Ordinary Dividends

Post on: 16 Март, 2015 No Comment

Updated February 4, 2008

This category includes qualified dividends that may be taxed at lower rates, as well as nonqualified dividends.

As the term is used in income tax reporting, ordinary dividends include all taxable distributions that aren’t treated as long-term capital gain. That means the number appearing in the box with this label on Form 1099-DIV can include some items that are not exactly ordinary.

Qualified dividends

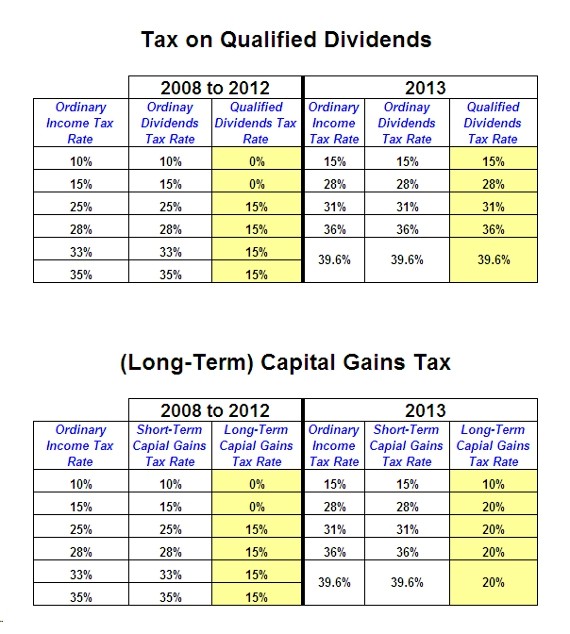

Ever since 2003, dividend income can qualify for the same low tax rates that apply to long-term capital gain. For dividend income that falls in the higher tax brackets, the rate is 15%; in the first two brackets (where ordinary income is taxed at the 10% and 15% rates) the dividend rate is 5% for years before 2008 and 0% beginning in 2008.

It’s important to understand that on Form 1099-DIV, qualified dividends are included in ordinary dividends. If you receive $350 in qualified dividends and $150 in nonqualified dividends, you’ll receive a Form 1099-DIV that shows $500 in ordinary dividends (the total from both categories) and $350 in qualified dividends (the subcategory that gets special treatment). On your tax return you’ll report the entire $500 as income, but the $350 of qualified dividend will end up being taxed at a lower rate.

Nonqualified Dividends

A portion of your ordinary dividend may be nonqualified because it can include items like these:

- Taxable interest. When a mutual fund receives taxable interest, the income gets paid out as a dividend. It’s a dividend when it goes out of the mutual fund, but it wasn’t a dividend when it came into the mutual fund, so it can’t be a qualified dividend.

- Nonqualified dividends. Your mutual fund may receive dividends that are nonqualified. For example, the mutual fund may sell shares just 35 days after buying them, but after receiving a dividend. The mutual fund has to hold the shares at least 61 days to have a qualified dividend. Any amount the mutual fund receives as a nonqualified dividend gets paid to you as a nonqualified dividend.

- Short-term capital gain. When a mutual fund has a short-term capital gain, it pays this amount to the mutual fund shareholders as an ordinary dividend.

That last statement may seem surprising if you’re familiar with the way capital gains work. Short-term capital gains often end up being taxed at the same rate as ordinary income, but they’re not treated the same as ordinary income. In particular, if you have a large capital loss — long-term or short-term — you may be better off if you have short-term capital gain than if you have ordinary income.

You aren’t allowed to treat any part of your mutual fund dividend as short-term capital gain, though. That’s true even if the mutual fund includes information in its report telling you how much of the dividend came from short-term gains. You have to treat that amount as part of your ordinary dividend.

Holding mutual fund shares less than 61 days

You should also be aware that any dividend you receive on mutual fund shares held less than 61 days is a nonqualified dividend, even if the mutual fund reports that amount to you as a qualified dividend. You don’t have to buy the shares 61 days before the dividend is paid, but the total amount of time you hold the shares (including time before and after the dividend) has to be at least 61 days.

Example: You bought shares in XYZ mutual fund in December and received a dividend of $1,000. Late in January you moved your money to a different mutual fund. You receive Form 1099-DIV saying $800 of your dividend is qualified dividend.

When they prepared Form 1099-DIV, the mutual fund company didn’t know whether you would hold the shares long enough to have a qualified dividend. They had to assume you would hold the shares long enough. But since you didn’t, you have to treat that $800 as nonqualified dividend, even though Form 1099-DIV says it’s qualified.