Profiting From Selling Puts and Calls

Post on: 3 Июль, 2015 No Comment

Error.

December 22, 2012

It was a good year to sell calls. It was an even better year to sell puts.

In fact, 2012 will most likely be remembered as the year when all of Wall Street and much of Main Street embraced options as a more cost-effective way to buy blue-chip stocks that have stable business models and the financial strength to reliably pay dividends.

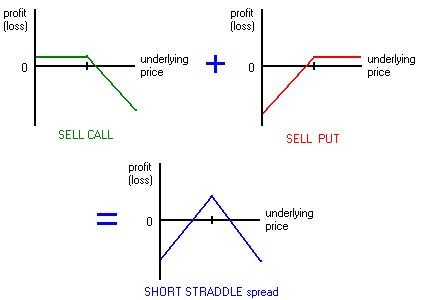

By strategically selling puts and calls, investors can collect conditional dividends from the options market. The condition is that put sellers are obligated to buy the stock if it declines below the put strike price. Call sellers must sell the stock if the stock price exceeds the call strike price. In other words, the options market will pay you to buy lower and sell higher.

In a world of low economic growth, with many investors wary of assuming too much risk, 2013 should be a milestone for put and call selling. The year could prove historic for the options market, if, as expected, some major mutual-fund companies, which have often shunned puts and calls, integrate them as overlay strategies into general stock-portfolio management.

Performance has proved compelling. As of Thursday’s close, the Chicago Board Options Exchange’s BuyWrite Index (BXM) was up 5.4% on the year. The CBOE’s 2% OTM BuyWrite Index (BXY), which sells out-of-the-money calls, was up 10.4%. The S&P 500 PutWrite Index (PUT) was up 7.6%.

True, the Standard & Poor’s 500 index is outperforming the options indexes, but the latter are less risky. The strategies are in such demand, even among bond investors, that Goldman Sachs now sends clients a weekly overwriting list.

Put and call selling was the main plank in this column’s do no harm strategy for 2012. In a year when the broad market ground higher against an unforgiving backdrop of a presidential election, war, and the fiscal cliff, it was often difficult to find compelling trades with reasonable risk and return profiles. Many top banks had the same problem, and backed away from issuing trading recommendations because clients were not interested.

So selling puts or calls on stocks with reliable dividend yields often carried the day. Venturing away from that discipline sometimes produced unsatisfactory results.

Almost everyone knows that the cost of hedging stock portfolios is fairly inexpensive, because the CBOE’s Volatility Index (VIX) seems stuck at about 17, below its long-term average of 20. Because VIX options are like Standard & Poor’s 500 index options on steroids, the idea of buying VIX calls as a portfolio often seemed prudent—and often lost money. (Rule: Be very careful of derivatives of derivatives.)

THE DISCONNECT BETWEEN what might happen and what did was a reminder of the cardinal rule of options trading: Keep it simple, stupid.

The Street is now releasing all kinds of investment outlooks that suggest someone actually knows what will happen. Don’t be fooled. In 2013, remember the overarching lesson of 2012: Focus on what is made truer by time (overwriting, for example) and ignore the noise (information without any economic value). Those are timeless market facts.