Parabolic SAR

Post on: 5 Июнь, 2015 No Comment

Parabolic SAR was developed by J. Welles Wilder Jr. The Parabolic SAR is a trading system that sets trailing stop-losses in a trending market. Although it works well in trending markets, it tends to whipsaw during non-trending, sideways phases, so it is best used strictly in trending markets.

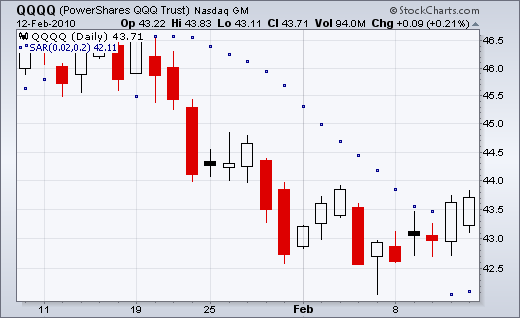

The parabolic part of its name is derived from the shape of the output of the indicator. The indicator output follows the price movements in the form of a dotted line which tends to follow a parabolic path. When the parabola follows along below the price, it is providing buy signals. A parabola above the price suggests selling or going short. The dots themselves are setting the levels for the trailing stop loss that is recommended for the position. In a bullish trend, a long position should be established with a trailing stop that will move up every day until activated by the price falling to the stop level. In a bearish trend, a short position can be established with a trailing stop that will move down every day until activated by the price rising to the stop level.

This trading system helps traders catch new trends relatively early. If the new trend fails, the parabola quickly switches from one side of the price to the other, thus generating the stop and reverse signal. The SAR part of the name of this system is an acronym for stop and reverse indicating when the trader should close his position or open an opposing position when this switch occurs.

An acceleration factor is built into the indicator so that it starts off slowly with the dots close together as the trend develops, then moves faster with the dots further apart until it catches up to the price. The acceleration factor will sometimes tighten up the stop prematurely, reversing a position on a minor market correction just before the major trend starts again.

In a bullish trend, this indicator will produce dots following an upward parabolic path below the price. In a bearish trend, this system will produce dots following a downward parabolic path above the price.

It is useful to examine different time periods (daily, weekly and monthly charts) and to use this indicator in conjunction with other indicators. John Murphy recommends using the Directional Movement Index (DMI) to help eliminate whipsaws and false signals of the Parabolic SAR. In a bullish trend, when the +DI line is above the -DI line, whipsawing can be eliminated by ignoring Parabolic SAR sell signals.

If a trend is not established and the market is in a narrow trading range or just fluctuating around the moving average, signals should be ignored.

In a bullish trend, a long position can be established if the moving average is providing support for the price, and exited when the price falls to the Parabolic SAR stop level. Do not go short if the moving average is sloping upward. If the price goes back above the stop level, the position can be reestablished.

Since Wilder suggests using this indicator in a trending market, if the security is trending up, it may be prudent to initiate only long positions. If the security is trending down, it may be prudent to initiate only short positions.

In a bullish trend, if the price makes a new high without the indicator doing the same, it is a bearish signal.

In a bearish trend, if the price makes a new low without the indicator doing the same, it is a bullish signal.

For a more detailed description of Parabolic SAR, read New Concepts in Technical Trading Systems by J. Welles Wilder Jr.

When you are analyzing potential option positions, it helps to have a computer program like Option-Aid that swiftly calculates volatility impacts, probabilities, statistics, and other parameters of interest. These programs can pay for themselves with the first trade that they help you with.

Get FREE Option Tips

The Option Trading Tips Newsletter is published by MindXpansion, the developers of Option-Aid. This newsletter gives you information for maximizing your profits in options trading, including option strategies and market indicators. Fill in the following information to subscribe to this FREE service.

(Please select SEND button after you have filled in information.)