Preferreds Present Outsized Risks If Rates Rise Wells Fargo Income Investing

Post on: 11 Июнь, 2015 No Comment

By Michael Aneiro

Preferred securities might offer comparatively attractive yields in a low-yield world, but theyre highly vulnerable to any rise in interest rates, and Wells Fargo Advisors advises investors to scale back their preferred holdings to prevent losses if rates do rise. Brian Rehling, Wells chief fixed-income strategist, says preferreds traditionally high 7%-8% coupons have been refinanced across the market with lower coupons that present outsized risks if rates rise, and he offers a pretty sweeping cautionary note for investors:

The last several years have seen a dramatic shift in the market for preferred securities, a shift we believe is negative for investors. Investors use the term preferred security as a blanket term to describe any security that typically trades with a $25 par value, has a fixed dividend and is listed on a major stock exchange. Today the preferred security market encompasses a wide range of structures with meaningful differences that can have a significant impact on individual security valuations and stability. These securities could be either senior in nature or a deeply subordinated junior security.

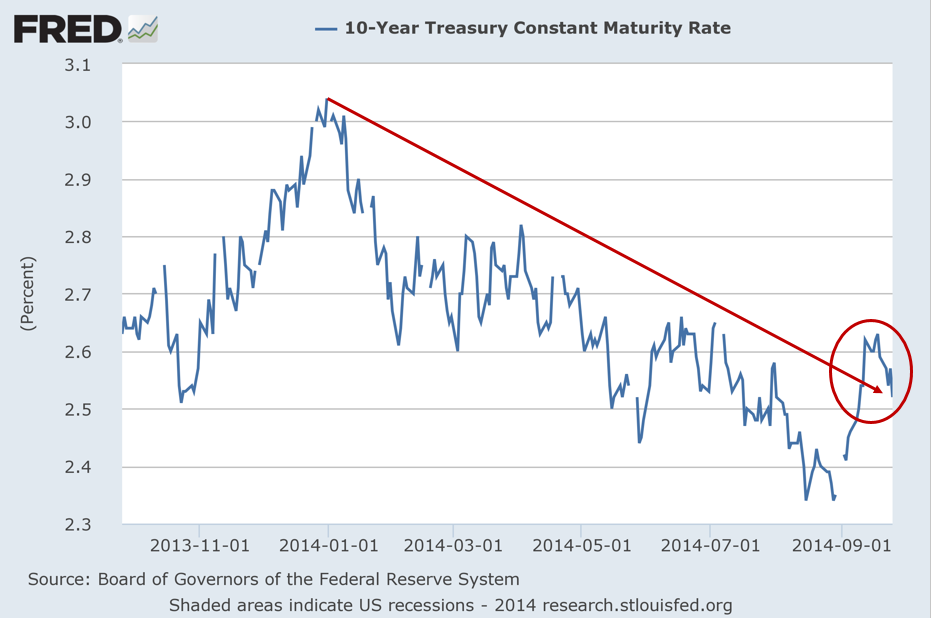

Regardless of subordination all of these securities have one element in common: they are generally all very long-term securities which make them sensitive to changes in interest rates. In addition, most of the new offerings in this space are coming to market with coupons that are at or near the lowest level most issuers have ever issued.

Wells says determining the specific duration, or interest-rate sensitivity, of preferreds can be difficult and potentially misleading due to structural issues and call options that allow the issuer to redeem the securities early, leading to a wide variability in the timing of potential cash flows. Wells notes that if rates fall, issuers will typically call the securities away and refinance them, making them short-duration assets during periods of falling rates, but that if rates rise issuers wont call them and they become long-duration holdings. More from Wells:

With prices still at or near all-time highs for many of the securities, investors that are over allocated should take this opportunity to return to recommended allocations. We currently recommend that 10% of a traditional fixed-income portfolio be allocated to preferred securities. Because of their high volatility we recommend that such exposure to the preferred sector be diversified among a variety of issuers, sectors and structures.

Remember that our 10% allocation recommendation is a percentage of our traditional fixed-income allocations. Investors with a greater growth objective would have a much lower (or no) allocation to preferred securities.