Playing The VIX As A Portfolio Strategy Tool

Post on: 26 Апрель, 2015 No Comment

The market volatility index VIX is considered as the Fear Gauge of the market and is expected to tell us whether the market has become over confident or very frightened.

But can the VIX be used to employ select strategies that can boost your returns? Is being defensive in a low VIX environment wise? Let’s find out.

Reverse engineering the VIX

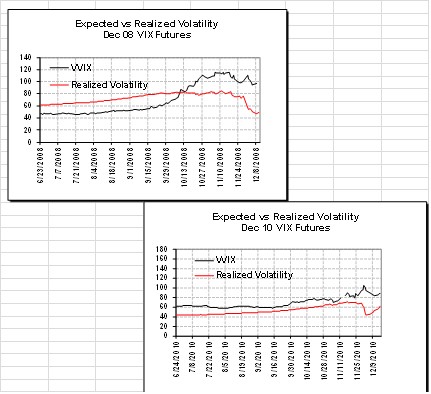

VIX is nothing but a weighted average of SPX out of the money options expiring in the first two months, calculated to reflect the volatility of an option with 30 days to expiration (click chart to enlarge ).

Huh?

Never mind. It is just a simple weighted average calculation followed by a bit more complex adjustment. If you want complicated formulae, hundreds of websites including Wikipedia have that information. But the formula is not important.

What is important for the investor, is to remember that the VIX indicates how much the market will go up or down, not just down; and that VIX is not always a bearish indicator.

Consider a bull run — when investors are bullish, premiums for higher SPX strike prices will rise because no one wants to sell SPX calls at low premiums in such bullish markets. Also there is demand for high strike price calls and premiums automatically go higher.

Similarly in bearish markets, premiums for lower SPX puts go higher, causing the VIX to jump.

Using the VIX to strategize

Don’t use VIX to determine market direction. All you care about is your portfolio anyways, why worry about the market?

Instead, use VIX as a signal to make an informed decision to strategize your portfolio based on the market’s fear, or lack there of.

- If the VIX is high, instead of buying stocks hands over fist (or as many say, loading the truck) in a panic environment, consider selling uncovered puts on stocks that have good long term outlook and horrible recent happenings.

The benefit here is that you get a high option premium because the stock is in its doldrums, and if your short put does get assigned (this is not really a worst case scenario if its a great long term stock, is it?), your cost basis for the stock becomes discounted further, thanks to that credit you received from selling the put.

The strategy discussed in the first bullet might not be as fruitful in a low VIX environment, because the premium on selling the call would be lesser and therefore the net credit is much lesser in such scenarios, eventually leading to lesser discount on the cost basis.

Conclusion

When trying to sell calls in a bearish environment, select stocks that are more volatile to benefit from high premiums. Calendar spreads on the other hand can help in defensive plays when you want the time decay to be on your side and need lesser risk compared to covered calls. Don’t chase dumb money when the VIX gets low, and don’t be too bearish when the VIX goes high. In both cases, using these option strategies can help you decide your portfolio. And finally, if VIX is behaving like a flat-line itself (not impossible), wait for the right time.

Note: Investors must understand the risks involved with Options. There is always a higher risk of losing money compared to stocks.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.