Palladium Investing 2014

Post on: 6 Апрель, 2015 No Comment

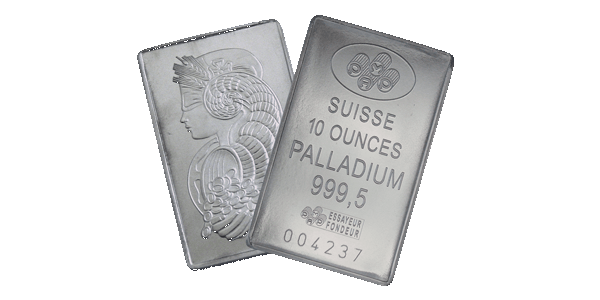

Palladium Investing 2014

Rate this post

Money Wise

The exotic metals market is set to perform in the forthcoming year. Near future increases in demand for palladium, as well as platinum and rhodium indicate that exotic precious metals will see advances in the next few cycles. Forecast for the precious metal palladium is set poised for a twenty two percent gain by the close of 2014.

Investment analysts point to the global demand in palladium commodities as a factor of industrial demand. If demand outstrips supply next year, it will not be any surprise. In 2013 demand fostered by manufacturing for palladium and palladium market trading saw one of the widest margins ever.

The general international demand for palladium for high end chemical and other major manufacturing production is the driver of this predictor. U.K. forecasts indicate a firm demand for palladium exceeding supply by 740,000 ounces at present, following a continuous supply deficit in the past several reporting cycles.

The slated launch of a South African exchange dedicated to the trade of palladium investment value would extend financial investment to stock buyers. South Africa currently holds the single largest platinum exchange traded fund (ETF) on the global market.

Investment is the lynch-pin for the macroeconomic picture. The supply-demand disequilibrium prompted by fungible convertibility of those raw resources in the auto and other manufacturing sectors means that investment developers must be conscious of creating and even larger deficit of reserves.

Global Supply-Demand

Even if gross demand for palladium drops overall, the automotive sector manufacture of catalytic converters will mitigate such a retraction in sales. Palladium inputs in catalytic converters are essential to manufacture compliance with environmental regulation of GHG emissions reduction rules. In some sectors, palladium investment was lower than predicted, yet the principal market, the automotive sector still demands volume reserves of the precious metal.

Due to the fact that large mining reserves of palladium are only found in Russia and South Africa, a virtual monopoly on mining shares by those two national markets is the result. The investment prospects in palladium could change soon, however.

Russian reserves are experiencing a similar reduction in surplus. Sales of palladium have dropped in response to this condition. In 2013, the Russian government, the major holding of palladium reserves in the country, will have sold a minor 100,000 ounces of palladium on the open market.

This is noted drop from 250,000 ounces supplied to the global market the year prior. The prediction that Russia will see a 6.6% drop in reserves this year to 2.7 million ounces, is undoubtedly the force behind price increase and even greater deficits to follow in 2014.

South African competitive advantage over Russias decline as a leader in palladium sales, and the lack of strategy to fill those reserves, means that future profits from palladium investment are likely to be almost exclusively the gain of South Africa and palladium investors.

The market in palladium recycling is expected to rise by 7.4% to 2.46 million ounces in 2013 in response to this reality. The scenario of rising scrappage rates, and exceeding demand for palladium in auto catalysts is pushing up the price of the metal, and this trend is expected to continue into the forthcoming year.

Smart Finance

Cartel or Corruption

The decline in palladium mining and production in Russia, and the labor costs related to closures of those plants, has prompted an accelerated increase in the price of both platinum and palladium. Now is the time to invest in palladium and related metals, as the price is likely to rise markedly by the end of next year. This is good news for investors looking for low risk investment in speculation. Palladium is one of the least volatile metal commodities in price. Purchase of palladium assets today is liquidity in the pocket tomorrow.

Discussion about an OPEC model of cartel as a measure to combat corruption in the precious metals market is sourced in worries that monopoly breeds out of control pricing and black market practices in trade. If the palladium market is destined to be the focus of an organized cartel or council dedicated to the commission of policy, and in particular constraints on pricing, instability caused by escalation of cost to market will find resolution.

Speculation that the impact of a palladium cartel on the market would likely result in an unofficial trade council, providing rules to market based measures and fiscal incentives is a suggestion with some merit. The fact that mining companies are generally publicly-listed companies, rather than state-owned and controlled entities might be considered the framework for imposition of such a structure by international members of a cartel or association on the palladium trade.

Even skeptics agree that price controls of platinum group metals, including palladium are recovering in response to constraints, and that some agreement must be sought to monitor corruption and its exposure effect on the market. Nations subsidizing infrastructure in the palladium mining sector promise to be the vital resource producers of this high demand commodity.

Future Demand in Pollution Control

The manufacture of catalytic converters, the main source of demand behind the palladium trade, is part of a worldwide trend in automobile production in emerging markets. This is especially the case in the BRIC (Brazil, Russia, China, India) countries, where precious metals play a central role in the market economics of industrial manufacturing. Aside from Russia, which has its own reserves, emerging markets will be applying significant force on the world supply of palladium into the future. The steady rise in demand is expected to exceed 10 million ounces in 2014.

The two other national markets supplying palladium, the United States and Canada are set to profit from the growing demand for palladium. Still, limited reserves in Russia, which has historically been a major supplier of palladium, are foreseen to continue. The country has been selling off what was once a leading stockpile of palladium extracted from state owned and operated mines.

The transition to private palladium enterprise has somewhat left Russia outside of the ring, as the drain on its reserves has forced traders to go elsewhere. This is good news for South Africa, Canada and the United States, as environmental restrictions on trade promote demand for the metal. Palladium speculation on the New York Mercantile Exchange resulting in positive gains for investors in ETFs, mining stock, mutual funds, and options and futures contracts.

For more information about palladium investing in 2014, contact a broker specializing in exotic metals commodities. The demand for palladium guarantees capitalization on investment. Investors looking for return on investment in metals market speculation will gain on trading in on palladium stocks.