Principalprotected notes offer security but at a cost Investment Executive

Post on: 2 Июль, 2015 No Comment

It is up to advisors to understand those costs and inform clients what the trade-offs are

[Mid-January 2007]

Retirees and those close to retiring are seeking security as well as healthy investment income, and structured products such as principal-protected notes are meeting their needs by serving up an increasing array of options and features, including tax-advantaged income.

Essentially, PPNs offer a guarantee on invested capital and link returns to underlying investments such as mutual funds, key interest rates, stock or bond indices, customized stock portfolios or hedge funds. The primary attraction of PPNs is that if the notes are held to maturity — typically, five to 10 years — the original nest egg is protected, even if the underlying assets to which the note’s performance is tied fall in value.

If the underlying assets increase in value, investors participate in the gains, although to a lesser degree than if they had simply held the underlying assets because of extra fees on PPNs associated with the cost of the guarantee. The guarantees are typically provided by a major bank or government agency, which issues the PPN. The reputation of the guarantor is an important component of any PPN.

A growing number of PPNs are designed to offer regular quarterly or monthly income, based on the performance of the portfolio that underlies the note. Sometimes, depending on the terms of the note, this income is paid in the form of return of capital, allowing investors to defer income taxes until the note is ultimately sold or redeemed. Other times, the income is in the form of regular interest and is fully taxable each year.

“There have been a lot of recent innovations, and the beauty of some of these structured products is that the investor can get income along the way and still receive the guarantee,” says Jimmy Chu, analyst at Toronto-based Investor Economics Inc. “There’s been a lot of growth and innovation in the marketplace and more features have come into play on these products, offering downside risk protection combined with upside return potential.”

The most recent numbers from Investor Economics indicate the size of the Canadian PPN market was $13.8 billion as of June 30, 2006, about double the $6.9 billion in notes as of Dec. 31, 2004. As of Aug. 31, 2006, there were 657 notes outstanding, beating the 461 notes outstanding at the 2005 yearend and the 291 notes in 2004. And the pace of new issues is ramping up rapidly. For the eight months ended Aug. 31, there were 210 new issues, with the pace continuing in the latter part of the year, Chu says. In all of 2005, there were 182 new issues; in 2002, there were 41.

According to Raj Lala, managing director of Toronto-based Jovian Capital Corp. and president of subsidiary Gibraltar Consulting Group, the advantage of the notes that pay out distributions prior to maturity is that they provide investors with “locked-in” gains. At the end of the day, investors in these notes would be further ahead if there was a market disaster near the end of the note’s term, causing the note to drop below par in value and triggering the guarantee, he says, as the investors would typically get their guaranteed principal in addition to the distributions they had already received.

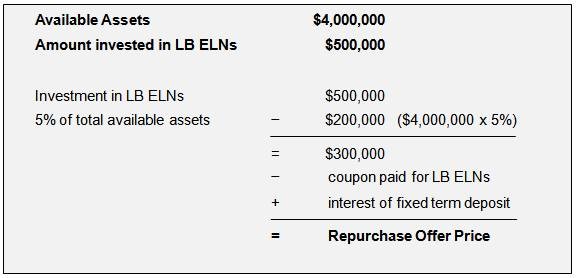

However, it’s important to read the fine print in the offering documents, as some notes may deduct any income paid annually in the form of return of capital from the principal guarantee at the end.

“The chance to take a gain while you can has broad appeal to an audience looking to create or subsidize an income,” says Lala, whose firm was involved in the creation of some $400 million these notes this past year. “There is immediate gratification instead of having to wait eight years or so until the note matures. However, the yield offered by notes is typically based on how the invested part of the portfolio performs. There is no guarantee on distributions or returns, making this product higher-risk than a bond or GIC, although the potential upside is greater.”