PPT Fundraising through convertible bonds PowerPoint presentation

Post on: 23 Апрель, 2015 No Comment

Fundraising through convertible bonds PowerPoint PPT presentation

Title: Fundraising through convertible bonds

Fundraising through convertible bonds

- Coaltrans South Africa 2009

An Authorised Financial Services Provider

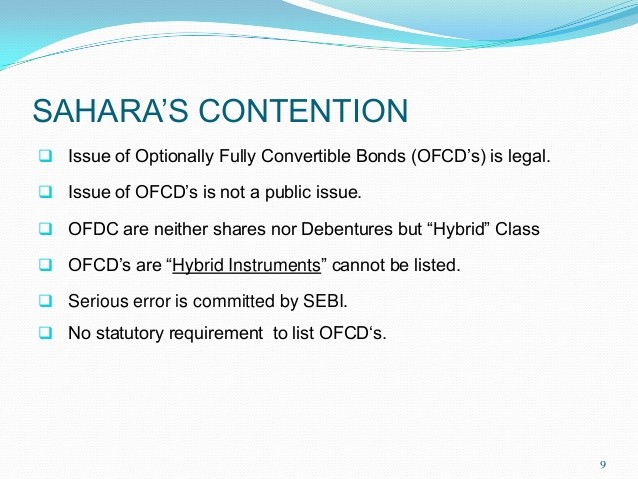

Introduction Convertible bonds

overview Indicative Terms Appendices

Introduction

Recent market activity has demonstrated

considerable appetite for hybrid equity

issuances

- Capital is in short supply, so it is expensive if

it is available

issue equity

is tax deductible is the cheapest form of capital

equity cheaper than equity and more expensive

than debt

cheap if conversion never happens

Introduction

- Current capital market response

- the market response to the Aquarius Platinum

Limited (Aquarius) convertible bond issue

(April 2009) and indicative feedback from the

marketing of the Anglo American plc (Anglo)

exchangeable bond (August 2009) indicate strong

Spectrum of capital instruments available

A convertible bond offers a number of advantages

to the issuer over straight debt and equity

funding

Convertible bond advantages

Convertible bond disadvantages

- Allows cash flow relief relative to term debt

(lower coupon and bullet profile)

funding cost

some dilution protection

vanilla debt

equity issue value

equity)

- Greater potential for equity dilution than

vanilla debt

- Option value typically not fully discounted in

pricing

- More complex than vanilla debt and equity

- Additional administrative burden

- Potentially complex tax treatment

- Complex accounting treatment

- Less flexibility than bank loans

Summary of terms for recent South African hybrid

issues

Introduction Convertible bonds

overview Indicative terms Funding

proposal Appendices

Convertible bond issue pricing

Convertible bond pricing components

- Main parameters used in pricing the convertible

- Volatility

- Conversion premium

- Issuer call

- Term to maturity also impacts option value

- The convertible bond coupon is determined by

valuing the embedded equity option and deducting

this from the coupon that would be paid on a

vanilla bond.

- The primary factors affecting the pricing are

- Volatility of the underlying equity

- Conversion premium

- Terms of Issuer call option on the bond

- Maturity

Convertible

Debt

- The higher the volatility the more valuable the

option and the lower the coupon

- Market soundings and past issuances indicate that

investors will price in a significantly lower

volatility to the actual share price volatility

Volatility of underlying equity

- The greater the conversion premium the lower the

value of the option

Conversion premium

- To protect against giving away equity too cheaply

through the convertible an issuer can often force

conversion after a specified date if the share

price increases by more than a specified

percentage

and the lower the coupon

Terms of issuer call option (soft call)

Maturity

Potential long-term savings of convertible bonds

- Any maturity share price below c.R115 will result

in savings from the convertible bond over vanilla

term debt

pre-tax interest saving of c.R38.7 million

range)

Analysis of net present value benefit of

convertible bond savings1

PV of benefit (m)

Share price in 3 years time (R)

- Note

- This graph depicts the present value if

conversion happens after year 3. If conversion

happens before three years, the coupon savings

will be less

- Based on the assumptions, the present value range

of the pre-tax interest saving is as follows

Overview of redemption and conversion features

Convertible bonds usually have various redemption

and conversion features, including

- Redemption

- The Bond may have soft call features

Issuer soft-call

- issuer soft-call

- issuer hard-call

- deferred conversion rights

- standard conversion price adjustments

T3

- The soft-call gives the issuer the right to

redeem all Bonds outstanding at face value within

a specified time period, subject to

pre-determined share price performance the

holder is given the chance to convert before

redemption (forced conversion)

- Redemptions can be cash or in shares

- Conversion

- Face value divided by conversion price gives the

into the shares within a specified time period

- The Conversion Price will be adjusted if various

events occur which dilute the interests of the

Bondholders these are standard for an

instrument of this type