Present Value of a Future Sum Calculator

Post on: 16 Март, 2015 No Comment

Calculator Use

Calculate the present value of a future value lump sum, based on a constant interest rate per period and compounding. This is a special instance of a present value calculation where payments = 0. The present value is the total amount that a future amount of money is worth right now.

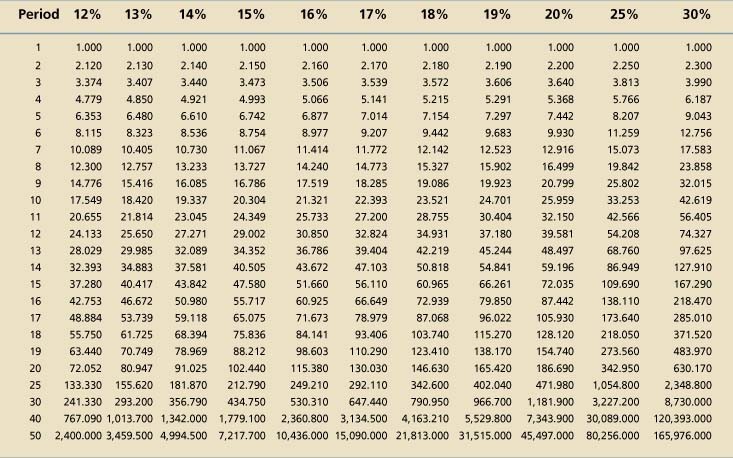

Period commonly a period will be a year but it can be any time interval you want as long as all inputs are consistent. Future Value (FV) is the future value sum of your investment that you want to find a present value for Number of Periods (t) commonly this will be number of years but periods can be any time unit. Enter whole numbers or use decimals for partial periods such as months for example, 7.5 years is 7 yr 6 mo. Interest Rate (R) is the annual nominal interest rate or stated rate in percent. r = R/100, the interest rate in decimal Compounding (m) is the number of times compounding occurs per period. If a period is a year then annually=1, quarterly=4, monthly=12, daily = 365, etc. Continuous Compounding is when the frequency of compounding (m) is increased up to infinity. Enter c, C or Continuous for m. Rate (i) i = (r/m); interest rate per compounding period. Total Number of Periods (n) n = mt; is the total number of compounding periods for the life of the investment. Present Value (PV) the calculated present value of your future value amount PVIF Present Value Interest Factor that accounts for your input Number of Periods, Interest Rate and Compounding Frequency and can now be applied to other future value amounts to find the present value under the same conditions.

Present Value Formula for a Future Value:

<(1+r/m)^

where r=R/100 and is generally applied with r as the yearly interest rate, t the number of years and m the number of compounding intervals per year. We can reduce this to the more general

<(1+i)^n> />

where i=r/m and n=mt with i the rate per compounding period and n the number of compounding periods.

When m approaches infinity, m (continuous compounding)

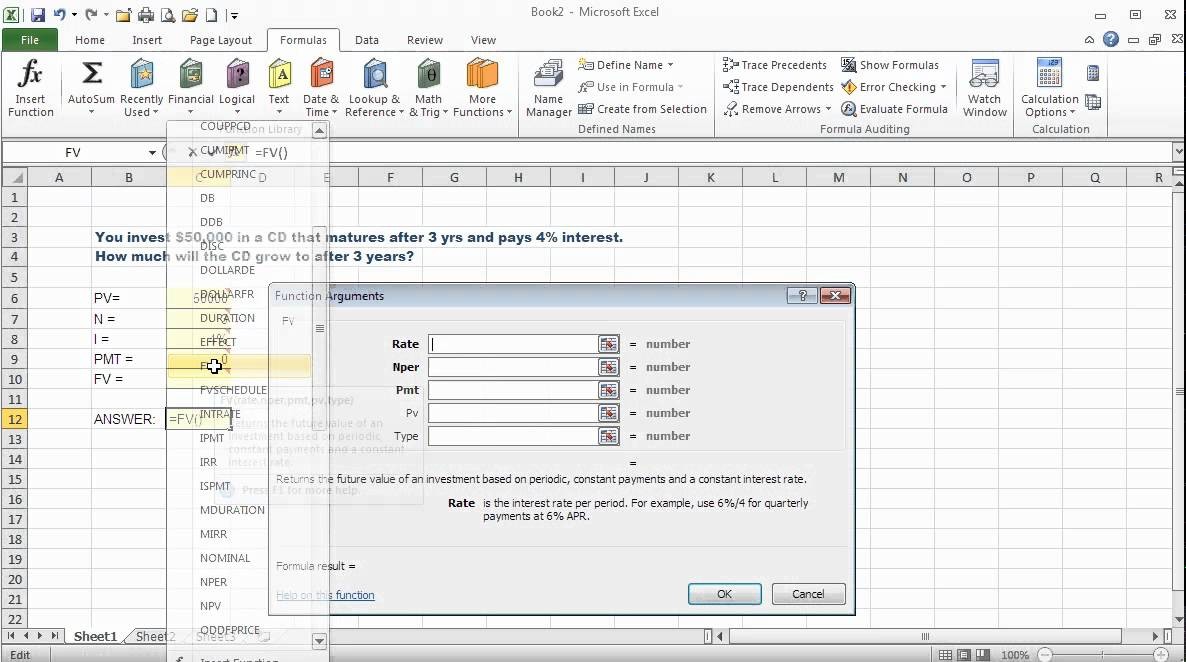

Example Present Value Calculations for a Lump Sum Investment:

You want an investment to have a value of $10,000 in 2 years. The account will earn 6.25% per year compounded monthly. You want to know the value of your investment now to acheive this or, the present value of your investment account.

- Investment Value in 2 years FV = $10,000

- Interest Rate R = 6.25%, r = 0.0625

- Number of Periods (years) t = 2

- Compounding per Period (per year) m = 12

<(1+0.0625/12)^<12times2>>= />