Portfolio Diversification

Post on: 18 Август, 2015 No Comment

Shares

In today’s fast growing economy, more and more Americans find themselves with a higher disposable income. The average person wants their money to work for them while maintaing low risk. A great way to do so is by investing, but one must know how to invest wisely. Most people have an idea of how to do so, but there are still a lot of people who have no idea how to minimize the risk undertaken with various investments. Diversifying your portfolio will make your overall portfolio less risky and buy you piece of mind.

what is diversification?

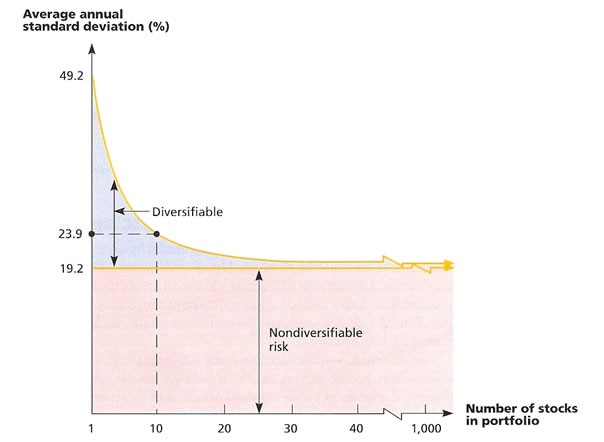

The basic notion of diversification involves spreading a portfolio over many investments to avoid excessive exposure to a single source of risk. In simple English this means, Don’t put all your eggs into one basket. This is the very essence of investing. In fact, all portfolio principles are directed towards achieving diversification to minimize risk. It is therefore important that the average investor also diversify his investments.

Proper diversification must take at least three factors into account. The first factor is the time factor. A person’s choice of investment should partly depend on his investment time horizon. For example, if the individual requires the funds within six months, then the investment should be planned using short term investment vehicles.

The second and third factors are tied together. Investors must decide how much return they want to aim at and what kind of risk tolerance they have towards the investment. This step is important, because it will help facilitate the types of investment that are suitable to the investor’s needs and help them avoid the most common investment mistakes .

These principles can be applied to different asset classes ranging from stocks, bonds, and options. The important point is to choose the investment that you feel most comfortable with.

how to diversify

The process is very simple, since you can diversify in many ways. You can buy a combination of well researched and undervalued stocks from different industries and different countries. Or, you can invest within corporate or government bonds. The safest investment with the lowest returns are Government T-Bills and Certificates of Deposit (CD).

Finally, you can reduce your portfolio’s risk by buying a combination of stocks, bonds and CDs. There is only one problem with diversifying many asset classes when you are a small investor-effective; economic diversification (not enough money and commission that is too high). In order to avoid this problem, you can invest in mutual funds, which pool the funds of many small investors together to achieve economies of scale and professionally manage the portfolio with expertise (or so they claim).

At the very minimum, try to avoid investing in only one particular stock. This is where many people get burned. What happens if the stock loses half its value? Or what happens if the company goes bankrupt? If you spread your investments, the gains of one might cover the losses of others. Investing is not all that it’s cracked-up to be, so don’t forget to avoid putting all your investments in one basket. You don’t want your hard earned money to become scrambled eggs.

On a final note, remember that you can diversify firm-specific risk (risk related to the company itself) through proper diversification and research, but you can’t diversify market risk (risk related to outside market events that cannot be predicted or controlled).

TRIVIA OF THE WEEK:

Name the first company to be added to the Dow Jones Industrial Average that trades on the Nasdaq stock exchange and pays no dividend. The Answer Is.