Placing Contingent Stop Orders on Spreads

Post on: 13 Апрель, 2015 No Comment

optionsguy posted on 11/28/11 at 04:12 PM

TradeKing potentially makes trading easier for the advanced option trader with an upgrade to the contingent order feature. TK’s Brian Overby describes how to use this new contingent order feature to place a stop loss order on a bull call spread.

The TradeKing trading platform has for a long time had the ability to trigger (send) a market or limit order for a stock or option contract based on a contingency. This advanced order feature has helped many clients control risk and the timing of their orders being sent to the exchanges. Until recently the contingent trigger could only be based on a specific stock, index or a single option contract’s price. We completed an upgrade to this feature to included net quotes of advance multi-leg option strategies like long or short spreads, butterflies, condors, covered calls and more.

The ability to trigger an order based on the net of quotes can be helpful in many different ways, today’s blog will focus on using this new feature as a way to place a contingent stop order on a simple long call vertical spread.

First things first: what’s a stop order?

You’ve probably been told before to “set your stops” every time you enter a new position. Simply put, stop orders can help you either protect profits or limit losses on positions you’re already holding. (Their full name, “stop-loss orders”, can help you remember that.) If you buy an option at 5, you might want to set a stop order below that price – say, 3.50 – to limit your potential losses.

In general here is how a stop order works. They come in two flavors: stop-limit and just regular stop orders. When your position trades at or through your stop price, regular stop orders get activated as market orders, seeking the best available market price. Stop-limit orders get activated the same way, but once activated they automatically send a limit order to the floor seeking to execute only if that limit price is met. A stop-limit order is more exacting, but also more finicky – if the stock or option is moving fast, it can easily blow through your stop and your limit prices without getting filled at all. With a regular stop order, a market order is sent to the floor and will get the next available price, so you will in all likelihood get filled — but no guarantee what that price may be.

…and what’s a contingent order?

A contingent order is somewhat similar: you set up a contingency, something that needs to happen to trigger (or place) your order. Just like a stop order, that contingency can be that the option trades at or through a certain price you specify. An example here would be if you bought an option at $5 and, contingent on the price of the option reaching $3.50, you’d send a sell to close order to the floor. This contingent order can be sent as a market or a limit order, just as with the stop order.

If you need a little more refresher on what a contingent order is here is a past blog that explains the basics of this advanced order type and how they were previously entered on the TradeKing platform.

New feature?

To the left is a picture of a TradeKing multi-leg quote box with a 1×1 contract long spread on fictitious stock XYZ. If we executed this trade and bought the spread at the asking price of 2.60. Our max risk for this position would be 2.60 plus commission. The max gain of the spread would be the difference between the 185 strike and 180 strike (5) minus the net debit paid (2.60) or 2.40. Commission to place the trade at TradeKing would be $6.25.

So at expiration the numbers look like this:

Commission: $6.25

Max Risk: 2.60 or $260.00 plus $6.25 = $266.25

Max Gain: 2.40 or $240.00 less $6.25 = $233.75

Okay, so now we have our bullish spread position on. We would be considered long this spread in the account. If the market value of the stock increases we put a standard limit order in to sell the spread to close at whatever target price we choose for the net value of the spread, but if the market decreases we would like some form of protection. The new contingent order feature can provide us a way to put a stop contingent order below the market to only trigger if the net value of the spread decreases in price. For example purposes let’s say if the net value (midpoint) of the spread decreased to 1.60 we would like an order triggered to sell to close the position at a limit price of 1.55. In our example we are going to make the contingent order a Good Until Canceled (GTC) order and we will send a day limit order to the market if the contingency happens to be triggered.

What are the steps involved with order entry?

Now let’s look at how to enter the order. We will use the contingent order entry screen based on a net quote for a spread position; you can access it from your TK account at Trading > Spreads, then choose “Contingent Orders” from the Advanced Order types pulldown at the middle of the screen (see the red box on graphic below).

Next, we set up the order we would like to send to the exchange if the contingency is met.

- Leg 1 — Buy to Close 1 XYZ Dec 17 2011 185 Call

- Leg 2 — Sell to Close 1 XYZ Dec 17 2011 180 Call

- Net credit of 1.55

- Day Order

Our focus turns to the contingent criteria and the drop downs for each column.

- Select the Trigger Source — Use My Order

- Select the Based On information — Midpoint of Net Quote

- Select the Trigger Price — Less Credit/More Debit Than

- Enter the Price at which we want the order triggered — Net Credit of 1.60

- Select the Duration for the contingent order — GTC

Our selections means the Trigger Source is going to use the net quote that goes along with the order we set up to be sent to the exchange. It will be Based on the Midpoint of that net quote to trigger the order. The other choice found in the Based On drop down is the Natural . The Natural may be the bid or the ask price, it depends on if we are buying or selling the advanced order. If you ever are confused just look at the net quote box, the word natural will be next to either the bid or the ask as an indication of where the current market is at (see quote box above for example). The next selection is the Trigger Price , which is very important to make sure is correct. We only want to send the order we set up if the market gets worse than the current market price (in this case), so for us that means Less Credit because we are selling to close this spread for a net credit to the account, so our selection is Less Credit/More Debit Than . On to the Price , our net quote midpoint price is 1.60 credit. This Price and the Trigger Price instructions imply to only send the order if the credit received would be less than 1.60. I will restate a different way — if the midpoint net quote is equal to 1.59 or LESS than 1.59 send the above order to the trading floor. Now if you DO NOT get the Trigger Price drop down selection correct don’t panic we will let you know with this error message.

Last selection is the easiest, the Duration the contingent order will be good for — either for the Day only or Good Until Cancelled GTC . Do note that there is also a duration selection for the order that would be triggered if/when the contingency is met. These are interdependent of each other.

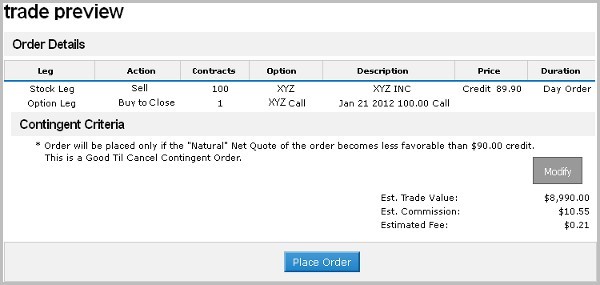

The next step is to click the Preview Order button and make sure everything is correct. Below is what the preview screen would look like. Make sure the text next to the star * makes sense to you. For our example it reads Order will be placed only if the Midpoint Net Quote of the order becomes less favorable that $1.60 credit. Lastly, click the Place Order button!

A final word to the wise…

Any discussion on contingent or stop orders isn’t complete without mentioning this caveat: they do not provide much protection if the market is closed or trading is halted during the day. It the stock gaps the downside protective order will most likely trigger, but who knows what the next available price will be. The only true day and night protect is to use other options positions to hedge and design strategies where the risk is limited and known from the get-go. Please read the full terms and disclosures when using Advanced Orders .

Limitless possibilities.

This is just one of the many uses of this advanced order type and is definitely a tool that must be kept in an advanced option traders toolbag!

TradeKing

Regards,

Brian Overby

TradeKing’s Options Guy

www.tradeking.com/ODD .

Any strategies discussed or securities mentioned, are strictly for illustrative and educational purposes only and are not to be construed as an endorsement, recommendation, or solicitation to buy or sell securities.

TradeKing provides self-directed investors with discount brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice.

Online trading has inherent risks due to system response and access times that vary due to market conditions, system performance and other factors. An investor should understand these and additional risks before trading.

Multiple leg options strategies involve additional risks and multiple commissions. and may result in complex tax treatments. Please consult a tax professional prior to implementing these strategies.

Supporting documentation for any claims made in this post will be supplied upon request by emailing Brian Overby at support @tradeking.com.