Property taxes are charged based on a predetermined rate and an assessment of property value that is typically updated from year to year. This means that property taxes due can Read More

What Does Taxable Vs. Assessed Value Mean for Michigan Property Tax?

Deciphering your Michigan tax bill requires a general understanding of what the value amounts on your property tax bill mean. If you own property in Michigan, you may receive up Read More

Can I Claim Property Tax I Paid on My Parent’s House?

If you itemize deductions, you can deduct property taxes. You cannot, however, deduct taxes you pay on property you don’t own. If you generously paid your parents’ taxes to help Read More

Dealing with real property deeds, taxes and liens can be confusing, especially when you are searching for your tax parcel number. Rather than naturally follow the number and name of Read More

Local governments calculate the property tax based on the value of your property. Typically, you can request a refund if there is an overage after the local tax office receives Read More

If you are a senior or disabled resident in Lorain County, Ohio and own your principal place of residence, you can apply for the Homestead Tax Exemption. With the Homestead Read More

Capital Gains and Property Laws of Inherited Land in Minnesota

While Minnesota does not have an inheritance tax, it does have an estate tax. An inheritance tax is levied on the beneficiaries of the estate after receiving the proceeds, while Read More

Eligibility for the Homestead Exemption in Florida

Florida allows homeowners to exempt up to $50,000 of the value of their home from property taxes. To get this homestead exemption, however, you must own the home and be Read More

If you own your home, claiming a homestead exemption can potentially reduce the amount of property taxes you pay each year. The laws governing homestead exemptions vary from state to Read More

Disabled Persons and Real Estate Tax Credits

To help low-income, disabled residents deal with the rising costs of property values, most states provide them with property tax exemptions. Property taxes pay for local improvements and benefit local Read More

How Often Do I Need to Apply for Homestead Exemption?

Homeowners typically apply one time for a homestead exemption through their county tax assessor’s office. Once you go through the process and are approved, your homestead exemption automatically will roll Read More

Homestead Exemption Statutes in North Carolina

Homeowners in the Old North State, or North Carolina, can get property tax relief in the form of a homestead exemption if they meet certain requirements. North Carolina’s statutes allow Read More

Supplemental Property Tax Deductions

Property tax deductions are important for landowners, particularly for landowners who put their property to agricultural use. Property tax deductions can cut costs by either lowering other taxes or by Read More

Texas Homestead Exemption Requirements

Texas homestead exemptions allow you to take a property tax credit for a portion, or all, of your home’s appraised value. Texas law allows you to only take a homestead Read More

About Homestead Exemption Requirements in Pennsylvania

The Pennsylvania homestead and farmstead exemption, also known as the homestead and farmstead exclusion, allows owners of a primary residence in the Keystone State to receive property tax relief on Read More

What Are the Benefits of a Homestead Exemption in Texas?

You may believe the general definition of a homestead describes your residence. However, to gain the benefits covered by the Texas homestead law, your residence must satisfy legal requirements to Read More

Value-added tax, sometimes called VAT, is a tax assessed as a surcharge to the sale price of an item purchased. The tax is essentially a sales tax, but is often Read More

Are Easement Payments Taxable Income?

An easement is a legal device that a property owner can use to convey an interest in his land to another person, business or organization without selling the property or Read More

What Is Tax Millage?

Tax millage is a simple mathematical formula used to determine the impact of a local levy on a property owner’s real estate taxes. If a local tax levy passes under Read More

What Is Considered Tangible Personal Property in Virginia?

Virginia breaks private property down into two primary categories. The first is real property, which refers primarily to real estate and other types of property that cannot be moved. The Read More

Tax Laws on Inherited Property

When a person dies, he often leaves behind property to a spouse or heir as specified through his will. When this occurs, the U.S. government needs to know about it. Read More

How to Keep a Florida Homestead While Living in Another State

The Florida homestead exemption offers up to $50,000 off the assessed value of a home for property tax. The Florida constitution article governing homestead status states that the exemption is Read More

Massachusetts Circuit Breaker Law

In Massachusetts, some people over 65 qualify for a refundable state income-tax credit on home property taxes paid in the previous year. If an individual’s income tax is lower than Read More

How to Claim the Diminished Value of a Car in Kentucky

After your car has been damaged in an accident and repaired, you can request a refund for its diminished value in Kentucky. The state determines the reduction in your car’s Read More

Will an In-Ground Pool Increase Your New York State Taxes?

An in-ground swimming pool provides summer fun, but it can also be a financial burden. Not only are there significant chemical costs, but an in-ground pool increases a homeowner’s insurance Read More

How Taxes Are Paid Forward in Arrears

Real estate property taxes are paid partially in advance and partially in arrears in most areas. While this sounds confusing, it is easy to understand when you consider the due Read More

If You Are on Social Security & You Own Rental Property Do You Have to Pay Property Taxes?

Property taxes can be expensive and some homeowners can’t easily afford them, especially if they are elderly or disabled and have limited income. In many states, such individuals may qualify Read More

Financial Help for Paying Property Taxes

Every state taxes real property. Most states offer certain classes of property and certain classes of taxpayers tax exemptions or credits to reduce or help pay property tax. Beyond that, Read More

Help With Paying Deliquent Property Taxes in Michigan

Michigan provides a variety of services for residents who find themselves behind on their property taxes. From special programs for senior citizens to installment plans to a poverty exemption, resources Read More

Will Inground Pools Increase Your Taxes?

An in-ground swimming pool can increase a homeowner’s property taxes if the pool is operational and well-maintained. Since an in-ground pool is a permanent fixture on your property, it can Read More

Indiana Property Tax Sale List

The Hoosier Property Tax Sale List provides an information and research tool for investors interested in purchasing foreclosed real estate and confiscated properties offered by Hoosier county governments. The main Read More

Homestead Property Tax Laws in Michigan

In Michigan, a homestead property is your permanent and primary home. A homestead property can be a home that you own or rent. This includes single family, mobile and manufactured Read More

Can My Inground Pool Add to My Property Taxes?

An in-ground swimming pool is a permanent concrete addition to your home that is installed below ground level. A swimming pool can add value to your home and increase your Read More

Do We Owe Property Taxes If We Sold Our House?

State and local governments require business and residential property owners to pay property taxes. You are responsible for paying property tax for the period of time that you owned your Read More

What Happens If I Don’t Pay My Property Tax in Ohio?

Property taxes are assessed in every state. Each state has its own set of rules for handling delinquent taxes. Most commonly, the process begins with assessing late fees and penalties Read More

Help Paying Property Taxes in California

The state of California and its counties provide ample help for homeowners who need a hand paying their property taxes. Although the state eliminated the Property Tax Postponement program in Read More

Definition of Taxes Paid in Arrears

State and local governments raise revenue from several sources, including property taxes on the real estate and personal property that residents own. Each local government or special district has its Read More

Which States Do Not Charge Senior Citizens Property Taxes?

You may be surprised, but no state government collects property taxes directly tied to property values. When it comes to taxing real estate, you have to look at the local Read More

How Does the Indiana Homestead Credit Work?

Forty states provide a tax break related to property taxes on owner-occupied properties, according to the Retirement Living Information Center. In most of these states, the program is a partial Read More

Definition of Prorated Taxes

In most cases, taxes apply to a specific individual and cover the duration of a tax period, generally one year. However, in the case of property tax, which only applies Read More

Is Property Tax Paid on a Condo in California?

A condominium, according to the BusinessDictionary.com is a single, individually owned housing unit in a multi-unit building. The definition goes on to explain the owner holds sole title to the Read More

Can I Get an Extension on My Property Taxes?

Property taxes are due either annually, semiannually or in smaller installments three or four times a year. In some states, the due date is followed by a grace period. On Read More

How Can I Get My Real Estate Taxes Reduced if I Am 65?

Property taxes, the semiannual bill that pays for local services like schools, libraries and the police, are quite often a hardship for those over the age of 65. However, every Read More

Part of owning real estate in the United States is paying property taxes. If you do not pay your taxes as part of your mortgage payment, it can amount to Read More

While property taxes are usually collected by a county tax collector, the rules are most often written at the state level and apply statewide, sometimes allowing local governments to opt Read More

What to Do If You Owe Back Property Taxes on Your Home?

When you owe back property taxes on your home, you really only have two options: pay up or lose your house. This stark reality is tempered by a generous timeframe Read More

California Law on Delinquent Property Taxes

Not paying property taxes in California can cause problems. Property owners in California pay their taxes in two installments. If either payment is late, the department collecting the tax considers Read More

How Do I Calculate What My Taxes Will Be if I’m Eligible for the New York State Basic Star Program?

Calculating your New York State local school property taxes if eligible for the STAR program is not complicated, provided you know your property’s current assessment and the amount of the Read More

What Percentage of Property Taxes Are Deductible From a Federal & State Income Tax Return?

State and local real estate taxes can be deducted 100 percent on Schedule A of your federal income tax return. There are exceptions, but for the majority of taxpayers, real Read More

Help with Defaulted Property Taxes

Not paying property taxes on time will cause your home to go into default, and if the tax liability remains unpaid, then the county can order a foreclosure sale. As Read More

Is California Property Tax Deductible?

If you have an expense, you want it to be deductible because it offsets income — that is, it reduces your taxes. In California, if you pay property taxes on Read More

What If I Can’t Pay My California Property Taxes?

If you’ve got to juggle your bills through part of the post-2007 Great Recession, don’t feel like you’re alone. Instead, analyze your options in order to know what you should Read More

How Long Can I Go Without Paying Property Taxes Before I Will Be in Foreclosure?

Property tax foreclosure is the final attempt that state or county agencies use to collect delinquent taxes. The time you have to pay the total amount due plus interest and Read More

Are Real Property Taxes in California Paid in Arrears?

In some states, you pay property taxes in arrears. In California, you pay half the tax in advance, and the other half in arrears of the start of the fiscal Read More

How to Apply for a Homestead Exemption in Indian River County, Florida

There are seven different types of homestead exemption in Indian River County, Florida. If you are an Indian River County homeowner in a permanent residence, you are entitled to at Read More

The Declaration of Homestead in Texas

Texas homeowners pay high property taxes, partially because there is no state income tax. A 2008 study showed Texas as 14th in the nation in property tax, according to AARP. Read More

What Does Declaring a Texas Homestead Mean?

The Texas Homestead Act exempts part of the value of a principal residence from taxation, but the homeowner must declare the property as a homestead. You must use the home Read More

City of Westland Michigan Property Tax Information

Property taxes in the city of Westland, Michigan, are based on an assessment by the city assessor. The assessor determines the value of property based on the size of the Read More

How Much Does Property Tax Affect Filing Your Taxes?

Taxpayers who own property are assessed a tax annually on the value of that property. These taxes are paid either out-of-pocket or through escrow as part of a mortgage loan. Read More

How to Claim a Texas Homestead Credit

A homestead exemption in Texas gives the homeowner a credit on taxes—reducing the taxable amount as much as $15,000 on school taxes and $3,000 on county road taxes. An additional Read More

How Long Do You Have to Pay Your Property Taxes After You’re Late?

Any person or company that owns property is required to pay property tax. Because such taxes are important to the infrastructure and functionality of every city, county and state, the Read More

How to Dispute a Property Tax Assessment

Disputing a property tax assessment requires proper planning and research. The property tax is primarily a tax levied and collected in support of your local government including the municipality, school Read More

Tax Foreclosure Procedures in Texas

In the state of Texas, all real estate property can be auctioned off to the highest bidder if the property taxes are left unpaid for too long. This applies to Read More

How Long Until a Tax Delinquent Property Is Sold for the Taxes?

When property taxes become too far past due in payment, some states will sell the property deed as a way to recuperate the taxes they’re owed. Not all states sell Read More

How to Value Farm Equipment

Unless owned by a large corporation, farms tend to utilize the same equipment for many years. After purchasing it used, that is. Repairs are made and parts are replaced, but Read More

How to Calculate Michigan Taxable Value

Michigan voters approved Proposal A in 1994 to cap annual property tax increases at 5 percent. Assessors use either the rate of inflation multiplier or 5 percent, whichever is the Read More

What Are Mello-Roos Taxes?

Mello-Roos taxes apply to specific areas within California that have issued bonds to fund improvements to local infrastructure. The tax is an additional property tax, with the money covering the Read More

Property taxes pay for the functions of local and state governments, including road construction, education, utilities and other services. Property owners can deduct all property taxes paid on vehicles and Read More

Property tax, which is determined by your assessed property value, is one way for the government to raise funds to pay for public services. How much your local or state Read More

All states assess property taxes against commercial and residential real estate. Some mortgage lenders may include the property taxes in home mortgage loans and place them in an escrow account Read More

What Is a Budget Overlay?

A budget overlay establishes a municipal cash reserve account. The purpose of the overlay is to provide a backup source of money that covers unexpected shortfalls in property tax revenue. Read More

Michigan Homestead Taxes Vs. Non-Homestead

The state of Michigan offers two programs to help qualified homesteaders reduce the amount of money they owe in property tax. The Homestead Property Tax Credit Program (HPTCP) allows Michigan Read More

How to Defer Property Taxes

States throughout the country give homeowners the ability to defer property taxes if they meet certain conditions. Although these conditions vary from state to state, programs are generally available for Read More

Taxes on RVs vs. Mobile Homes

RVs and mobile homes are usually taxed differently from one another. In general, if the unit can be used like a vehicle, it is taxed as personal property, subject to Read More

What Happens If Property Taxes Are Not Paid?

There is no uniform code or method across the United States that determines what happens if property taxes are not paid. Individual tax districts impose their own regulations. Some impose Read More

When Do You Claim Property Taxes?

Property taxes can take a big bite out of your wallet, but you can lessen the pain by deducting those taxes when you do your income tax at the beginning Read More

How to Calculate Property Taxes in Kentucky

Kentucky has a state income tax, and state and local property taxes. Local property taxes in Kentucky include county, city, school district and special tax district property taxes, and each Read More

The Legal Process of Texas Property Tax Foreclosure

Property taxes are assessed at state, county and local levels in order to fund public projects. Failure to pay property taxes can result in costly fines or the loss of Read More

Do Corporations Pay State & Federal Taxes?

Taxpayers let out a collective groan as April 15 rolls around each year. Employees at the Internal Revenue Service and state governments work overtime to manage income tax forms and Read More

How to Calculate Property Taxes in Florida

If you own property in the Florida, local governments have the right under the Florida Constitution to charge ad valorem taxes (taxes based on property value), which are the largest Read More

What Happens If I Cannot Pay My Property Taxes?

When you own a home or real estate, you are responsible for paying the property taxes that are assessed by your local government. The amount of property taxes you owe Read More

What Happens if I Do Not Pay Property Taxes?

Property taxes are assessed on real estate holdings owed by individuals and businesses. In most cases, property taxes are assessed by local municipalities, such as cities and counties. Generally, an Read More

Can You Get Help Paying Property Taxes?

If you are unable to pay property taxes, there are options you can pursue to prevent the loss of your home through tax foreclosure. One alternative is to find ways Read More

New Jersey Property Tax Calculation

New Jersey uses an ad valorem real property taxation method where homeowners pay property taxes based on their property values. Tax assessors use standard fair market measures to determine each Read More

When Are Property Taxes Due in Ohio?

Taxes are an inescapable part of life in the modern era. Not only is there the big bite of federal and state (and sometimes municipal) income tax, there are also Read More

Real Estate Benefits for Disabled American Veterans in Alabama

In Alabama, disabled veterans may receive real estate tax exemptions. Alabama residents are subject to real property taxes at the state government level and at the local level. The Alabama Read More