PE investors shift focus to renewable energy sector

Post on: 12 Июль, 2015 No Comment

Source Url:

www.livemint.com/Industry/jUai6T2Ih79yM5VOEK2zyN/PE-investors-shift-focus-to-renewable-energy-sector.html

In a reflection of investors aversion towards Indian power projects using conventional fuel such as coal and gas, no private-equity (PE) firm pledged investment in the space all through the last calendar year.

But the renewable energy sector that includes wind and solar power saw 12 PE deals valued at $325.1 million (about Rs.1,765.30 crore) in the 2012 calendar year, according to VCCEdge, an investment tracker.

In the same period of the previous year, the power sector saw 27 deals valued at $1.19 billion, of which six were for conventional fuel-based projects.

While there is muted interest in the conventional utility space, most of the transactions are being done in the renewable space, said Shubhranshu Patnaik, senior director, consulting (energy and resources) at Deloitte Touche Tohmatsu India Pvt. Ltd, an audit and consulting firm.

Indias power sector is struggling with the countrys worst shortage of fuel, including coal, causing electricity plants to run on minimal supplies. High fuel costs and low capacity utilization have increased financial stress at a number of power producers.

When it comes to the conventional power sector, we are also concerned about issues such as delays in getting permits and clearances, the deteriorating health of the state electricity boards and a lack of financing for the sector, among others, a Mumbai-based PE investor said on condition of anonymity.

India has an installed power generation capacity of 210,952 megawatts (MW), of which 12.3% or 25,856MW is renewable energy capacity. While there is interest in developing wind energy sources from conventional power generation utilities, the funding of such efforts has become a concern. It takes capital expenditure of Rs.4.2-4.5 crore per MW of power generated through coal-based or gas-based projects, compared with wind-based projects requiring Rs.6-7 crore per MW.

The current spate of challenges affecting Indias power sector (conventional thermal power plants, specifically)fuel shortage (coal, natural gas), a delay in signing of fuel supply agreements, land acquisition, environmental clearances, etc. have resulted in various power projects facing execution hurdles and getting delayed, said Amol Kotwal, associate director, energy and power systems practice for South Asia at consulting firm Frost and Sullivan.

On the contrary, the renewable energy space offers tremendous amount of opportunity due to various factorsno dependency on fuel (wind, solar), regulations (such as renewable purchase obligation, or RPO), reducing prices (solar), besides the government mandate to ramp up renewable energy contribution to Indias overall energy basket, Kotwal said.

Indias national action plan on climate change recommends that the country generate 10% of its power production from solar, wind, hydropower and other renewable sources by 2015, and 15% by 2020.

The Central Electricity Regulatory Commission, or CERC, the countrys apex power sector regulator, has also come up with guidelines on issuing renewable energy certificates to promote green energy.

The certificate holders will be able to sell green energy to states, individuals or other trading entities. States have been allotted different renewable energy purchase obligations.

There are fundamental economic issues with the power sector in India, including fuel shortage, fixed tariffs and the high cost of imported coal. It will be difficult for the power sector to attract PE investors or debt or foreign direct investment as long as these issues are not sorted out, said Mukul Gulati, managing director, Zephyr Peacock India, a global PE fund.

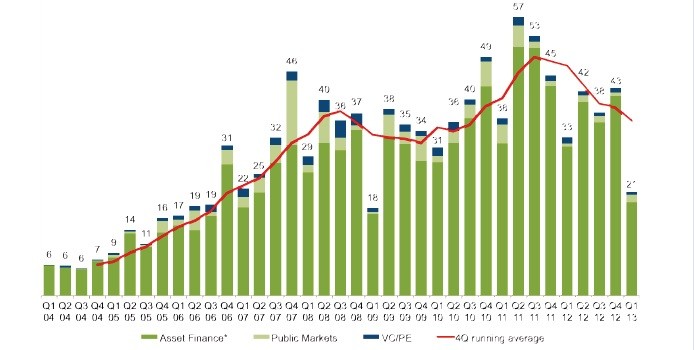

This fiscal has seen a three-year low in the PE deal space as a lack of exit options, subdued investment sentiment, slowing economic growth and the challenges in fresh fund raising, coupled with prolonged due diligence, keep investors away.

Both deal volume and value have fallen steeply, with PE firms making 268 transactions worth $7.59 billion, compared with 352 deals in 2011 worth $11.45 billion and 303 deals worth $9.19 billion in 2010, according to VCCEdge.

The largest PE deal of $212.03 million in the power sector space in the current fiscal was made by Morgan Stanley Infrastructure Partners in wind power firm Continuum Energy Pte Ltd.

Other deals in the renewable space include Bharat Light and Powers (BLP) acquisition of real estate developer DLF Ltds wind power assets.

Investments in renewable energy will only increase as due to the low base, growth is high in this segment. There are, however, operational issues across wind, solar and hydro and they need to be addressed. Also, there are funds that have a dedicated investment strategy for renewable energy and they will invest, said Vikram Hosangady, head of PE at KPMG India, a consultancy.