Portfolio Construction Broaden your horizons

Post on: 18 Апрель, 2015 No Comment

Asset Classes

On the hunt for truly diversified sources of risk, Martin Steward takes aim at different investment time horizons

Let us be clear: long-term investors do make investment decisions based on diverse time horizons. A pension fund can have liabilities stretching out for decades but it regularly and frequently buys the assets that it will hold to meet those liabilities out of incoming cashflows — cost averaging is the most basic form of time horizon diversification. Similarly, most will make strategic asset allocation decisions on a 3-5 year horizon, rather than a liability duration-related multi-decade horizon. Within that, portfolios may be rebalanced once a year or so and active tactical asset allocation decisions might be made every 6-12 months.

But all of this is either a by-product of some other consideration or an acknowledgement that inter-asset class correlations are unstable and must therefore be managed with market timing. If you suspect that all growth assets merely offer different gearing on equity risk, and all other assets merely offer duration risk, shouldnt the search for diversification be within — rather than between — asset classes? If so, might time horizon be the key vector for that diversification?

Again, pension funds do act as if these premises hold. The very concept of a pension scheme is adopting a multi-decade risk and managing it day-to-day, month-to-month, and swaps-based liability-driven investing embodies this concept in the pure duration part of the portfolio: when you enter into a 30-year interest rate swap and invest to meet its six-month LIBOR funding leg, what else are you doing but creating a ‘barbell exposure to a very long and a very short time horizon within the same risk?

We do not see the same systematic approach to time horizon diversification in the growth portfolio. A pension fund may buy options if it takes a dim view of equity markets over the next six months — so why not systematically implement a six-month view at all times? And while its passive exposure may be implemented with a horizon of 3-5 years-plus and its active managers may be trading around the quarterly earnings cycle, this is conceptualised (problematically) as an alpha/beta diversification rather than a time-horizon diversification.

This is one of the most important questions there is on the subject of diversification, says Terence Moll, a strategist at Investec Asset Management. Mysteriously, very few people seem to think about it.

Moll thinks about it a lot, but he specialises in foreign exchange and has been involved in the managed futures world for years, where this stuff is bread and butter. One reason CTAs tend to diversify by time signals is that their portfolio-set is that much smaller and they do not have the luxury of taking leveraged risk over long periods of time, says Aref Karim, CEO of futures strategy manager Quality Capital Management. Some trade only currencies or only energy — its clearly important either to have strategy diversification or time diversification or both.

Man AHL is the biggest managed futures programme in the world, and investment manager Harry Skaliotis says that it spreads its risk capital across models spanning one day out to about one year, to exploit the low correlation between the fast, medium and slow strategies: Its a very important part of our portfolio construction.

At Aspect Capital, another trend follower, chief commercial officer John Wareham, confirms that risk is allocated in a broadly stable way to different time horizons: The best time filters today will not necessarily be the best tomorrow, so it pays to exploit the essential truth that diversification is a benefit at all times.

These diversification benefits are intuitive. Just think how two different traders would respond to a market reversal, for example. Medium-term trend followers could take a considerable amount of time to eliminate their positions but, in the meantime, the short-term managers will probably have got into those markets and captured the reversals more efficiently, observes George Coplit, head of the CTA and macro team at LGT Capital Partners, which has just launched a UCITS version of its Crown Managed Futures fund of funds. Moreover, different time horizons lend themselves to different trading strategies (or vice versa). The two most basic — momentum (running with the market) and mean reversion (betting against the market) — clearly buy and sell in a diametrically opposed way. Mean reversion dominates intra-day, while momentum works better from one day out to about three or four years, before mean reversion begins to pay off again over longer spans.

Basically, an active trading strategy is a multi-period model, says Christoph Sporer, investment specialist for strategy allocation at Berenberg Bank Asset Management. The fundamental explanation why time diversification might work is that different time horizons might lead to different investment conclusions. In other words, the same position might be bought or sold at (at least) two different times in two different ways for two different reasons.

This is the theoretical foundation of one of the few academic papers on this subject, Simon Polbennikov, Albert Desclée and Jay Hymans recently-published ‘Horizon Diversification, which concludes that combining alpha strategies based on independent signals can help reduce portfolio risk, even when the returns of the underlying assets are correlated. Plenty of empirical evidence backs up the theory.

Indeed, the diversification within short timeframes is so efficient that it does not take much to become over-diversified, according to Karim, who recounts that QCMs experimentation with equally-weighting several time horizons led to the system ‘cannibalising itself. Instead it now goes with just one longer-term and one shorter-term model. The challenge is to maintain the alternative beta exposure while managing the orthogonal risk or the tail risk that comes about because of sharp reversals in the market, he explains. We have found that it is more efficient [when] a dynamic mix of the two strategies, in essence, replaces a number of time-diversified indicators. Furthermore, because these two contrasting strategies essentially trade the ‘noise of the market orthogonally against its ‘drift, their correlation actually falls as the noise increases: contrast attempts to diversify across asset classes or factor risks, where correlations tend to rise with, rather than against, volatility.

This is all very well at shorter timeframes. The higher the frequency of trading, the more idiosyncratic different strategies become, the less correlation one might expect. Contrasting time horizons of days with horizons of months and years begins to look like a straightforward alpha/beta (or trading/carry) distinction. Anthony Limbrick, CIO at Pure Capital, a serial-correlation trader that holds positions for between two days and about two months, imagines all investment products as a mix of the time value of money and optionality: By compressing the time element we are able to give an investment product access to a wider range of optionality, introducing diversification, he observes. The flipside, of course, is that increasing the time element probably compresses the optionality.

Not surprisingly, the traders are the most insistent about this. Investecs Moll goes so far as to suggest that most time-horizon diversification benefit is only available from the really fast strategies with time horizons below 10 days. He says that this is based on empirical work, but he also offers a compelling common sense explanation: In the long term you do expect beta to come through and if you fight it youre probably going to lose. For LGTs Coplitt, time horizon provides the best diversification at two days or less. He observes: The patterns under the intraday market are completely distinct from the open/high/close price data. There will be a high correlation between managers operating in those medium-term timeframes of a couple of weeks out to four or five years. Managers will be pursuing momentum or price breakout strategies, entering and exiting at different times — and we do favour managers who are broadly diversified across asset classes. But ultimately they do all rely on trends to some extent, so there will be some correlation.

This does not invalidate the potential benefit of the ‘barbell approach of pairing beta/carry type exposures with alpha/trading exposures. Figures 1 and 2 show that a naïve, systematic, medium-term momentum trading strategy exhibits random correlation with both longer-term momentum and 10-year buy-and-hold strategies in US equities. And while the longer-term momentum strategy exhibits very high correlation with the buy-and-hold exposure, it can be negative or positive, and it does a surprisingly good job of delivering the upside of the underlying asset class while shorting most of the downside. The benefits of that kind of correlation to a long-term investor are clear.

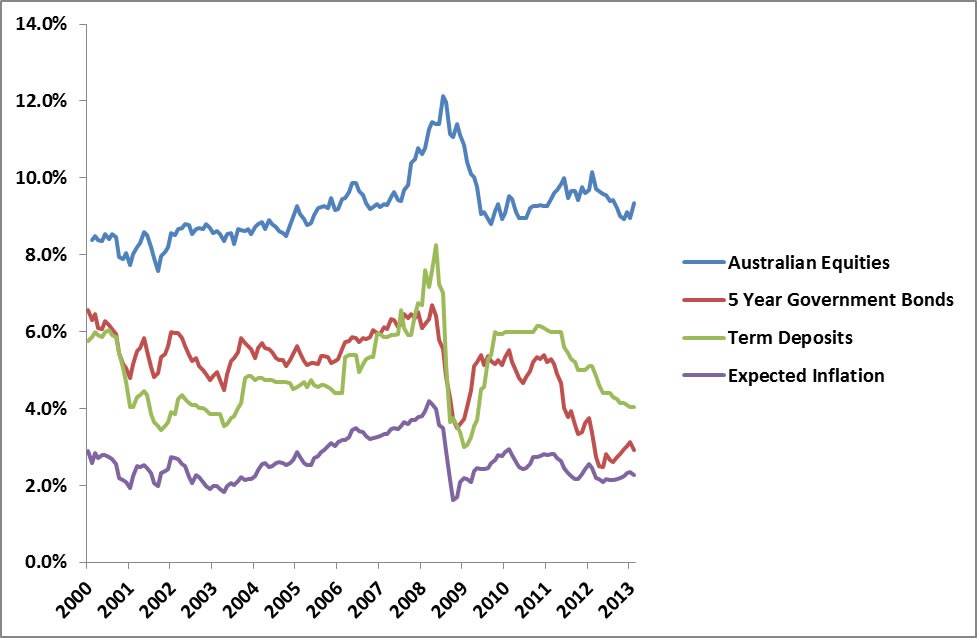

Its true that in longer-term territory you would expect traditional, systematically rewarding risk premia to deliver, so you become more averse to being short, says Euan Munro, head of multi-asset investing and fixed income at Standard Life Investments. But the equity risk premium comes to you in big lumps. These things carry nicely 80% of the time. The challenge is making your portfolio do well during the other 20%. Mark Humphreys, head of UK strategic solutions at Schroders, makes a similar point: Average duration of pension liabilities is about 20 years and shrinking as schemes close to new accruals, he observes. As weve seen, the equity risk premium fails over that time horizon with depressing regularity.

Nonetheless, it is also useful to consider the theoretical basis for diversification from longer-term strategies that fall into distinct time horizons. The first observation to make is that mean reversion makes its comeback out beyond about four years. Figure 1 shows this at work, and also shows how combining it with buy-and-hold and different momentum strategies extracts the equity risk premium with a very pleasing volatility profile. It has long been observed that growth and value diversify quite nicely and this, too, can be expressed as a time horizon effect — growth managers tend to find their strategy playing out over shorter time horizons and value managers tend to find theirs playing out over longer, so they tend to buy and sell at different points in time. Then, of course, there is value versus ‘deep value, and value with an enhanced ‘ownership or ‘stewardship element, all of which could potentially impose different time horizons on the same underlying position.

If you spoke to an equity analyst looking at a company that has restructuring plans set to be implemented over the next three years, he would say that that strategy is not carry-based but based on the market undervaluing what he believes will be a successful restructuring, observes Paul Zemsky, head of the multi-asset and solutions group at ING Investment Management. Bottom-up stockpickers who buy a company today to realise the true value over three years, are not necessarily delivering pure beta. Theres very likely to be reasonably low correlation between the excess returns of those managers.

Crispin Lace, senior investment consultant at Mercer, suggests that we might begin to think about a time horizon spectrum, from short-term trading at one end, through medium and long-term investing and engaged ownership, through to private equity. What people do recognise is that those all involve very distinct skills, and to the extent that they try to exploit those different skills for diversification you get time-horizon diversification appearing in the portfolio as a result, he says.

The extent to which those different skills deliver true diversification is certainly open to debate — and again, the traders tend to be the most sceptical. Investecs Moll has no doubt that long-term investors can bring an activist premium to the table, for example, but he suspects that this will itself be highly correlated with equities. Activist managers seem to do best when markets are strong, he notes. Is that just a statistical effect arising from choosing bull markets to realise value that they have in fact created at other times? Perhaps — but thats not relevant if your concern is to maintain a low correlation with equity markets.

Nonetheless, even if we retain some scepticism about the diversification benefits of longer-term investment strategies against carry, we can acknowledge that longer time horizons do enable us to pile up the greatest number of premia — to maximise carry. In this context, the ‘barbell might help us to purchase that illiquidity premium at the long end with our trading strategies at the short end: again, its about smoothing out lumpy systematic returns.

Under-exploited

Here lies perhaps the key justification for re-thinking portfolio optimisation around investment time horizon (alongside traditional inputs like alpha, beta, asset classes and factor risks). As Lace suggests, where time horizon diversification is achieved, it tends to be by accident, so it should not surprise us that very little is achieved: most pension fund growth portfolio positions are held with a one-to-three year view. There are usually minimal high-frequency trading strategies (often packaged in a fund of hedge funds rather than as a consciously-purchased exposure), where diversification benefits are most abundant and most effective against core carry positions. This limits the illiquidity risk the fund can take to maximise its long-term carry exposure. The profile ends up concave rather than convex, the very opposite of the desired ‘barbell — but one only recognises that if one poses the optimisation question in terms of time horizon in the first place.

At the moment, the industry simply does not do that. When traders sell strategies to pension funds and consultants, they rarely explain that a large chunk of their diversification benefit derives from the fact that their time horizons differ so greatly from the standard portfolios positions. We might not put it in quite those words, but its certainly an underlying message, says Man AHLs Skaliotis. We dont present ourselves as a diversifier by virtue of our trading time horizons, even though I believe very strongly that it is an important determinant of our return profile, Moll concedes. Its complicated enough for people to understand our strategies in the first place, without adding another layer of complexity. Limbrick offers almost exactly the same logic: Time-horizon diversification is something we discuss internally, but clients are still just getting used to understanding the nature of the payoff we deliver.

But there is a strong case that this has the psychology of the pension fund trustee the wrong way around. Certainly, some of the resistance to high-frequency trading can be traced to the feeling that pension funds ought to be ‘strategic. John Hastings, a senior investment consultant with Hymans Robertson, puts it well: Within its governance structure a pension fund trustee body is happy to say, ‘We will take this risk even though we are not sure if it will deliver value over five, 10 or 15 years, he observes. But the idea that they might buy a bunch of momentum for the short term does not sit so comfortably with that governance structure. But of course the shorter time horizons are strategic if you can take those 15-year risks — 2008 showed us the importance of having those bridges to get over the horrifying craters that can appear in the equity risk premium. Moreover, if they are explained in terms of alternative, ‘time horizon betas, we avoid the complexities of alpha payoffs, which can often seem like witchcraft to the layperson.

There would be practical difficulties associated with implementing a truly diversified portfolio of time horizons. Latency costs can be crippling at the very, very short end; and both the shorter and longer ends push investors into higher fees than they pay for either the buy-and-hold or the active management strategies into which they are currently bunched. But most long-term institutional investors can go a long way before running up against these issues: time horizon remains a hugely under-examined and under-exploited source of portfolio risk management.